Telework Drives Hard Look at Federal Office Spaces for Savings

- Pandemic response accelerated hybrid workforce model

- Expiring leases, underutilized buildings targeted for savings

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to grow your opportunities. Learn more.

The federal government’s pivot to telework in response to the Covid-19 pandemic is fundamentally reshaping long-term agency spending plans for office buildings, parking garages, warehouses, and other physical assets and amenities.

The transformation of telework from a convenient efficiency practice to an essential component of delivering government services has made building use a central element of agency IT, workforce, and financial planning. Agencies are evaluating underutilized properties for potential cost savings, even as they attempt to recruit, train, and retain a civilian workforce predicted to grow in fiscal 2024.

The General Services Administration’s fiscal 2024 budget proposal cites the need for continued spending on IT infrastructure, training, and other workforce improvements through contracts such as its Multiple Award Schedule for Human Capital and through the $5.75 billion Human Capital and Training Solutions (HCaTs) vehicle. These are some of the procurement building blocks making continued real estate cutbacks possible.

HCaTs is being rolled into GSA’s pending $60 billion OASIS+ requirement.

GSA, the government’s civilian real estate provider, is partnering with the 24 Chief Financial Officers Act agencies to create individual workspace portfolio plans for real estate footprints that match personnel needs, in part by incorporating telework, hybrid work environments, and distributed offices.

GSA reports engaging with half of the agencies covered by the CFO Act on their portfolio plans in fiscal 2022, with a goal of engaging all 24 agencies by the end of fiscal 2023.

Among the primary targets for savings will be expiring leases for underutilized space.

Policy Drivers

The onset of Covid-19 accelerated real estate efficiency moves begun more than a decade ago. The Obama administration initiated a “Freeze the Footprint” policy in 2012, which was followed by the National Strategy for Real Property and Reduce the Footprint initiatives in 2015.

Leased building square footage was already declining by the time Congress passed federal property management changes in 2016 (Public Law 114-318).

The law created created the Federal Real Property Council to help develop strategies for better managing federal property. The Office of Management and Budget followed up with guidance in November 2019 to help agencies carry out the new policies and improve performance.

OMB paused these changes to allow agencies time to respond to Covid. By July 2022, however, a new policy memo instructed agencies to submit comprehensive five-year capital plans for fiscal 2024 through fiscal 2028—plans that include detailed consideration of “hybrid work, onsite work, telework, alternative work schedules, online collaboration, and remote work policies and practices.”

Telework and space reduction plans are now tightly integrated into agency capital planning.

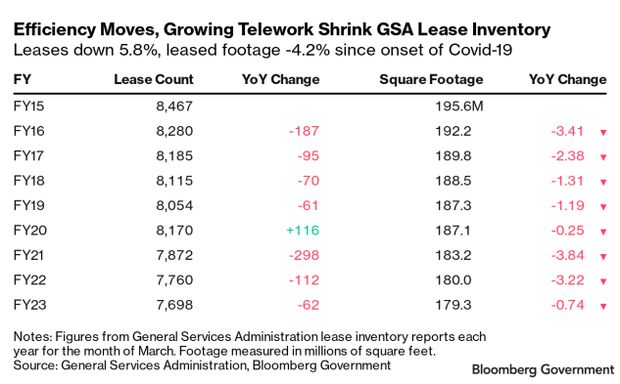

Analysis of GSA’s historical building lease inventory since fiscal 2015 shows how efficiency planning has taken root.

The most recent inventory data shows a 9.1% decline in the number of GSA leases issued and an 8.3% decline in leased square footage. Since the Covid-19 pandemic erupted in March 2020, leases are down 5.8% and square footage by 4.2%.

IT Indicators

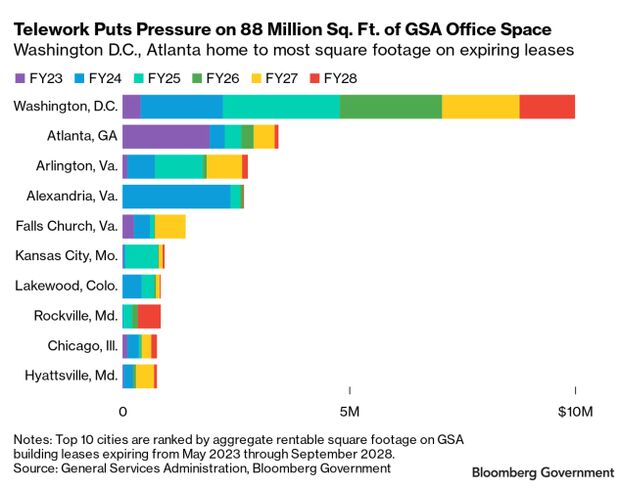

With telework-related savings now an integral part of capital plans, an agency’s expiring lease portfolio could be a leading indicator of forthcoming IT spending.

