Treasury Outlines $1.5 Billion Cloud Road Map: This Is IT

The Treasury Department plans to invest more than $1.5 billion over the next decade to migrate its systems and data to the cloud, according to a procurement forecast released Sept. 15.

The department plans to pursue a “shared service cloud infrastructure model in order to capture Treasury-wide efficiencies in access, contracting, and security,” according to the forecast. It currently maintains a community cloud environment built on Amazon Web Services Inc. infrastructure, though Treasury officials are seeking to expand a footprint with Microsoft Corp. and other providers in the future. Treasury’s spending growth with cloud service providers is expected to exceed 30% on a year-over-year basis, according to the document.

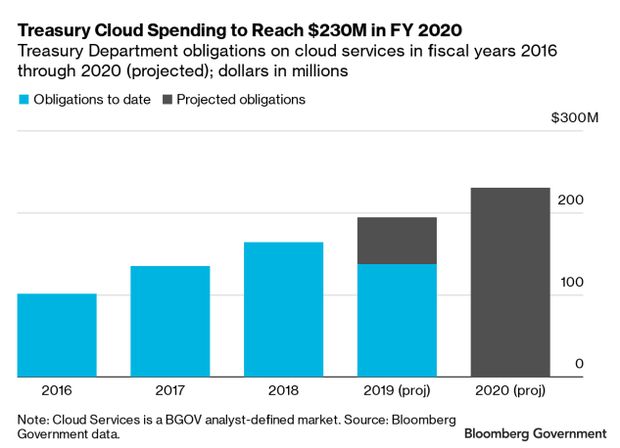

The department obligated $163 million on cloud services in fiscal 2018, according to Bloomberg Government’s market definition, with the majority of that spending on cloud software and on-premises, private cloud infrastructure. Given the current trend, BGOV projects Treasury’s total cloud spending to reach $230 million in fiscal 2020.

Treasury officials plan to conduct requirements gathering to identify common needs for commercial infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS) across the department. The agency will also offer commodity SaaS applications, such as email as a service and cyber threat monitoring, at a lower price point through bulk purchasing, according to the document.

The forecast outlined the department’s three-step acquisition road map:

- A short-term extension of current small-scale cloud contracts: Treasury’s Office of the Chief Information Officer (OCIO) plans to renew two small cloud services contracts for the Workplace.gov Community Cloud (WC2): a $6.4 million task order for AWS cloud infrastructure through a reseller, Four Points Technology LLC, and a sole-source $3.3 million task order to MetroStar Systems Inc. for cloud support services. Both were awarded at the end of July 2019.

- A medium-term bridge contract for cloud infrastructure and support services: The OCIO plans to expand the services available via the WC2 environment in fiscal years 2020 and 2021 through three separate acquisitions. First, the plan calls for a four-year, $170 million cloud migration and support services contract through Chief Information Officer – Solutions and Products 3 (CIO-SP3). Treasury plans to issue an award by the end of September 2019. Second, OCIO officials plan to recompete Four Points Technology’s contract for AWS cloud infrastructure in early fiscal 2020. The follow-on will have a four-year period of performance and a $200 million ceiling. Third, the department plans to simultaneously award a separate four-year, $200 million contract for Microsoft cloud infrastructure, platforms, and software.

- A long-term multi-cloud contract: Treasury officials plan to acquire a full suite of enterprise IaaS, PaaS, and SaaS through a single cloud broker or systems integrator. The contract, dubbed “T-Cloud,” will have a period of performance of eight years and a ceiling value of $1 billion, with an award expected in early fiscal 2022. The contract will support a full suite of cloud services provided by AWS, Microsoft, Google Inc., and Oracle Corp., as well as SaaS providers such as Salesforce.com Inc. and Box Inc. The department will compete T-Cloud using a Best-in-Class vehicle, such as Schedule IT-70 or Alliant, beginning with a conceptual request for information in early fiscal 2020.

Treasury’s move follows large-scale cloud migration strategies from the departments of Defense and Homeland Security as well as the Central Intelligence Agency (CIA). Like the Pentagon’s Joint Enterprise Defense Infrastructure (JEDI) program, the T-Cloud will be centrally managed as a shared service for Treasury subagencies. But like the CIA’s Cloud Computing Enterprise (C2E) program, the contract will use multiple cloud service providers, which may offer greater flexibility and limit the potential for costly bid protests.

Given T-Cloud’s expected size and scope, it will no doubt be a contract that cloud providers and systems integrators follow closely over the next two years.

Chris Cornillie is a federal market analyst with Bloomberg Government.

To contact the analyst on this story: Chris Cornillie in Washington at ccornillie@bgov.com

To contact the editors responsible for this story: Daniel Snyder at dsnyder@bgov.com; Jodie Morris at jmorris@bgov.com