TOPIC

Your Guide to Navigating the Federal Budget Process

May 29, 2024

The annual process of funding the government is a monumental task, and staying on top of the many moving parts can be complicated and time intensive. To help you make sense of how the federal budget is determined, we break down the theoretical timeline, explain the significance of each step, and highlight how details of the federal budget impact state budgets.

How does the federal budget process work?

The federal budget process typically consists of seven steps, outlined in greater detail below:

- President’s budget request

- Budget resolution

- Appropriations bills

- Authorization bills

- Revenue measures

- Budget reconciliation

- Debt limit legislation and raising the U.S. debt ceiling

1. President’s budget request

Early each year, the White House proposes the level of spending for federal agencies and programs. It outlines estimates for revenue and expenditures and details the administration’s policy and spending priorities.

2. Budget resolution

The budget resolution is a blueprint that takes a holistic approach to spending, revenue, and the resulting deficit or surplus to govern internal decision-making. The resolution is without force of law, and it doesn’t go to the president. Lawmakers have often skipped this step in recent years, instead working out a series of two-year deals that increased spending caps that had been set by law. The Senate didn’t adopt budget resolutions for fiscal years 2011 through 2013, as well as FY23. The House didn’t adopt a budget resolution for FY11. And in FY17, the resolution was adopted in January, four months into the fiscal year.

3. Appropriations bills

Federal agencies receive funding for a fiscal year through appropriations bills passed by Congress based on the president’s recommendations and congressional priorities.

What occurs during the appropriations process

The House and Senate appropriations committees are divided into 12 subcommittees, which hold hearings to discuss budget requests and needs. Each subcommittee comes up with a bill that must pass both chambers and be signed by the president to take effect. If a full-year appropriation isn’t in place by Oct. 1, the start of a fiscal year, a continuing resolution can be used to extend funding for a period of time, typically at the previous year’s level.

Congressional appropriations panels split jurisdiction among 12 subcommittees

4. Authorization bills

Authorization measures are used to create departments, agencies, and programs; set rules for how they’re operated; and set funding levels. Some authorization bills provide funding for one or more years without further action, known as a mandatory program. Most authorizations require congressional appropriations action and are referred to as discretionary.

5. Revenue measures

Congress doesn’t have to act each year on a measure raising revenue. Some tax laws are permanent, while others have expiration dates that cause Congress to revisit tax rates, credits, and other rules.

6. Budget reconciliation

The reconciliation process was created by the Congressional Budget Act of 1974. It allows lawmakers to advance spending and tax policies through the Senate with a simple majority.

How the budget reconciliation process works

Budget resolutions can include instructions to committees to report reconciliation legislation, often with a deadline, to meet spending and revenue targets.

The reconciliation instructions also can require reporting of debt-ceiling legislation, which can come in handy because of the simple majority factor.

If more than one committee receives instructions, then the individual committees first send their recommendations to the House and Senate Budget committees, which consolidate the proposals. If a single committee receives instructions (for example, just the House Ways and Means Committee on a revenue measure), its recommendation can be sent directly for a floor vote.

Senate debate time limits

In the Senate, debate is limited to 20 hours, meaning the measures can’t be filibustered. Proponents also only need a simple majority rather than the 60-vote supermajority that applies to most legislation under the chamber’s cloture rules – if everyone shows up, that means 51 votes.

These details make reconciliation bills an attractive target for policy changes that have a budgetary effect (such as health care programs).

7. Debt limit legislation and raising the U.S. debt ceiling

The federal government imposes a limit on the amount of debt it can incur. Congress considers legislation to either increase the dollar amount in law or suspend the debt limit for a period of time to allow the government to take steps to finance the difference between the amount of revenue brought in and the amount of spending required by law.

On June 3, 2023, President Biden signed the Fiscal Responsibility Act into law in order to avoid a default on federal debt and reduce the budget deficit by establishing new caps on defense and non-defense discretionary spending for FY24 and FY25.

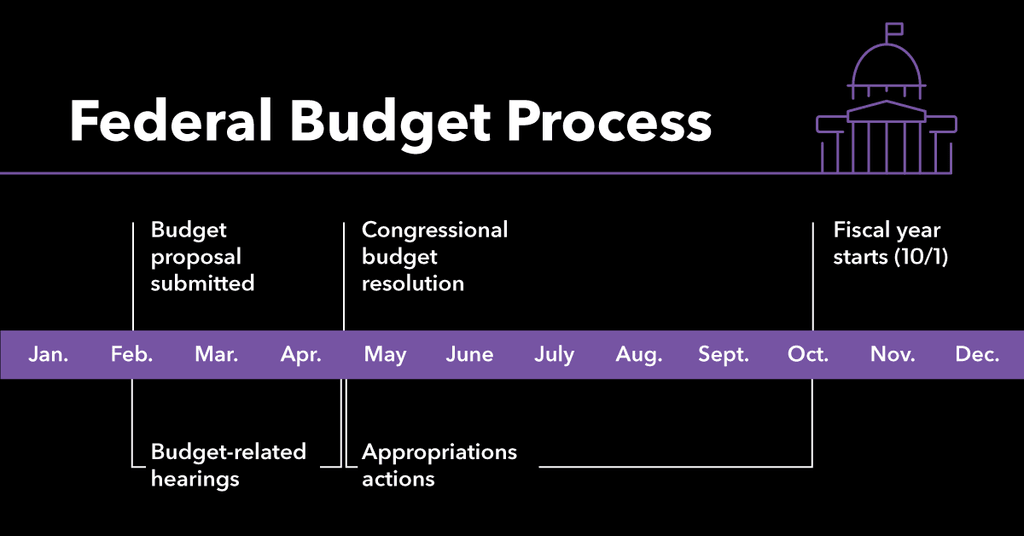

What is the federal budget timeline?

