What to Know in Washington: Stimulus Watchdogs Face Immense Task

The federal watchdog that will oversee thousands of small-business rescue loans worth roughly $350 billion will have to ramp up in a hurry: Last year, it investigated only eight such loans.

“To say the amount of money that’s going out is large, that’s kind of an understatement,” said Hannibal “Mike” Ware, the inspector general of the Small Business Administration, which is scheduled to open the spigot on the small-business bailout today.

The $2.2 trillion stimulus bill that Congress adopted last month will give Ware’s office $25 million – more than double its annual budget – to beef up its auditing and investigative capacities over the next four years. Overall, the legislation also establishes a $500 billion bailout fund for large businesses and expands unemployment benefits. To police that spending, it creates layers of oversight that would be paid for with more than $155 million in new funding.

In racing to craft the legislation while building in ways to protect taxpayers, lawmakers borrowed heavily from protections that were put in place for federal bailouts in 2008 and 2009. Already, though, some question whether the bill’s oversight provisions will work in harmony – and whether the watchdogs’ funding will be robust enough.

“Hopefully, they’ll get more,” said Neil Barofsky, a former federal prosecutor who served as the first special inspector general for the Troubled Asset Relief Program. Barofsky’s office, called SIGTARP, received $50 million in seed money in 2008 to examine $435 billion in spending – most of it loans to banks and financial institutions that were concentrated in New York City.

This time around, the big-business bailout provisions will provide as much as $500 billion in loans from the U.S. Treasury and Federal Reserve – and create a new inspector general to oversee them, with start-up funds of just $25 million. Barofsky noted that this new office, called the Special Inspector General for Pandemic Recovery, will have a nationwide purview. That will require a large travel budget and expertise in an array of industries, not just the financial knowledge that SIGTARP’s employees had to have.

“The organization cannot succeed with $25 million,” he said. Read more from Jason Grotto and Todd Shields.

How to Read Today’s U.S. Jobs Data: America’s once-robust labor market is collapsing faster than at any point in the last century. The details are about to start showing in the monthly jobs report. Nearly 10 million jobless claims have been filed in the past two weeks as government-mandated shutdowns to contain the coronavirus force companies large and small, and industries from restaurants to manufacturers, to close their doors.

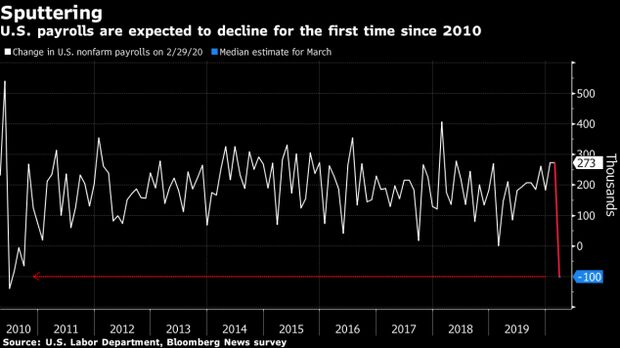

Payrolls are forecast to decline in March for the first time since 2010 as the early impacts of the pandemic began moving through the economy. But the reference week for today’s data ended just before business closures, along with employee layoffs and furloughs, became more widespread, Reade Pickert and Max Reyes report. That means reports in the coming months will provide a more comprehensive and detailed picture of how the virus-containment measures are crippling the nation’s jobs engine.

What to Watch Today

The House holds a pro forma session at 10 a.m.

Senate Minority Leader Chuck Schumer (D-N.Y.) and Senate Finance Committee Ranking Member Ron Wyden (D-Ore.) will hold a press call at 9:15 a.m. on the Trump administration’s distribution of of unemployment benefits.

President Donald Trump is slated to meet with oil executives at the White House at 3 p.m. to discuss plunging prices amid the pandemic.

The Coronavirus Task Force holds a briefing at the White House at 5 p.m.

