Cyber, Cloud, AI Spur IT Spending Growth in FY 2019: This Is IT

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to grow your opportunities. Learn more.

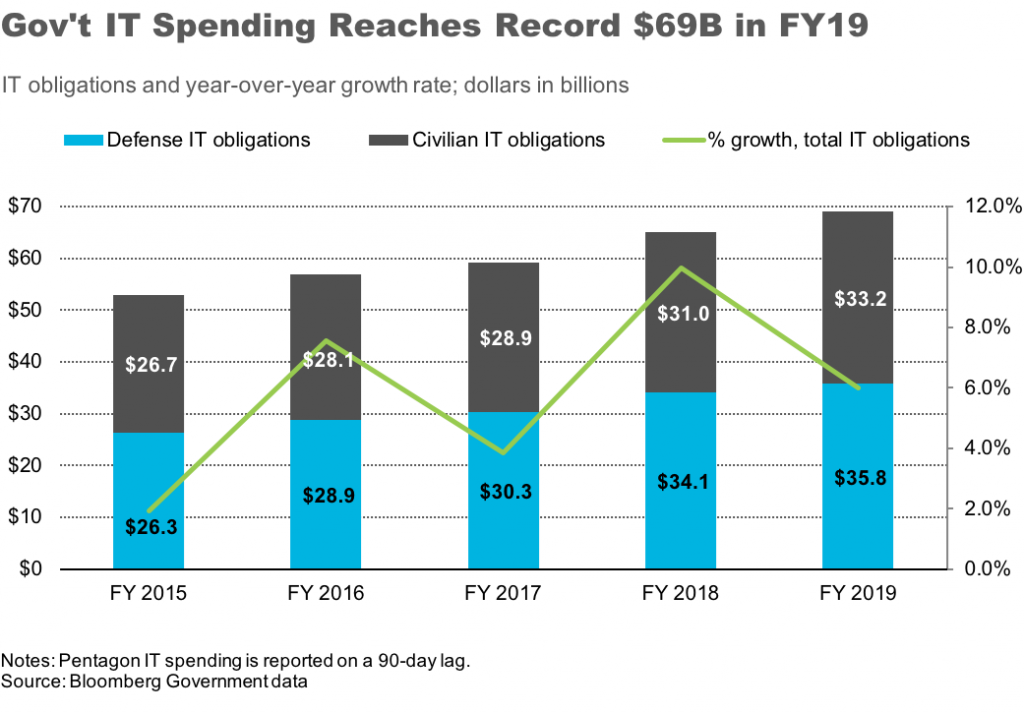

With a surge in spending on cybersecurity, cloud services, and software development, the U.S. federal government obligated $69 billion on unclassified IT contracts in the 2019 fiscal year, a 6% increase from fiscal 2018 IT spending, according to a Bloomberg Government analysis. That growth rate exceeded the Trump administration’s budget projections.

The Defense Department accounted for more than half of all federal IT contract spending, $35.9 billion in fiscal 2019, up 5.3%. Federal civilian agencies obligated $33.2 billion, an increase of more than 7% from the $31 billion they spent in fiscal 2018. The top-spending civilian agencies were the departments of Health and Human Services ($5.5 billion), Homeland Security ($5 billion), and Veterans Affairs ($4.6 billion).

Although the 2019 fiscal year ended on Sept. 30, a complete picture of governmentwide spending is typically not available until 90 days later. That’s because, for security reasons, the Defense Department reports its spending data to the Federal Procurement Data System on a 90-day lag.

These figures — $69 billion in total IT contract spending and 6% growth — are largely consistent with recent trends. President Trump’s fiscal 2020 budget request projected growth of only about 3.5% in the federal unclassified IT budget from fiscal 2018 through 2019. However, governmentwide IT contract spending has risen by an average of 5.8% per year over the previous five years, according to Bloomberg Government’s analysis.

Among cabinet-level agencies, the largest year-to-year spending growth occurred at the departments of Commerce (59%), Energy (58%), and Housing and Urban Development (48%). At the Pentagon, two components, the U.S. Navy and the Defense Information Systems Agency (DISA), accounted for more than half of the department’s spending growth in fiscal 2019. Navy IT contract spending rose by about 8% to $8.5 billion, while DISA spent $3.6 billion on IT contracts, a 27% increase from 2018.

IT obligations decreased at a handful of agencies from fiscal 2018 through 2019. After a strong fiscal 2018, IT contract spending shrank by about 1% at both the U.S. Army and Air Force — to $9.6 billion and $7.6 billion, respectively. The greatest civilian drop in IT spending was at the Federal Bureau of Investigation, where obligations fell from $764 million to $594 million, a decline of about 22%.