Months of behind-the-scenes work precedes the publication of the president’s budget request. During the summer, agencies work on the budget request for the year after next. For example, in summer 2024, agencies will work on their FY26 request. Then agencies send their requests to the Office of Management and Budget in the fall. (Note: the Department of Defense typically sends its request to OMB weeks or months after other agencies.)

The White House negotiates final numbers with agencies to reflect its priorities and ensure the totals fit within budget caps. These numbers are finalized at the end of December or early January in a typical year, or during the spring for a new administration.

Federal budget process flowchart

1. President’s budget request (first Monday in February)

A detailed request for each department and agency. The law requires submission, but there is no penalty for being late. The president’s budget request timing is typically delayed in a new administration. For example, President Joe Biden released his first budget request on May 28, 2021, and the request for FY2023 on March 28, 2022.

2. Congressional hearings (February – spring)

Agency officials testify before authorizing and appropriating committees in order to justify budget requests. This offers a preview of the major spending and policy debates.

3. Budget resolution (April 15)

Sets revenue and spending targets for legislation. There is no penalty for being late, or even for declining to adopt a budget resolution, and no role for the president.

4. Appropriations bills (Sept. 30; fiscal year starts Oct. 1)

Twelve measures funding federal agencies and programs. Congress has not completed this work on time since 1997.

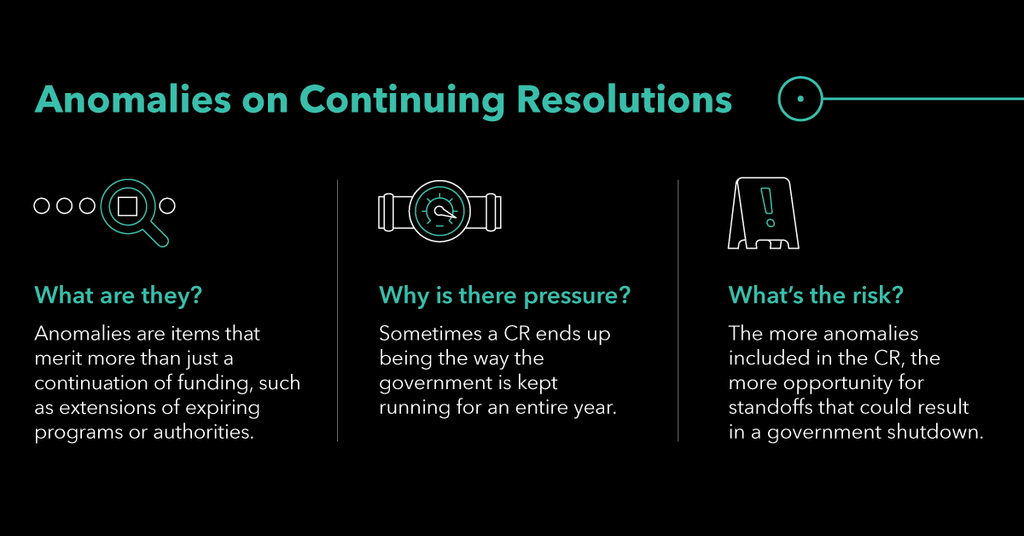

5. Continuing resolution (only if necessary)

Maintains funding based on the current rate to prevent a lapse in spending. Anomalies provide spending adjustments. Lawmakers averted a government shutdown at the end of 2021 by passing a CR on Dec. 2.

How does the federal budget affect state budgets?

Historically, federal funds have made up about one quarter to one third of state revenue. In recent years, that number has remained close to one third. In most states, the bulk of federal grant money goes toward Medicaid and other health programs and services. Medicaid increases have been a significant driver in an increase in federal funding to states.

Medicaid falls under mandatory spending, as do programs such as Temporary Assistance for Needy Families (TANF), SNAP, adoption and foster care programs, and child nutrition programs that provide meals to low-income students in school. Examples of discretionary funding to states include Title I funds for high-poverty schools, Head Start, and public safety grants.

Unlike the federal government, states have balanced budget requirements. This means uncertainty or a delay in the federal budget can have significant consequences for states, given how much of their revenue depends on federal funds. For example, Covid-19 placed an unexpected strain on state finances as they grappled with the economic fallout of the pandemic. This caused declines in state revenues that needed to be balanced by more federal aid, and/or spending cuts.

Navigating the federal budget with Bloomberg Government

Bloomberg Government is a comprehensive platform that offers resources on effectively navigating the federal budget. Our news and analysis covering agency funding, spending trends, proposed budgets, and appropriations bills together provide insight into budgetary priorities of various industries. With our legislative tracker, you can stay informed on committee actions and voting decisions that will help you anticipate developments of evolving budgetary landscapes. Request a demo.