IRS Outlines $2.8B in IT Modernization Contracts Post-Stimulus

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to grow your opportunities. Learn more.

Officials at the Internal Revenue Service (IRS) wasted no time laying out an ambitious digital agenda in the week since Congress appropriated the agency $1.5 billion in technology modernization funding as part of the $1.9 trillion stimulus package.

In the week since the American Rescue Plan Act (PL 117-2) became law March 11, IRS officials have announced a slate of new IT acquisition programs that could generate $2.8 billion or more over the next five to seven years. Meanwhile, the agency is preparing to release several requests for proposal (RFP) for procurements that kicked off in fiscal 2020 and could lead to billions of dollars in additional IT modernization spending.

IRS’s Budget Backdrop

The IRS is in the midst of a multi-year digital transformation effort driven by the need to replace decades-old legacy systems and offer taxpayers more responsive online tools. Years of cuts to its budget and headcount constrained the agency’s ability to make transformational investments in cloud computing, digital services, and cybersecurity. In a January 2021 report, IRS officials estimated the agency would need $4.1 billion over five years to cover the costs of its IT modernization strategy and comply with congressional mandates under the Taxpayer First Act (PL 116-25).

The $1.9 trillion stimulus package partially alleviated the agency’s budget uncertainty, but added to its core responsibilities. Congress allocated $1.5 billion in funding to modernize and secure IRS information systems, and to oversee $1,400 payments to millions of Americans. Lawmakers also tasked the IRS with overhauling the Child Tax Credit to disburse guaranteed monthly payments to millions of American families with children.

A $2.6 Billion IT Consolidation

In response, the IRS is considering a measure to pair its IT modernization goals with an aggressive contract consolidation plan, according to a March 18 request for information. IRS officials are seeking input from industry on a proposal, called Enterprise Development Operation Services (EDOS), that would transition management of more than a dozen IT systems to a single contractor. EDOS, planned as a task order on a Best-in-Class contract, would have a possible seven-year period of performance and a ceiling value of $2.6 billion, according to the RFI.

EDOS would help the IRS “reduce operational costs while maintaining current operational effectiveness” by minimizing system, management, and operational redundancies. It would also enable the agency to implement cost-cutting incentives including “performance-based services.”

At the same time, the contractor would assume responsibility for operating and upgrading more than a dozen key enterprise IT systems, including:

- IRS Integrated Financial System (IFS), an Alliant 2 Large Business task order currently managed by International Business Machines Corp. ($338 million total value);

- IT Financial Management Applications Support (ITFMAS), another Alliant 2 task order currently managed by MAXIMUS Inc. ($42 million);

- Customer Account Data Engine 2 (CADE2), a third Alliant 2 task order currently managed by Deloitte Touche Tohmatsu Ltd. ($205 million);

- IRS Integrated Enterprise Portals (IEP), currently managed by Accenture PLC ($692 million);

- Return Review Program (RRP), a Total Information Processing Support Services 4 (TIPSS-4) task order currently managed by IBM ($116 million).

In addition, the contractor would oversee several tax systems designed to carry out legislative mandates, such as the Affordable Care Act and the Foreign Account Tax Compliance Act.

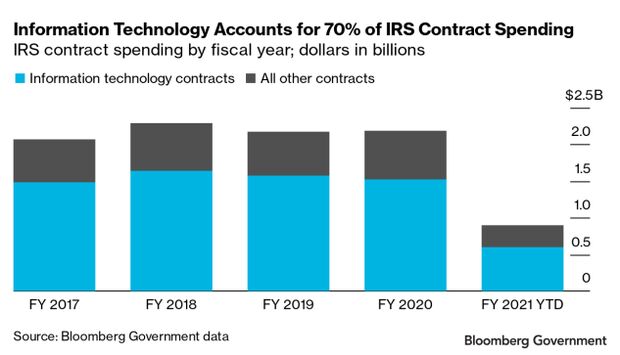

These systems account for a significant share of the IRS IT portfolio. For comparison, the agency spent $1.5 billion on contracts for IT products and services in fiscal 2020. At $2.6 billion over seven years, EDOS could shift anywhere from 10% to 20% of all IRS IT contract spending to a single company.