Trump to Get Pressure on Tariffs in Meeting With Oil Industry

Trump will meet with titans of the oil industry today who are battling among themselves over whether he should slap tariffs on Saudi crude to get the kingdom to reduce its output.

It’s an idea championed by Oklahoma oil man Harold Hamm, a Trump confidant on energy who will be part of the meeting today, as well as some Republican senators who say tariffs could help the president win concessions from Saudi Arabia and stabilize the global crude market.

Tariffs are also a weapon of choice for the president, who has wielded it against China, foreign steel producers and during trade negotiations with Mexico and Canada. Within the oil industry, the idea has exposed deep rifts, with refiners firmly opposed.

“If they were to go down this route it would probably result in some refineries shutting down completely,” said Chet Thompson, head of the industry’s top trade group, the American Fuel & Petrochemical Manufacturers.

Trump has indicated he already has a plan in mind for helping oil companies he says are being “ravaged” by a price war between Russia and Saudi Arabia. He said he knows what to do to solve the problem, though he declined to reveal the strategy other than to say it’s “tough” and “I’d rather not do that.”

Instead, the president said, he hoped the Russians and Saudis would strike an agreement to cut production. Read more from Jennifer A. Dlouhy and Stephen Cunningham.

Trump will likely also face a bitterly divided oil industry when he meets with energy executives to discuss the perilous state of world crude markets and the threat to U.S. shale fields, Kevin Crowley, Rachel Adams-Heard and Jennifer A. Dlouhy report.

Treasury Secretary Steven Mnuchin said energy companies squeezed by the oil-price war can turn to the Federal Reserve’s lending facilities for aid but won’t get direct loans from his department. “I have very limited ability to do direct loans out of the Treasury,” he said yesterday at a White House news conference, Saleha Mohsin reports.

More Economic Actions & Industry Pains

Checks May Not Arrive Till Fall: Some people counting on $1,200 stimulus checks from the government may not see the money until mid-September, according to a House Ways and Means Committee analysis. The IRS will begin making about 60 million direct deposit payments in mid-April to the people who have bank account information on file with the agency, according to the analysis sent to lawmakers on Wednesday. Those payments will take about three weeks to process. The IRS then will begin putting paper checks in the mail in early May. The IRS will send approximately 100 million checks at a rate of 5 million per week, which could take 20 weeks, according to the committee’s document. Read more from Laura Davison.

- Still, Mnuchin said yesterday that some checks for individuals under the stimulus will begin showing up in bank accounts within two weeks. “You’ll get the money,” Mnuchin said at a coronavirus briefing at the White House. The original plan was for payments to be arriving in three weeks, Justin Sink and Mario Parker report.

- Meanwhile, the IRS is already warning bad actors may target the checks with the same tricks used to steal tax refunds, reports David Hood.

Retail Furloughs to Pass 1 Million: Retailers have furloughed nearly 1 million workers this week amid an unprecedented shutdown of shopping in America, according to data compiled by Bloomberg. Neiman Marcus to Ross are among the latest major chains to announce they’re halting pay for their workers while maintaining benefits. Nonessential retail stores are closed across much of the U.S. in a bid to halt the spread of coronavirus. The total of furloughed workers now stands at about 900,000. Read more from Kim Bhasin.

Mnuchin Announces Bankers for Virus Aid: The Treasury Department has retained several Wall Street banks to assist with loans to three industries during the coronavirus crisis. PJT Partners will handle loans to airlines, while Perella Weinberg Partners will assist companies involved in national security, Mnuchin said yesterday at a White House briefing. Boeing will be receiving aid on national security grounds. Moelis will work with companies in the cargo industry, Justin Sink, Mario Parker and Saleha Mohsin report.