The most recent data shows a total of 4,366 individual leases are slated to expire between May 2023 and the end of fiscal 2028, accounting for 88 million square feet of space. Together the annual value of these expiring leases totals $2.8 billion. Offices comprise 88% of the space, followed by 9% for warehouses, and 3% for other structures.

Matching expiring leases with buildings identified as underutilized in GSA’s most recent real property inventory flags potential downsizing targets—and the agencies that may be ramping up spending for telework and IT to economize on lease costs.

For example, the Federal Aviation Administration is one of a pair of agencies reported to be leasing space at 950 L’Enfant Plaza in Washington, DC. GSA’s inventory reports four leases at this location, covering 146,000 square feet of rentable space at an annual cost of $5.9 million. FAA leases comprise a minimum of 7% of the building’s space costing at least $1 million. All of the leases expire in the next two years.

GSA lists the property linked to FAA in its Federal Real Property inventory as “underutilized.”

Not surprisingly, the Department of Transportation’s fiscal 2024–28 capital plan details the agency’s joint initiative with GSA to consolidate operations from around the city by collapsing several GSA-controlled leases that total approximately 210,000 square feet and consolidating offices at FAA headquarters.

Other Department of Transportation buildings around Washington are also underutilized. The department reports its headquarters building is currently less than 61% occupied, below pre-pandemic levels. Plans for its headquarters include some physical renovation as well as broad use of telework, remote work, and “workspace hoteling” to make space available for more employees to share building resources.

GSA’s property inventory currently identifies more than 260 leased buildings nationwide as underutilized or unused.

Agencies are examining building costs for potential savings case by case. “The COVID-19 pandemic has forever changed the Federal government’s approach to telework,” Office of Personnel Management Director Kiran Ahuja said in OPM’s most recent Status of Telework report.

“Now,” she says, “there is no going back.”

Telework Metrics

OPM, which tracks governmentwide workforce trends, reported the federal employee telework participation rate hit 47% in fiscal 2021, up 25% from fiscal 2019. This figure includes 94% of all telework-eligible employees, up 4% from the previous year.

Additionally, 72% of the agencies confirmed the ability to track telework cost savings. Many cited lower costs from reduced employee absences and lower commuting subsidies. But for others, lower space demands stood out. Examples include:

- GSA reported that from fiscal 2012 through fiscal 2021, occupied office and warehouse space has declined by 3 million usable square feet, or 47%, as a result of telework, hoteling, desk sharing, and right-sizing workspaces.

- The Department of Veterans Affairs reduced office space by 94,000 square feet, leading to savings of $5.2 million in the Washington area.

- The Defense Contract Audit Agency flagged $1.5 million in lease savings.

- A sub-agency of the Department of Labor reported a a 60% reduction in office space use.

- The Patent and Trademark Office avoided $45.4 million in office space costs as a result of increased telework, enabling the agency to increase its total number of employees.

Reported efficiencies like these have GSA, the government’s civilian real estate provider, eyeing potential savings in the approximately 60% of its lease portfolio expiring over the next five years, even as the Biden administration predicts continued growth in the federal civilian workforce.

Driving the pursuit of savings are a pair of GSA efficiency initiatives: the “Lease Cost Avoidance Program,” designed to optimize space utilization; and the more recent Workplace 2030, the source of GSA’s push for workspace portfolio plans that’s integrated with the agency’s latest Performance Plan.

To contact the reporter on this story: Paul Murphy in Washington at pmurphy@bloombergindustry.com

To contact the editors responsible for this story: Amanda H. Allen at aallen@bloombergindustry.com; Robin Meszoly at rmeszoly@bgov.com

Stay informed with more news like this – the intel you need to win new federal business – subscribe to Bloomberg Government today. Learn more.