Federal Contract Spending Trends: Five Years in Five Charts

Contract spending has grown by almost 6 percent per year over the past five years as federal agencies relied increasingly on governmentwide contract vehicles and simplified acquisition procedures. Bloomberg Government has identified five important spending trends that developed from fiscal 2014 through 2018.

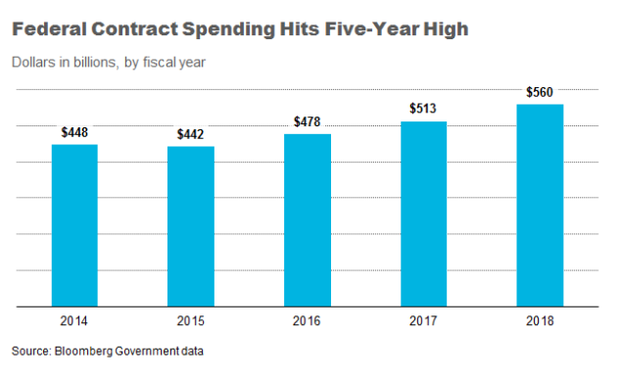

Federal contract spending grew at a rate of about 5.8 percent annually between fiscal years 2014 and 2018. The $560 billion in federal contract spending in fiscal 2018 is the highest level since fiscal 2010, when it hit $562 billion.

The trend suggests that efforts to slow federal discretionary spending — such as the Budget Control Act, which began imposing annual spending caps in 2013 — are having less of an effect as the Trump administration boosts defense spending. Spending could remain above $550 billion in fiscal 2019 and beyond. From fiscal 2008 through 2012, annual contract spending averaged $542 billion.

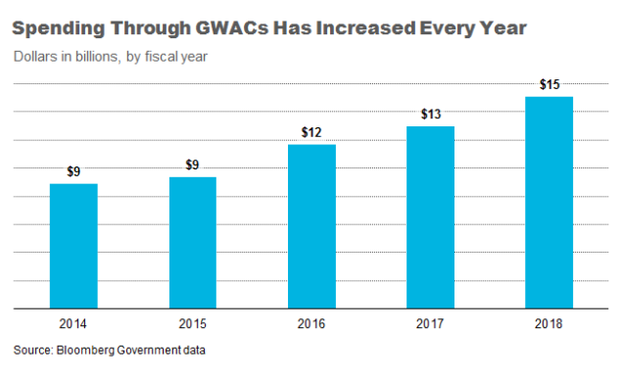

Federal spending has surged on governmentwide acquisition contracts that agencies use to buy information technology — to $15 billion in fiscal 2018. The trend suggests that agencies are relying more on GWACs each year to satisfy IT purchases and modernize legacy systems.

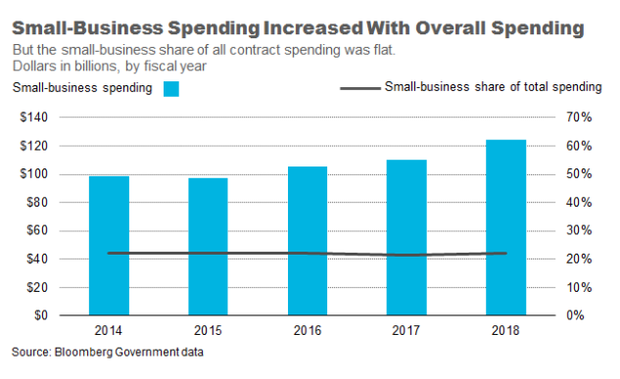

Federal spending on small businesses has risen in lockstep with overall contract spending, meaning that the share of federal dollars won by small businesses has remained relatively flat. From fiscal 2014 through 2018, small-business spending has hovered around 22 percent of the market.

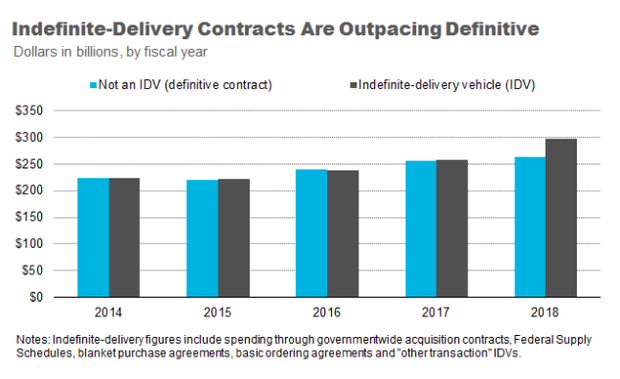

Spending on indefinite-delivery contracts outpaced obligations on definitive contracts by about $34 billion in fiscal 2018. The share from fiscal 2014 through 2017 was just about evenly split.

Spending through simplified acquisition procedures (SAP), a government process for buying commonly acquired goods and services that fall below a certain price threshold, has inched up each year since fiscal 2014. In 2018, SAP spending reached the highest amount ever reported. The increase can be attributed to both threshold increases and the fact that SAP allows agencies to cut some red tape.

To contact the analyst: Daniel Snyder at dsnyder@bgov.com

To contact the editor responsible for this story: Jodie Morris at jmorris@bgov.com