Dark Clouds Loom for Lobby Firms Currently Buzzing With Business

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

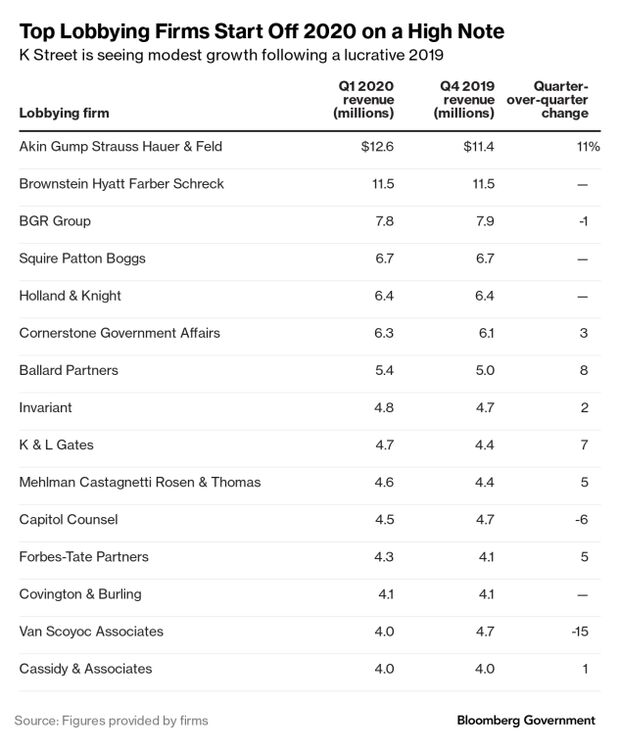

Lobbying firms exceeded revenue expectations in the first three months of 2020 with the anticipation that a Covid-19-driven lobbying bonanza will lift second-quarter balance sheets.

Earnings across K Street remained stable despite the anticipated slowdown that election years bring and the added wrinkle of President Donald Trump’s impeachment trial, according to first-quarter figures sent to the House and Senate on Monday.

“I think conventional wisdom was that, leaving impeachment and turning into the 2020 election year, things would slow down and that people were paying less attention to Washington,” said Marc Lampkin, the managing partner of Brownstein Hyatt Farber Schreck’s D.C. office.

Brownstein, the No. 2 firm on K Street by revenue, reported earning $11.52 million in the first quarter. That was roughly the same amount as the preceding quarter, but it was a 26% jump over the same time in 2019. The firm signed at least 23 new first quarter clients since January, with most of the work coming in March.

The prospects for the rest of the year hinges on how and if the economy comes back from collapse.

Josh Lahey is a founder of the boutique public affairs firm Lot Sixteen, which took in $530,000 in lobbying fees during the first quarter, a 51% increase over the same time in 2019 and a 9% boost from the preceding three-month period. He said a prolonged economic downturn is likely to lead to widespread budget cuts across corporations, trade associations and other clients.

“I am worried about the long tail,” he said. “All that takes months to come about, but it’s already starting to happen and it just hasn’t filtered down.”

“Gonna be a long, hot summer,” Lahey added.

Strong Start

Akin Gump Strauss Hauer & Feld, the No. 1 lobbying firm by revenue, took in $12.64 million in the first three months of the year, its fourth consecutive quarter with more than $10 million or more in revenue and the first time it’s broken the $12 million mark in a three-month earnings period.

“I think it’s hard to say any one thing that drove us having the strongest quarter we have on record,” said Hunter Bates, one of the leaders of the firm’s public policy practice. “The last year, and particularly the last quarter, have really been off the charts busy for our firm. It’s not just been the policy work, but it’s been a huge amount of collaboration with our policy, our legal and our regulatory teams.”

While the pandemic spurred an onslaught of advocacy and new clients, lobbyists said it didn’t begin to ramp up until mid-March, the last month of the first quarter. So, much of those earnings won’t be reflected until the next round of disclosures in July.

Muftiah McCartin, the co-chair of Covington & Burling’s public policy practice, said she thought the action this year would be Democrats teeing up priorities for 2021, including legislation addressing climate change, infrastructure spending and drug pricing.

“Now we are just dealing with keeping our head above water!” she said in an email. “We had no idea then how hectic it would be as companies across industries are now facing an economic crisis that demands Federal attention, and will continue to demand Federal attention through the end of the year.”

Darrell Conner, who co-leads the lobbying shop at K&L Gates, expects the rest of 2020 to be filled with Covid-19 issues, as well as the industry’s “bread and butter” work, such as lobbying on must-pass appropriations bills and a defense reauthorization.

“We’re still in the relief phase, figuring out how to get cash into the system,” Conner said. “Then we’re going to move to the recovery phase which is kind of getting people back to work. And I think Congress and the administration have a lot of work to do there.”

Anxiety Lingers

Despite a strong first three months and plenty of work to come surrounding economic relief, there is anxiety within the industry about how the state of the economy could affect business in the months ahead, lobbyists said.

“The longer that this crisis continues and creates this economic standstill, the more potential there is for a business retraction from Washington in all areas of expenditures, so that’s the fear,” Lampkin said.

The head of a lobbying firm, who asked for anonymity to talk about their business, said some of their clients are asking for a temporary discount on their retainers.

Other advocates worry that if clients are faced with the choice of cutting the pay of internal advocacy staff or culling outside firms, they are likely to choose the latter. The key is offering a combination of services, knowledge and connections, said many lobbyists.

“If the clients find you to be providing value, then they’re going to keep you. The whole truth about client service is to make sure that you are seen as an essential person,” said David Tamasi, a founder of Chartwell Strategy Group. “Some people, they exist, and other people are trying to justify their existence.”

While some law firms are reportedly cutting salaries for higher-paid employees, the lobbying operations inside those shops can be insulated from economic shocks, bolstered by non-lobbying revenues from legal, regulatory and congressional investigations work.

“We’re getting hired for a very diverse group of reasons right now, so that gives me the sense that the work will kind of be there,” said Rich Gold, who leads the public policy and regulation group Holland & Knight, which took in $6.4 million in the first quarter, a 12% jump from the same period in 2019.

“Now, if this goes on for six to nine months and the economy doesn’t open back up, do I worry? Yeah,” he said. “But it doesn’t feel like that’s where we’re heading.”

To contact the reporter on this story: Megan R. Wilson in Washington at mwilson@bgov.com

To contact the editors responsible for this story: Kyle Trygstad at ktrygstad@bgov.com; Bennett Roth at broth@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.