Pandemic Business Loan Extension Pressed by Chamber and Allies

- Paycheck Protection Program set to expire on March 31

- Groups sent letter to Senate leaders seeking more time

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Hundreds of business groups, led by the U.S. Chamber of Commerce, have launched an effort to extend the Paycheck Protection Program that’s intended to help small businesses hurt by the pandemic and which expires at the end of the month.

The Chamber sent a letter to key Senate leaders Wednesday requesting that Congress stretch the program through 2021. More than 670 other business organizations joined in, including chambers in all 50 states and industry groups such as the National Association of Realtors, the National Community Pharmacists Association, and the U.S. Travel Association.

“While the vaccine rollout is a light at the end of the tunnel, these small businesses must make it through the darkness first,” said Matt Haller, the senior vice president of government relations and public affairs at the International Franchise Association, which signed the letter. “At a time when both parties need to put up some easy wins to demonstrate Congress can function, extending the PPP deadline is as close to an uncontested layup as exists.”

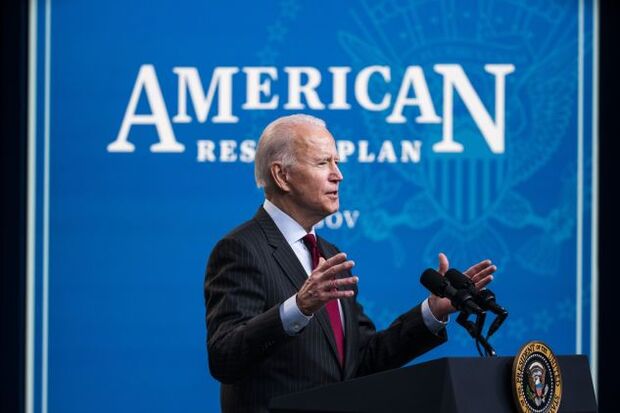

The advocacy effort had been focused on prodding the Senate to include the extension in the massive pandemic relief package sought by President Joe Biden. But proponents will have to look for other ways to push the provision through after a key senator said Thursday the extension couldn’t be included in the recovery measure under the reconciliation process Democrats are using to pass the aid plan with a simple majority. The House passed a $1.9 trillion recovery package that provided $7.25 billion in additional funds to the forgivable loan program, but it didn’t include language that extends it beyond March 31.

The letter, sent to Majority Leader Chuck Schumer (D-N.Y.), Minority Leader Mitch McConnell (R-Ky.), and Small Business Committee Chair Ben Cardin (D-Md.) and ranking member Rand Paul (R-Ky.), highlights the plight of minority-owned businesses, which the business groups said are at greater risk of shuttering and have a harder time getting access to capital.

The Biden administration is prioritizing the smallest businesses for PPP loans and making the process more equitable, only processing loan applications for businesses or nonprofits with 20 or fewer employees from Feb. 24 through March 9. Biden ordered the changes in February saying that in the early days of the program smaller businesses “got muscled out of the way” by bigger businesses that were more adept at securing funding.

The business groups said in their letter that because of changes enacted since December, the program needs “additional time for them to actually produce the desired result.”

There are other commonly mentioned concerns with the looming deadline: the Small Business Administration hasn’t released the updated guidance for Biden’s priority process, participants often face error messages upon submitting applications, and the system risks a backlog with increased demand.

Tom Sullivan, the Chamber’s vice president of small business policy, said in an interview that 95% of Black-owned businesses are sole proprietorships that would benefit from priority access. However, minority-owned businesses are less likely to have banking relationships, so getting them to know about the program, trust it, and receive a loan can take longer, he said.

“We know that everyone is trying to help the segment that needs the help the most. And the U.S. Chamber is right along there with them,” Sullivan said in a telephone interview. But “trying to help and actually helping are not always the same.”

The Chamber and its allies need to find a legislative alternative for the extension, either as a stand-alone bill or as part of other measures moving on Capitol Hill. Lawmakers explored putting the extension in the pandemic package but “couldn’t do it” under reconciliation rules, Cardin said in an interview on Capitol Hill. Cardin said his committee would hold a hearing this month to examine how much money is in the program and hear from the Small Business Administration to see how quickly the agency is able to process applications.

‘Shot in the Arm’

The National Community Pharmacists Association has been leveraging coalitions like the one put together by the Chamber to complement its own lobbying and keep pressure on policymakers with weekly communications, said Karry La Violette, the group’s senior vice president of government affairs.

The program has been “a shot in the arm for our members,” she said. There are 21,000 community pharmacies in the U.S., and an average of 11 employees at each store.

An extension is needed because there’s more than $120 billion in the Paycheck Protection Program that still hasn’t been allocated, said Charles Crain, the senior director of tax and domestic economic policy at the National Association of Manufacturers, which also signed the letter. He said it’s already helped 330,000 small manufacturers keep workers on payroll.

Destination Marketing Organizations, a large portion of the travel sector that run tourism bureaus, weren’t able to access the program until Congress expanded it in December.

“We are at a point now where you could easily craft a hardest-hit provision. Most everyone in the travel and hospitality sector would qualify,” said Tori Barnes, executive vice president of public affairs and policy at the U.S. Travel Association.

Small Business Majority, a group that’s been critical of the bureaucratic hurdles of the program, signed on to the Chamber’s letter.

“While we have consistently pointed out the program’s limitations,” Small Business Majority CEO John Arensmeyer said in an email, “it’s the primary vehicle right now for small business assistance and it has significant money allocated to it. So, it needs to be fully utilized, and that means it needs to be extended.”

Separate from the Chamber’s initiative, the American Institute of Certified Public Accountants is urging Congress to extend PPP’s sunset for at least 60 days, citing the error messages and other issues facing underserved and minority-owned businesses.

“The accounting profession believes that Congressional action now to extend the looming deadline will help ease Main Street America’s anxiety and frustration,” Barry Melancon, the group’s president and CEO, said in a statement.

To contact the reporter on this story: Megan R. Wilson in Washington at mwilson@bgov.com

To contact the editors responsible for this story: Bennett Roth at broth@bgov.com; Kyle Trygstad at ktrygstad@bgov.com

Erik Wasson with Bloomberg News also contributed to this story

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.