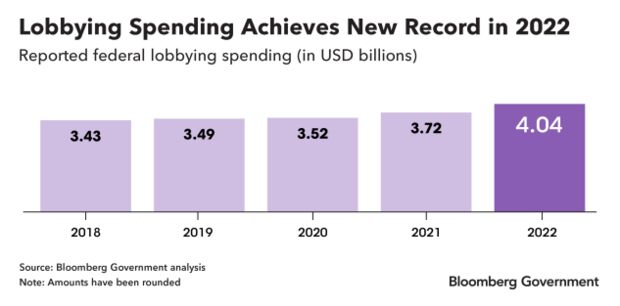

Record Annual Lobbying Spending Spurred by Active Congress

- Total lobbying spending topped $4 billion for the first time

- Spending in 2016 hit a low point after declining for years

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Lobbying spending in Washington reached a new high in 2022, continuing a multi-year streak driven by a law aimed at climate change and inflation, plus measures steering tax money into highways and semiconductor manufacturing.

In disclosures required by law, the influence industry collectively reported $4 billion in spending last year, according to a Bloomberg Government data analysis.

That continued a trend. Advocacy spending has been steadily climbing since the election year of 2016, when years of decline sent spending to a low point of $3.13 billion.

Lobbyists were busy in 2022 because Capitol Hill was so active, said Tim LaPira, a James Madison University political science professor who studies lawmakers and lobbying. “If Congress is doing more, that means stakeholders with an interest in those policies need to pay more attention.”

Democrats used their control of both chambers to pass a sweeping health-tax-climate law (Public Law 117-169) and reached a bipartisan deal on legislation to bolster the domestic semiconductor industry (Public Law 117-167). The White House and Congress also discussed curbing the power of big technology companies.

That was in addition to consideration of the multi-faceted appropriations and policy bills that drive agency funding and priorities. And of course hundreds of other measures didn’t become law, perhaps in part because of pushback leveraged through lobbyists.

Click here to download the annual BGOV lobbying analysis

“When Congress decides to act, the special interests respond,” LaPira said. “Both sides will ramp up, defense and offense.”

The growth of the advocacy industry is charted in an annual Bloomberg Government report that also examines the reported revenue and other performance metrics.

A key question for 2023 will be the impact of divided control of Congress, and whether the use of professional advocates changes now that consensus is so much harder to reach.

Loren Monroe, principal at BGR Group, said the new dynamics can benefit the influence industry because “the risks are just too high now not to be engaged.”

“Businesses can’t afford to sit on the sidelines,” Monroe said in an interview. “Uncertainty and risk often drive engagement in Washington, D.C., which will result in a steady growth in the lobbying business.”

One of the money generators: after big laws are enacted, federal agencies have to write the regulations that put the new measures into practice—creating even more questions from corporate clients.

“What companies often say is, ‘We prefer good rules. But, even if the rules are bad, as long as they’re predictable, we can figure out how to operate. What we really can’t deal with is uncertainty,’” said Brian Pomper, partner and co-head of the lobbying practice at Akin Gump Strauss Hauer & Feld.

“They need help figuring out, ‘What should we do in response to the various things swirling around in politics?’” he said.

Pomper’s firm in 2022 remained second-largest in total revenue with about $53.2 million, trailing Brownstein Hyatt Farber Schreck, which took in roughly $60.8 million, according to the BGOV analysis.

2022 Was a Rebuilding Year for Firm That Lost Lobbyists

At the No. 3 firm, Holland & Knight, revenue rose to about $43.2 million from $35.1 million earned in 2021.

“It was probably one of the most productive Congresses in the last 50 years,” said Rich Gold, head of the firm’s public policy group. “That created a huge amount of activity that will continue as the laws that went on the books in 2022 are implemented.

Of the firms with the most revenue, the BGOV analysis showed almost all of them with higher revenue in 2022 than the year before. The exception was Akin, with $53.2 million, compared with $53.6 million. Pomper said a quieter-than-usual second quarter was followed by what he described as the firm’s best-ever performance in the fourth quarter.

If this turns out to be a year in which Congress would rather trim spending than add to it, that, too, can be good for lobbying firms, said Cristina Antelo, principal and founder of Ferox Strategies.

“Either one of those inspires the industry to want to take part in the conversation,” she said. “People are going to want to spend money on lobbying to protect what they’ve got.”

As the 2024 election draws closer, though, LaPira anticipates less activity as lawmakers focus on re-election.

“All the oxygen gets sucked out of Washington out on the campaign trail and Congress is doing less,” he said.

Jorge Uquillas in Washington and Cordelia Gaffney in Washington also contributed to this story.

To contact the reporter on this story: Maura Kelly Lannan in Washington, D.C.

To contact the editors responsible for this story: Katherine Rizzo at krizzo@bgov.com; Angela Greiling Keane at agreilingkeane@bloombergindustry.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.