In many ways the move mirrors the Defense Information Systems Agency’s $11.7 billion Defense Enclave Services: the proposed contract would outsource several IT functions to a single managed services provider and consolidate dozens of legacy contracts in an effort to drive standardization and cost savings. And like Defense Enclave Services, competition for EDOS will be fierce as companies jostle to preserve their incumbent lines of business.

Potential bidders have until March 31 to respond to the RFI with a five-page capabilities statement.

Enterprise Case Management Modernization

EDOS was not the only significant IT opportunity the IRS introduced in mid-March. In a short statement posted March 12, IRS officials sketched out a plan to pursue a single- or multiple-award blanket purchase agreement supporting a newly-established Enterprise Digitalization and Case Management Office (EDCM) — a contract valued at $200 million over five years.

Enterprise case management modernization is a top priority for the IRS in fiscal 2021, according to the agency’s annual report, published Jan. 5. The IRS currently operates more than 60 aging, legacy case management systems. Officials aim to replace them with a cloud-based platform built on Pegasystems Inc. software designed to enhance information sharing and eliminate the need for manual workarounds.

The contract would involve setting up software development teams that use the Scaled Agile Framework (SAFe) to release regular updates and improvements. IRS officials have not yet released a formal RFI, but encourage interested parties to monitor federal contracting databases for updates in the coming weeks.

Major IT Acquisitions Continued From Fiscal 2020

In fiscal 2021, the IRS will continue work on a half-dozen IT contracts and recompetes valued at more than $100 million. In some cases, the agency released an RFI, others are in the pre-RFI phase and cited in its July 2020 procurement forecast.

The proposed enterprise cloud computing contract, Treasury Cloud, or T-Cloud, could be the largest of these opportunities. T-Cloud would have a ceiling value as high as $1 billion over eight years and offer Treasury agencies access to multiple cloud providers, according to the September 2019 cloud forecast. Treasury officials released a July 2020 RFI. Based on the stated timeline, contractors should expect a statement of objectives and request for quotes in fiscal 2021 and one or more awards in fiscal 2022.

In December, Treasury’s Office of the Chief Information Officer awarded Chantilly, Va.-based Four Points Technology LLC a second, smaller cloud contract called Workplace Community Cloud (WC2). Awarded as a task order on NASA’s Solutions for Enterprise Wide Procurement V (SEWP V), WC2 has a maximum value of $340 million over five years for Amazon Web Services and Microsoft Azure infrastructure-as-a-service.

A top IRS priority remains replacing aging COBOL-based systems through its Information Returns Program Development (IRPD) Modernization and Masterfiles Systems Programming Support acquisitions. The agency released an RFI for IRPD modernization in April 2020 seeking a contractor to build a “modern and flexible solution for Acceptance, Validation, Perfection, Management, and Use” of federal tax returns. The incumbent TIPSS-4 task order generated $104 million for Deloitte since December 2015. Officials posted an RFI for Masterfiles Systems Programming Support in June 2020, a follow-on to an incumbent task order currently held by InSysCo Inc. (a subsidiary of MAXIMUS Inc.). The recompete would shift to a Best-in-Class contract and expect to generate $50 million to $100 million, according to the July procurement forecast.

Finally, with Treasury’s June 2018 announcement to sunset TIPSS-4, federal contractors can get ahead of recompete opportunities. The IRS currently has 67 task orders on TIPSS-4, generating a combined $888 million to date, expiring between now and December 2022. The bulk of its IT services portfolio will shift to Best-in-Class contracts like Alliant 2 and SEWP V.

Bloomberg Government subscribers can click here to view 346 active RFIs, RFPs, and procurement forecasts at the IRS.

To contact the analyst on this story: Chris Cornillie in Washington at ccornillie@bgov.com

To contact the editor responsible for this story: Daniel Snyder in Washington at dsnyder@bgov.com

Stay informed with more news like this – the intel you need to win new federal business – subscribe to Bloomberg Government today. Learn more.