Introducing the $15.5 Billion Federal Telecom Market: This Is IT

Government telecommunications contracts are often baked into the overall information technology market. This makes it hard to pinpoint the size of the federal telecom market, understand how agencies are buying telecom products and services, and plan for future telecom spending.

Bloomberg Government has created a new telecommunications market in its Contracts Intelligence Tool to help solve that problem. This week’s This Is IT introduces the new market definition and shows how you can use it.

How BGOV Defined the Market

Bloomberg Government defines telecommunications as the technologies that promote communication or the sharing of information. Those technologies include the internet, radio networks, television broadcasting, satellite communications, mobile devices, and more.

BGOV’s market definition includes contracts and task orders found using a few key terms, such as “telecommunications,” “telecom,” or “SATCOM.” The market also relies heavily on how the General Services Administration has structured telecommunications and network services acquisition.

The definition incorporates governmentwide telecom contracts, including Enterprise Infrastructure Solutions and its predecessors, Custom SATCOM Solutions, Connections II, and Federal Strategic Sourcing Initiative Wireless (Wireless FSSI). It also includes product service codes such as D316 (Telecommunications Network Management) and D304 (Telecommunications and Transmission), as well as North American Industry Classification System codes, including the 517s (Telecommunications) and the 513s (Broadcasting and Telecommunications), that are specific to telecom.

The market excludes telecommunications spending that’s intertwined with more general IT spending if it can’t be differentiated through keywords, specific contracts, NAICS codes, or PSCs. For example, NAICS 541511 (Custom Computer Programming Services) covers planning and designing computer systems that integrate computer hardware, software, website design, and communication technologies. It was excluded even though it includes communications technologies because it contains many other services.

BGOV’s Findings

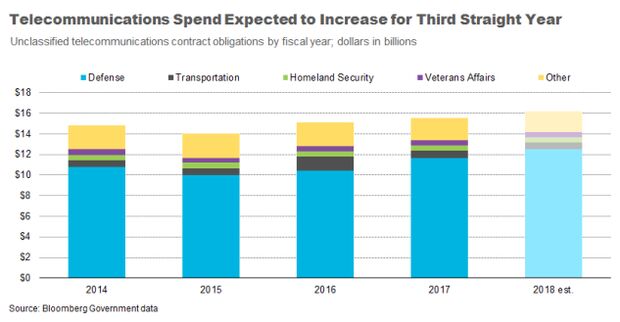

Between fiscal 2014 and 2017, federal government agencies spent $59.5 billion, an average of $14.9 billion per year on unclassified telecommunications products and services, according to Bloomberg Government data. Annual telecommunications spending has increased since fiscal 2015, a trend that’s expected to continue in fiscal 2018. BGOV estimates the 2018 market will hit $16 billion for the first time since fiscal 2012.

The Defense Department has been the largest buyer during that period, accounting for about 72 percent of the federal government’s telecom contract obligations, and BGOV expects its spending to increase as the overall market rises. For the next three biggest-spending agencies — Transportation, Homeland Security, and Veterans Affairs — BGOV anticipates a slight drop or no change in fiscal 2018 obligations.

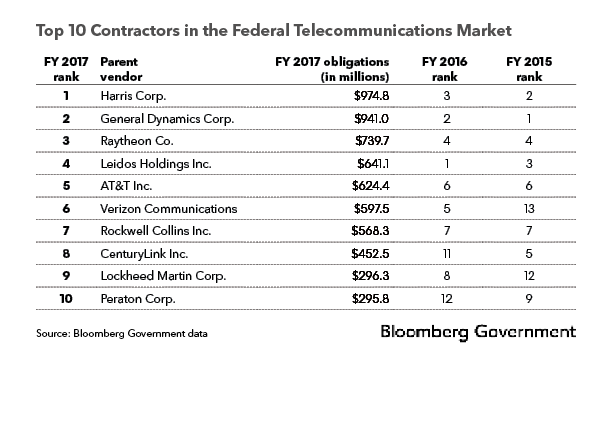

The telecommunications market isn’t overly concentrated in the top vendors, which allows for a variety of contractors to compete. The top 10 contractors, shown below, won 39 percent of the contract obligations in fiscal 2017. The telecom leaders have stayed roughly the same since fiscal 2015, with the order changing slightly each year.

The top vendors represent different telecom submarkets, including radios, communication networks for soldiers, satellite communications, mobile devices, and more.

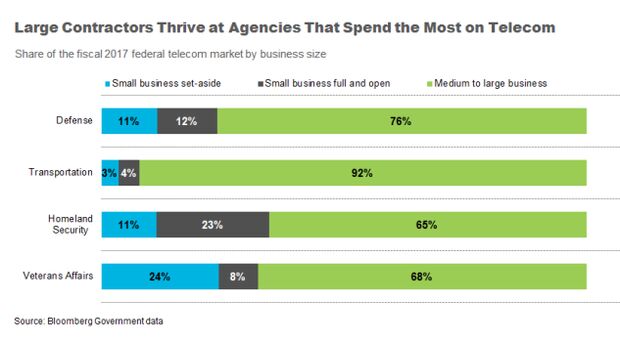

Medium- and large-sized businesses dominate in this space, especially in the Transportation Department, where small businesses win just 7 percent of the telecom contract obligations. At the other top agencies — Defense, Homeland Security, and Veterans Affairs– small businesses win 23 percent to 34 percent of the telecom obligations.

Many contracts and vehicles are used to acquire telecommunications products and services. The top five accounted for just 16 percent of telecom spending in fiscal 2017: Network Centric Solutions 2 – Small Business ($629.6 million in obligations), Networx Enterprise ($595.2 million), Schedule IT-70 ($529.1 million), Harris radios ($403.5 million), and Networx Universal ($372.7 million).

Explore BGOV’s telecommunications market to view leading vendors, the most-used contract vehicles, top agencies, contracts expiring in fiscal 2019, and top NAICS and product service codes.

Keep in mind that as BGOV develops the criteria used to search the data, some things you’re looking for may be excluded, while others you’d prefer to omit may be included. BGOV welcomes your feedback on the telecommunications market definition.

To contact the analyst: Laura Criste in Washington, D.C. at lcriste@bgov.com

To contact the editors responsible for this story: Daniel Snyder at dsnyder@bgov.com; Jodie Morris at jmorris@bgov.com