Trump Tax Cuts Exceed Agencies’ Cost: What to Know in Washington

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Donald Trump is selling tax cuts to voters that would cost more than $9.8 trillion, or every dollar of non-defense discretionary spending over the next 10 years. But first, you should know:

- House Republicans want new citizenship requirements for voters in exchange for skirting a government shutdown.

- Joe Biden is preparing to block Nippon Steel’s takeover of US Steel.

- Kamala Harris plans to trim a capital gains tax increase proposed by Biden.

Trump Tax Cuts Cost More Than Almost All Federal Agencies

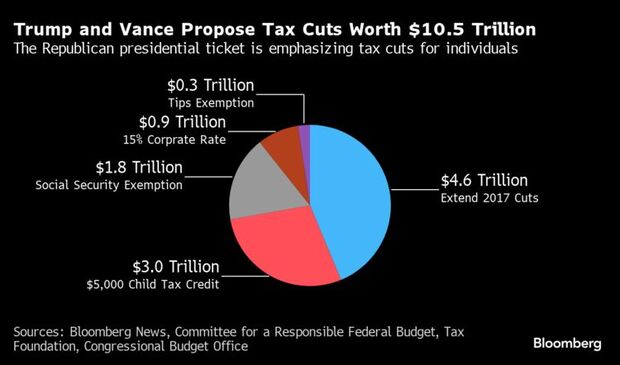

The tax cuts Donald Trump and running mate JD Vance are pitching to voters could cost up to $10.5 trillion over a decade, exceeding the combined budgets of every domestic federal agency.

The cost of Trump’s plans is so big that if Congress passed the tax cut proposals and kept spending flat, they could fund the military, federal benefit programs like Social Security, pay interest on the debt — and nothing else. That means eliminating federal agencies handling law enforcement, border security, air traffic control, tax collection, and international relations.

Republicans argue tax cuts boost growth, but it’s not clear how much Trump’s proposals, which largely cut levies for individuals rather than businesses, would spur new economic activity.

The impact of Vice President Kamala Harris’ proposed cuts — exempting tips from taxation and expanding the child tax credit — pales in comparison. She wants to offset the lost income, estimated at $2 trillion by one think tanks, with tax increases on corporations and wealthy individuals. Harris is rolling out policy ideas piecemeal, and recently called for an expanded deduction for start-up businesses.

It’s highly unlikely Trump’s promises would pass even in a Congress controlled by Trump allies. The Republican ticket’s tax proposals include extending Trump’s 2017 tax cuts, a big expansion to the child tax credit and exemptions for tips and Social Security payments. Read More

GOP Ties Noncitizen Voting to Government Funding

House Republicans want to make voters to show proof of US citizenship in exchange for averting a government shutdown.

Federal coffers run dry Oct. 1 unless Congress passes a stopgap spending bill, but conservative lawmakers say they won’t support short-term funding without including a plan to block noncitizens from polls. It’s Republicans’ latest attempt to place immigration concerns front and center in high-stakes negotiations on Capitol Hill, and exploit Democrats’ political vulnerabilities.

The issue is unlikely to force a shutdown. House Democrats largely oppose the legislation, and only five defected to support it in an otherwise party-line July vote. Some Republicans who support the bill believe it should be left off a continuing resolution, since it would cost Democratic votes. Even if House leaders move a CR with the bill attached, the Democrat-led Senate will likely strip it out.

That’ll force the House to pass a clean CR without the GOP rider. Most Republicans will want to avoid an October shutdown that could prove politically disastrous just before the election. Read More

Harris Pushes 28% Capital Gains Tax Rate on $1 Million Earners

Harris is paring back the capital gains tax increase proposed by President Joe Biden in a bid to court the business community and deep-pocketed donors.

Harris called for a 28% rate on people earning $1 million or more, touting it as a means to ensure the wealthy pay their fair share. Her proposal falls short of the 39.6% rate Biden embraced, setting apart her economic vision from the sitting president as voter skepticism of the administration’s economic record threatens to weigh down her ticket. The current capital gains tax rate is 20%.