Virus Aid to Mortgage Servicers: U.S. regulators are holding off on helping mortgage servicing firms that could be hit with a surge of missed payments from borrowers hurt by the crisis, according to people familiar with the matter. Mortgage servicers, companies that collect home-loan payments and distribute them to investors, want the Fed and Treasury to use money from the stimulus to help them deal with a liquidity crisis industry groups say could drive many firms out of business. But members of the Financial Stability Oversight Council have discussed holding off on setting up such a program. Read more from Elizabeth Dexheimer and Saleha Mohsin.

Farm Groups Fight for Access to Loans: American farm groups are fighting for access to a small business disaster loan program expanded in response to the outbreak, arguing they’re being unfairly excluded. The American Farm Bureau Federation and 30 other agricultural organizations wrote the Small Business Administration objecting to a prohibition on the application form for Economic Injury Disaster Loans barring farms and most other agricultural businesses from participating. Read more from Mike Dorning.

Treatment, Research & Coordination

Trump Attacks 3M While U.S. Pushes Mask, Ventilator Makers: Trump attacked 3M over unspecified problems with its production of protective masks on the same day that his administration issued an order under the Defense Production Act to speed production of ventilators and masks for coronavirus patients. The president said at a White House news conference yesterday he signed an “element of the act against 3M” that allows the Federal Emergency Management Agency to obtain as many N95 respirators as it needs from the company. Trump earlier yesterday signed an executive order directing the Department of Health and Human Services to ensure that a half dozen companies, including General Electric, obtain needed supplies to produce ventilators.

- Meanwhile New York Governor Andrew Cuomo said yesterday the state would run out of ventilators in six days at the current rate. Trump said at the White House later that “thousands” of ventilators are in production. But he faulted states for failing to stockpile them, deflecting criticism of his administration. Read more from Jordan Fabian.

- Trump said New York state would have been better prepared for the coronavirus outbreak if Sen. Schumer hadn’t been distracted by impeachment, in an unusual rebuttal letter prompted by the Senate minority leader’s criticism of the administration’s handling of the outbreak. The spat conducted via TV interviews and letters shows two of the most powerful politicians in the U.S. trying to score political points as the nation faces a serious health and economic crisis. Trump was acquitted by the Senate on Feb. 5. He downplayed the threat from the virus for weeks afterward. Read more from Justin Sink.

FEMA to Be in Charge of Stockpile: The Trump administration is expected to put the Federal Emergency Management Agency in charge of obtaining medical supplies like masks and gloves for the Strategic National Stockpile, including deciding who gets federal contracts, according to two people familiar with the discussions. The method that the White House is looking to use is an “interagency agreement” in which one federal agency does work for another. Typically, such arrangements are used when one agency lacks a certain capability. Read more from Shira Stein.

White House Mask Guidance: The White House is likely to recommend that people living in areas hardest hit by the coronavirus cover their faces when in public, according to a person familiar with the matter, as new research shows that the pathogen may hang in the air after people sneeze, cough and even talk. The White House won’t urge Americans to purchase commercial medical-grade masks, which are in short supply at hospitals. The recommendation by the CDC would apply to areas with high levels of community transmission of coronavirus, the person said. Read more from Jennifer Jacobs and Michelle Fay Cortez.

Pence Says Hospital Fund will Pay for Uninsured: Some of the $100 billion in federal funds earmarked to help hospitals cope with the coronavirus pandemic will cover bills for the uninsured, Vice President Mike Pence said yesterday when asked about the administration’s move not to reopen Obamacare exchanges. “We don’t want any Americans to worry about the cost of getting a test, the cost of getting treatment,” Pence told reporters yesterday at the White House. The Trump administration is working on a proposal for the president to direct some of the funds targeted to hospitals to cover expenses for the uninsured. The funds would go directly to the medical facilities, Pence said. Officials expect to have an announcement today, Justin Sink and Mario Parker report.

- Around 3.5 million American workers probably lost their employer-provided health insurance policies in the past two weeks as the epidemic triggered an unprecedented wave of layoffs, according to research published yesterday by the Economic Policy Institute.

