Navy Ship Maintenance Budget Would Grow 3% With Extra Funds

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to grow your opportunities. Learn more.

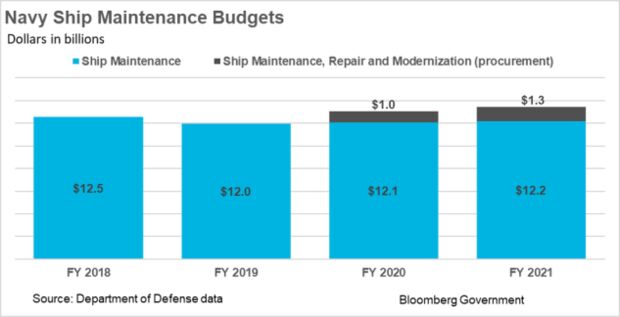

The U.S. Navy’s ship maintenance budget now has two funding streams: traditional operation and maintenance funding; and a new line item from procurement funds added by Congress last year and requested by the administration again for 2021.

Added together, the $13.5 billion total budget for fiscal 2021 represents a 3.1% increase.

The Navy’s proposed fiscal 2021 $12.2 billion operation and maintenance funding for ship maintenance would grow by just 1% from the fiscal 2020 enacted level. But there’s more to the story: the Navy followed up on a $1 billion fiscal 2020 congressional initiative and has requested nearly $1.3 billion in procurement funding to augment the traditional O&M budget. The use of two pots of money represents a change for the program in response to past shortfalls and ongoing scheduling headaches.

The private sector doesn’t perform all ship maintenance, as noted in an earlier Bloomberg Government analysis. Some of the work is done in large government facilities by government workers, including at the Norfolk, Pearl Harbor, Portsmouth, and Puget Sound naval shipyards.The Navy says 20.6% of its total government civilian manpower would be dedicated to ship maintenance in fiscal 2021.

So while not all of those budget dollars go to contractors, the budget increase is good news for companies such as BAE Systems Plc, General Dynamics Corp., and Huntington Ingalls Industries Inc., leading contractors in a market that topped $4.6 billion in fiscal 2018. Contract spending on ship maintenance hit a 10-year peak in fiscal 2018, but then dropped to $4.0 billion in fiscal 2019. The spike in 2018 was due in part to the one-time costs of repairing two ships damaged in collisions.

Pilot Program

The procurement funding is a pilot program. In fiscal 2020, it was used to fund 16 private contracted ship maintenance “availabilities” — the tight time-windows for working on ships — for the Pacific Fleet. Availabilities are scheduled for the amount of time needed for the overhaul or repairs, and planned far in advance. If a ship shows up late because of longer-than-planned deployment, it throws the schedule off.

In fiscal 2021, the plan is to use the $1.3 billion for 26 Pacific Fleet private contracted availabilities. Part of the rationale for adding procurement funding to the mix is that O&M funding is available for obligation for just one year; procurement funding is available for obligation for three. This change is designed to help shipyards to manage the complexities of funding ship maintenance more effectively, especially important given schedule disruptions in recent years.

Scheduling Challenges

The Navy says that the ship maintenance budget request will cover 98% of the full requirement that can be handled given the limits of current shipyard capacity. The overall budget increase should help the Navy address some major challenges.

Operational requirements have led to ships being deployed for longer periods of time than planned in recent years. That leads to increased wear and tear. It also plays havoc with the highly complex schedule of shipyard availabilities. When a ship is late going into a yard, that affects all the ships scheduled to come after it. Moreover, not every yard can work on every type of ship.

Clearly both the administration and the Congress consider ship maintenance a priority; the challenge is how to maintain robust funding, from O&M and/or Procurement, given the tight overall fiscal 2021 budget request for the Navy, which actually would decrease by 1% if enacted. The final fiscal 2021 appropriations level for any discretionary program is uncertain this early in the process, and Congress and the administration are unlikely to reach agreement on appropriations until after the November elections.

Interested observers will be watching the House and Senate Armed Services committees as well as the appropriations committees for signals about ship maintenance budgets. Despite its high priority, ship maintenance may come under pressure as a “bill-payer” to increase funding to build new ships; the request would decrease the shipbuilding budget by 16.8%.

To contact the analyst: Cameron Leuthy in Washington, D.C. at cleuthy@bgov.com

To contact the editors responsible for this story: Daniel Snyder at dsnyder@bgov.com; Jodie Morris at jmorris@bgov.com

Stay informed with more news like this – the intel you need to win new federal business – subscribe to Bloomberg Government today. Learn more.