Tax policy is taking center stage in the contest between Harris and Trump as the two pitch dueling measures aimed at courting key swing state voters and business leaders. Read More

Editor’s Picks

Trump Says His Debate Strategy Is to Give Harris Room to Speak

Donald Trump said he plans to allow his opponent, Kamala Harris, to speak without interruption during their presidential debate next week, a shift for the reality-television-star-turned-politician who built a career on combative exchanges.

Matt Damon, Lin-Manuel Miranda to Headline NYC Harris Fundraiser

Actor Matt Damon and Broadway musical creator Lin-Manuel Miranda will appear at a campaign fundraiser for Vice President Kamala Harris as she looks to expand her cash advantage over rival Donald Trump.

Kamala Harris Fundraising Blitz in Works by Supporters in Crypto

Crypto-industry supporters of Vice President Kamala Harris are working to set up at least eight fundraisers to benefit the Democratic nominee in the coming weeks.

Trump Campaign Spent $32 Million More Than It Raised in August

Donald Trump dug into his war chest in a bid to stem the momentum of Democratic rival Kamala Harris, drawing from his cash reserves as the presidential race shifts into its most frenzied — and expensive — stage yet.

Liz Cheney Says She’s Voting for Kamala Harris in November

Former Representative Liz Cheney, whose steady rise in the Republican Party ended when she opposed Donald Trump, said Wednesday that she’d vote for his Democratic rival in the November election.

News from the Hill

Pass-Through Tax Break Backers Target Centrist Democrats

A new coalition launching Thursday will target moderate Democrats in defending a key tax break for pass-through business income.

Steward CEO Won’t Testify in Senate Until Bankruptcy Ends

Steward Health Care Chief Executive Officer Ralph de La Torre has informed senators he won’t participate in an upcoming hearing probing the hospital operator’s failure until after its bankruptcy has concluded.

Warren Urges IRS Crackdown on Hotel, Hospital REIT Bad Actors

Sen. Elizabeth Warren (D-Mass.) wants the IRS to amplify its enforcement on real estate investment trusts that are skirting tax laws.

Harlan Crow Rejects Senate Records Request in Thomas Inquiry

Republican donor Harlan Crow is refusing to provide the Senate Finance Committee with financial records pertaining to his private yacht and jet travel.

What Else We’re Reading

Biden Administration Monitors Boeing Labor Talks as Strike Looms

The Biden Administration is monitoring contract discussions between Boeing Co. and its largest union as a strike deadline looms that could shut down the company’s Seattle-area airplane factories next week.

Biden to Award $7.3 Billion for Rural Energy in Boost for Harris

President Joe Biden will announce $7.3 billion in awards for more than a dozen rural electric cooperatives during a trip to Wisconsin on Thursday, as Democrats try to highlight efforts to combat inflation in a critical battleground state.

Biden to Block Nippon Steel’s Proposed Takeover of US Steel

US President Joe Biden is preparing to block Nippon Steel Corp.’s $14.1 billion takeover of United States Steel Corp., according to people familiar with the matter.

CDC Chief’s New Senate Confirmation Raises Questions for Harris

The Centers for Disease Control and Prevention has been one of the few health agencies with a leader that didn’t require Senate confirmation. That’s all changing next year.

Trump Presses Effort to Delay NY Sentencing With Federal Appeal

Donald Trump appealed a ruling that prevents him from moving his New York hush money case to federal court, pressing ahead with a bid to delay his Sept. 18 sentencing until well after the November presidential election.

Putin Says Russia Backs Biden’s Choice of Harris in US Election

Vladimir Putin said Russia will support US Vice President Kamala Harris in November’s presidential election because she’s been endorsed by President Joe Biden.

US Says Kremlin-Backed Plot to Meddle in Election Disrupted

Russia—backed entities pursued a sprawling, yearslong operation to meddle in the 2024 US presidential election and broadly boost the Kremlin’s interests, the Biden administration alleged in announcing steps to disrupt the scheme.

To contact the reporters on this story: Giuseppe Macri in Washington at gmacri@bgov.com; Jeannie Baumann in Washington at jbaumann@bloombergindustry.com

To contact the editor responsible for this story: Kayla Sharpe at ksharpe@bloombergindustry.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.