States Order Health Insurers to Keep Covering Workers: States including California, Ohio, Colorado, Wisconsin, and Maine are moving to require or encourage insurers to let employers continue covering employees under group policies—even if employees would normally lose eligibility due to layoffs or reduced hours. The move comes after employers asked health insurers to continue to cover employees forced into furloughs. Read more from Sara Hansard.

- Meanwhile, New York State’s unemployment fund nears insolvency as claims skyrocket stemming from the pandemic, reports Martin Z. Braun.

Michigan, Connecticut Seen as Next Hot Spots: The rate of positive coronavirus tests suggests that the next “hot spots” could include Michigan, Connecticut, Indiana, Georgia and Illinois, said White House virus task-force coordinator Deborah Birx. “We do have two states that have 35% positives. And that’s New York and New Jersey. So that confirms very clearly that that’s a very clear and an important hot zone.” Birx told reporters at a White House briefing. Louisiana’s positive test rate is 26%. Read more from Jennifer Jacobs and Jordan Fabian.

Crackdown on Virus Scams: The Justice Department and FBI in recent weeks have been investigating and prosecuting a string of fraudulent activity related to the coronavirus. As states, local governments and hospitals struggle to find and obtain critical medical equipment, a cottage industry has emerged of criminals and hackers seeking to scam and profit off the burgeoning crisis, reports Chris Strohm.

Virus ‘Death Ship’ Finally Docks: After being stranded at sea for three weeks, passengers on a Carnival cruise ship that was refused entry by multiple countries started disembarking in Fort Lauderdale, Fla. — but not all will be allowed to end a nightmare trip that left four dead and nine infected with coronavirus. Holland America Line’s Zaandam arrived at the port yesterday as emergency medical personnel waited to carry away the most seriously ill for treatment. The Rotterdam, a sister ship that came to the aid of the Zaandam and took on some of its healthy passengers, was also allowed to disembark. Read more from K. Oanh Ha and Jonathan Levin.

Elections & Politics

Trump Campaign Bets on Approval Rating Boost: Trump’s daily coronavirus briefings are delivering the highest approval ratings of his presidency, but that bump is at risk of fading before the November election — especially as deaths mount and scrutiny of the government response intensifies. Trump’s average job approval rating hit an all-time high on Wednesday at 47.7%, according to RealClearPolitics. That’s a 3.6-point jump from 10 days ago and surpasses the previous record set in his first week in office.

But as the pandemic progresses along with the economic fallout that accompanies it, Trump is facing the greatest crisis of his presidency just seven months before the general election. The White House has positioned Trump as a “wartime” president fighting an invisible enemy he said was introduced by China. He was made visible daily at the podium in lieu of the rallies that have sustained him politically. Read more from Mario Parker and Gregory Korte.

Virus Lockdowns Are Reshaping Senate Fight: Near-total lockdowns across the U.S. have shaken up the race for control of the Senate, with vulnerable incumbents and their challengers ditching traditional campaigning and the coronavirus pandemic putting a focus on Democrats’ strongest issue — health care.

Sen. Susan Collins (R-Maine) has switched from traditional campaign television spots on her record and promises for the future to ads like her most recent one featuring firefighters, doctors, police officers and restaurant workers making takeout meals. “They are the glue that holds us together, the real heroes of the coronavirus crisis, and we thank them,” she says in the ad.

Sen. Martha McSally (R-Ariz.), another of the most vulnerable GOP incumbents, has suspended traditional pitches for money. She is directing her donors to give instead to the Salvation Army for the next 15 days and is donating her monthly paycheck to virus relief. Read more from Steven T. Dennis and Laura Litvan.

