Wildfire-Weary Californians to Vote on Firefighting Taxes, Bonds

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

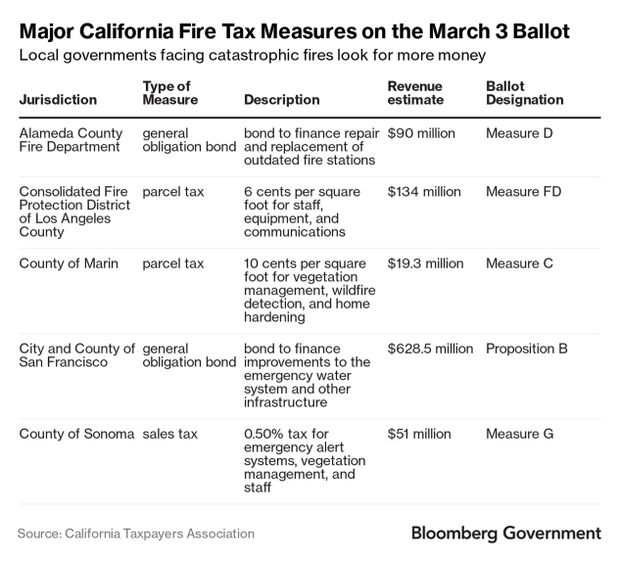

California’s catastrophic wildfires are fueling at least 17 local tax measures, with voters to decide on March 3 whether to raise hundreds of millions of dollars for fire prevention efforts.

The proposals are a mix of general obligation bonds, parcel taxes, and sales taxes on local ballots from San Bernardino in the south to Humboldt in the north. The proceeds would fund operations, buy new facilities and equipment, beef up staffing, and enhance brush clearing.

“They don’t want their communities to burn down,” said Michael McLaughlin, legislative director for the California Fire Chiefs Association. “Nobody wants to be that community.”

Measures supporting fire services tend to succeed, said Larry Tramutola, an Oakland-based political strategist who’s worked on tax campaigns across the country.

“My caution is that the majority of the money that is provided by taxpayers has got to go to those services that people are thinking that they’re getting,” he said in a phone interview.

In 2017 and 2018, California wildfires killed 147 people, consumed 3.5 million acres, and led to more than $24 billion in insurance claims, according to the California Department of Forestry and Fire Protection. That doesn’t include damages to publicly owned property or firefighting costs.

Last year, 259,823 acres burned and three people died, the department reported.

The National Interagency Fire Center has forecast an above-average potential for wildfires by late spring or early summer in Southern California.

Fire season is becoming year-round and many jurisdictions have tight budgets, particularly in rural areas. McLaughlin stressed the importance of steps to starve fires of fuel by thinning vegetation and the need to update evacuation plans.

“You can’t do anything if you don’t have the funding to do it,” he said.

L.A., San Francisco

Among the proposed parcel taxes is a 6-cent-per-square-foot tax in Los Angeles County that would raise $134 million annually for facilities maintenance, replacement, and operations.

San Francisco voters will consider a $628.5 million bond measure for its emergency firefighting water system.

Sonoma and Marin counties are combining their prevention and preparedness efforts. Sonoma is asking voters to approve a half-cent sales tax increase and the Marin Wildfire Prevention Authority seeks approval for an up to 10-cents-per-square-foot parcel tax.

At the state level, a $152 annual fee levied on property owners in areas where the state is responsible for fire prevention ended in 2017. Former Gov. Jerry Brown (D) enacted the fee in 2011 but property owners argued in legal challenges that it was an improperly enacted tax.

The state fee hindered local efforts to raise money from taxpayers who wrongly thought the dollars they paid would go to their own local fire districts, said McLaughlin.

Funding not reaching the local level as taxpayers expected “did more damage for these rural entities than anything else could have done in the state,” McLaughlin said.

To contact the reporters on this story: Joyce E. Cutler in San Francisco at jcutler@bloomberglaw.com; Laura Mahoney in Sacramento, Calif. at lmahoney@bloomberglaw.com; Emily C. Dooley at edooley@bloombergenvironment.com

To contact the editors responsible for this story: Katherine Rizzo at krizzo@bgov.com; Yuri Nagano at ynagano@bloombergtax.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.