Set-Aside Program Abusers Go Unchecked for Now: Ben Van Roo

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to grow your opportunities. Learn more.

After a long summer of debate, lobbying, and a media blitz, the “SBIR/STTR Extension Act of 2022″ passed the US Congress with only a few days to spare and got the president’s signature Sept. 30, the day the contracting set-aside program was set to expire.

Renewing the relatively popular program was a nonpartisan effort. There are many examples where the seed capital provided by Small Business Innovation Research (SBIR) or Small Business Technology Transfer (STTR) grants has stimulated research and growth at companies.

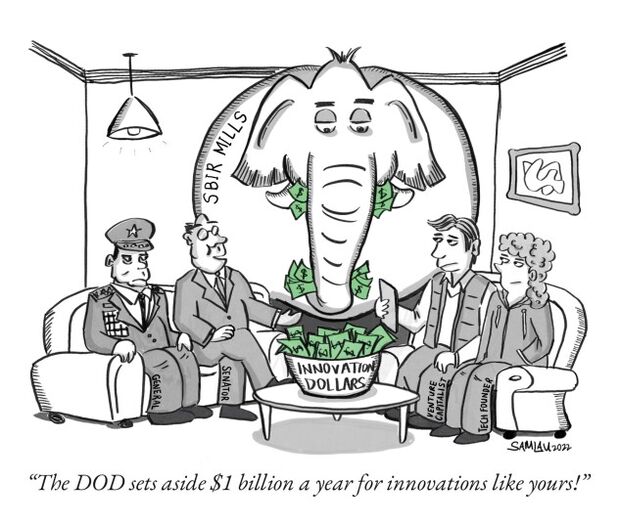

The issue at hand was not whether to cancel the program, but what could be done to address a few dozen companies that are viewed by many as abusers of the system. Of the $50 billion awarded in the last 20 years to over 21,000 companies, the 25 most awarded firms have received $5 billion.

Critics call these companies “SBIR mills.” They’re successful at receiving the awards, but their performance and the return on investment to the taxpayer and warfighter are in question.

Sen. Rand Paul (R-Ky.) questioned SBIR mills in three areas:

- their overall dependence on SBIR/STTR dollars as a means of staying in business,

- their inability to find success in converting SBIR award dollars into commercial technologies used by the DOD, and

- the inability of many of these firms to grow and scale the defense industrial base.

In the end, the extension that went through with some improvements, yet it does little to prevent abuse by “SBIR mills.”

On the plus side, the new law does plant seeds that may make the next reauthorization in 2025 look a bit different.

Changes in Law

The new law includes provisions to increase the commercialization rates of multiple awardees and their ability to move through the phases of the SBIR/STTR program. The language sounds meaningful, but a look at the actual data shows that little will change.

Phase I to Phase II transition. Congress upped the required transition rate from 25% to 50% for firms with 50 or more Phase 1 awards over five years (up from 15).

The net impact is neutral or negative. This policy would affect the top 20 to 25 companies demonstrating an inability to move their proposals through the SBIR stages. Currently, only about eight to 10 companies would be in danger of missing this relatively low bar.

Increased Commercialization & Outside Investment. Congress also put into place two increased checks around commercialization and additional investment.

- Companies that have won more than 50 Phase II awards during the previous 10 years (up from 15) must show $250,000 in sales or investments per Phase II award (up from $150,000).

- Companies that have won more than 100 Phase II awards over the past 10 years (up from 15) must show $450,000 in sales/investments per Phase II award (up from $150,000).

The net impact of these requirements is neutral or negative. In the first bucket, about 25 companies could be affected. The second covers only 10 firms.

In each case, it would mean that for every $5 being given by the government, between $1 and $2 would need to translate into sales or additional investment. That’s not inspirational performance, especially when these companies have received billions of taxpayer dollars.

Positive Changes

Mandatory use of open topics. Open topics are SBIR/STTR awards that allow for a broad range of technologies and have been shown to increase the number of companies participating in the program and working with the DOD. Championed by the Air Force, open topics are now mandatory for each component of the DOD at least once a year.

Process improvements. Three differences in processing awards address potential misuse and look to speed up bona fide awards.

- Safeguards barring companies with foreign influence and foreign investment respond to concerns by Sen. Joni Ernst (R-Iowa) that US firms are being crowded out by hostile entities like China.

- Private entities will be banned from helping to craft solicitations. This is important as it limits companies from influencing and tuning solicitations up front in order to “pre-wire” their specific products and services.

- The DOD will start a pilot program granting accelerated awards (90 days) with simplified procedures.

Meaningful analysis. The Government Accountability Office will be tasked with studying and comparing open topics and conventional topics on a number of dimensions. The GAO will also study multiple award winners and their subcontractors. Those two analyses will show how well open topics perform and shed light on the role of prime contractors used as subcontractors.

Final Thoughts

SBIR mills got away relatively unscathed from Sen. Paul’s early proposals of reform and accountability, but they won’t be able to go back to the good old days. With a three-year renewal period as opposed to the traditional five years, reformists will get another shot at change. Next time around, more eyes will be scrutinizing the use of these funds and the SBIR mills themselves, including the House and Senate Armed Services Committees.

Will 2025 be too late? With advances in drones, counter drones, AI, and hypersonics, our adversaries aren’t waiting. Could we have done better for the warfighter, taxpayer, and defense industrial base? Unequivocally yes.

Subscribers can find related content at Bloomberg Government .

Author Information

Ben Van Roo is the CEO and co-founder of Yurts Technologies Inc, an application development platform for large AI models. Ben also sits on the Advisory Council for the Global SOF Foundation, a non-profit organization for the global special operations community. Prior to Yurts, Ben built the National Security team at Primer Technologies Inc. and was a national security policy researcher at The RAND Corporation. Ben has a PhD in Operations Research from the University of Wisconsin-Madison.

Write for us: Email IndustryVoices@bloombergindustry.com

Stay informed with more news like this – the intel you need to win new federal business – subscribe to Bloomberg Government today. Learn more.