Georgia Senator Dumped Travel Stock: Sen. Kelly Loeffler (R-Ga.) sold a total of $46,027 worth of stock in an online travel company in the day leading up to Trump’s announcement of a ban on most European travel to the U.S. Though the transactions were relatively small for Loeffler and her husband, the sales represented an about-face, as Loeffler, a Georgia Republican, had just days earlier purchased the shares. Last month, news reports about her sales and purchases of other stocks — after government briefings to Congress on the virus — caused a stir, with critics questioning whether she was sufficiently focused on her constituents. Loeffler said outside finance professionals manage her portfolio and do so at arm’s length, Billy House and Greg Farrell report.

Judge Rejects Wisconsin Primary Delay: A federal judge refused to postpone Wisconsin’s presidential primary set for Tuesday, but extended the deadline for absentee voting by a week. The judge denied a request from state Democrats, including Gov. Tony Evers, and allied groups for Wisconsin to delay in-person voting in response to the pandemic. But the judge extended the deadline for requesting an absentee ballot until Friday and gave voters until the 13th to submit ballots. Read more from Jennifer Epstein.

What Else to Know

Captain Ousted After Virus Memo: The captain of the USS Theodore Roosevelt was relieved of command after writing a memo pleading for help in addressing the pandemic on the nuclear-powered aircraft carrier, which is now sidelined in Guam. Acting Navy Secretary Thomas Modly announced the decision yesterday at the Pentagon, criticizing the way Captain Brett Crozier expressed his concerns and saying the officer let the stress of the outbreak, which has affected more than 100 crew members, “overwhelm his ability to act professionally.”

The memo, which Navy leaders say was sent via unsecure email and distributed broadly outside the chain of command, “created a little bit of panic on the ship,” and “misrepresented the facts of what was going on on the ship as well,” Modly said. “It raised alarm bells unnecessarily.” Democratic lawmakers blasted the removal. Read more from Roxana Tiron, Glen Carey, and Travis J. Tritten.

2-for-1 Regulations Order Survives: Trump’s executive order directing agencies to scrap two regulations for every new one they create has weathered another legal assault, as a federal court yesterday scrapped a challenge from California and other states. The U.S. District Court for the District of Columbia ruled that California, Oregon, and Minnesota lacked standing to challenge the directive because they couldn’t show it directly harmed them.

The states filed suit last year, noting specific regulatory moves they say were motivated by the order. But Judge Randolph D. Moss concluded “they have not shown that either the two-for-one rule or the annual cap caused the relevant agency to act or to decline to act.” Read more from Ellen M. Gilmer.

Border Wall Notches Court Loss: Two environmental groups can proceed with a lawsuit aimed at blocking construction on Trump’s promised border wall with Mexico, a federal judge ruled. The ruling by U.S. District Judge Trevor McFadden in Washington was largely a victory for the Center for Biological Diversity and the Rio Grande International Study Center, though several of the groups’ claims, including environmental ones, were thrown out. The judge also said they can’t sue Trump. Read more from Erik Larson.

Deutsche Asked for Payment Delay: The Trump Organization, the family business of the president, is in informal discussions with Deutsche Bank about delaying some loan payments, according to a person familiar with the matter. The global coronavirus pandemic has forced borrowers and lenders to discuss ways to honor debts while acknowledging the enormous pressure on company bottom lines. The talks were reported earlier by the New York Times. Read more from Matthew Leising.

EPA Extends ‘Secret Science’ Comment Period: The EPA is extending by one month the comment period for a supplement to its “secret science” rulemaking, granting a wish to environmentalists and congressional Democrats who had asked for an extension amid the coronavirus pandemic. The EPA’s April 2018 proposal would bar the agency from using scientific research that isn’t or can’t be made public, marking a change from its decades-old approach to using science in rulemaking, Stephen Lee reports.

To contact the reporters on this story: Zachary Sherwood in Washington at zsherwood@bgov.com; Brandon Lee in Washington at blee@bgov.com

To contact the editors responsible for this story: Giuseppe Macri at gmacri@bgov.com; Loren Duggan at lduggan@bgov.com