Spending in Key Technology Markets

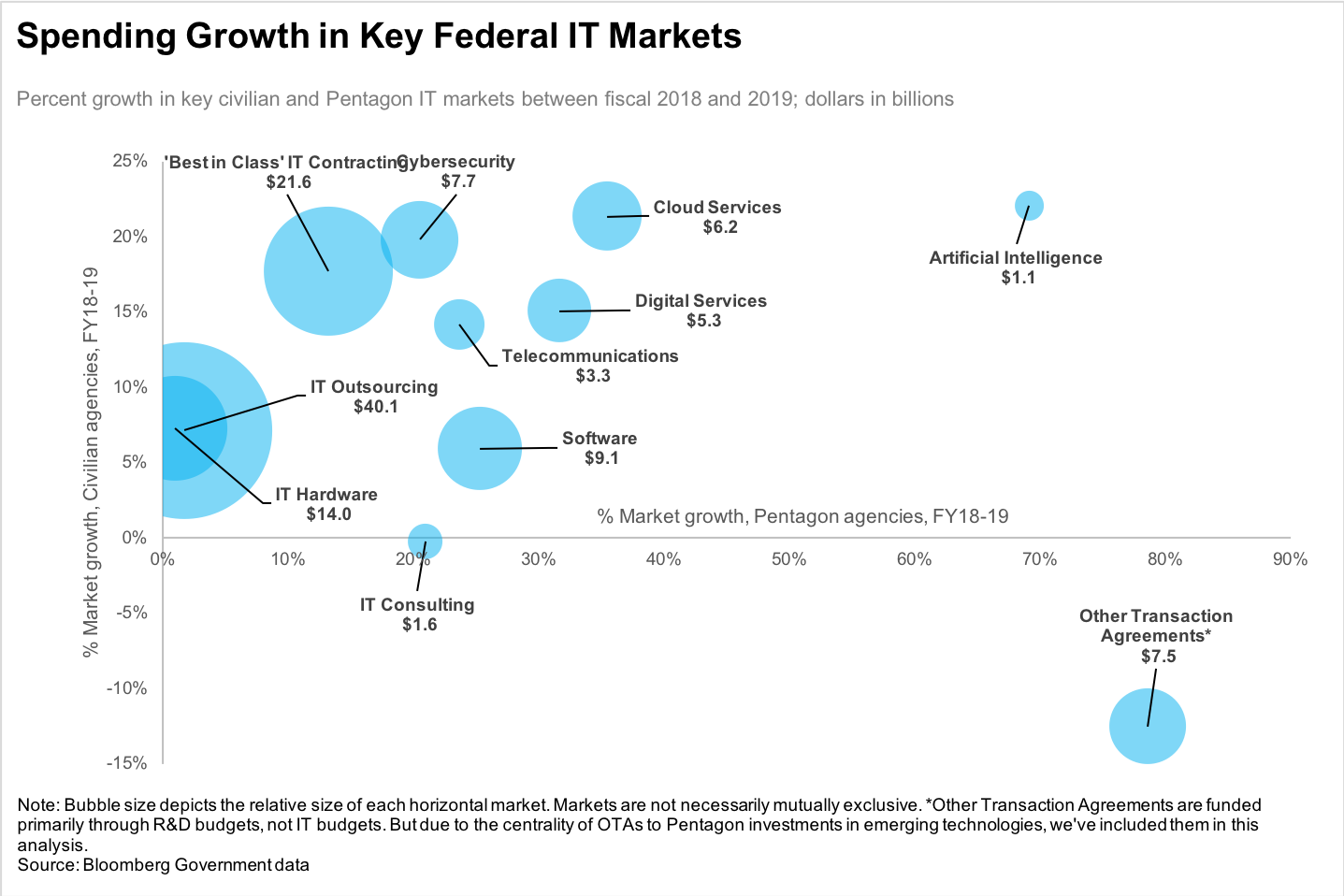

Though federal IT spending grew by 6% overall, that figure would appear to understate the steep rise in obligations in key horizontal markets, such as cloud computing and artificial intelligence, which saw double-digit growth in defense and civilian agencies alike. Similarly, agencies’ investments in emerging technologies through the use innovative procurement mechanisms such as other transaction agreements (OTAs) surged to $7.5 billion in fiscal 2019.

The chart below plots a series of markets that Bloomberg Government is tracking on behalf of its IT clients. Each bubble corresponds to a separate horizontal market Bloomberg Government is tracking. Five represent IT sub-markets as defined by the General Services Administration’s category management taxonomy (see below), four depict high-growth IT markets as defined by BGOV analysts, and two display spending that flows through novel acquisition mechanisms, OTAs and “Best in Class” (BIC) IT contracts. (Note: The majority of OTA funding comes from research and development budgets, rather than IT budgets. Nevertheless, given the central role of OTAs in technology development and prototyping, we included the market here.)

The position of each bubble refers to the growth rate in each market between fiscal years 2018 and 2019, with Pentagon spending on the x-axis (horizontal axis) and civilian spending on the y-axis (vertical axis). The size of each bubble corresponds to the amount of spending flowing through each market, in billions of dollars.

Government-Defined Markets

The following five markets refer to IT submarkets as defined by the General Services Administration, based on groupings of Product Service Codes. The latest category management taxonomy can be found here.

- Software — Federal software spending grew by about 15% to $9.1 billion, with much of that growth arising from the Pentagon’s Defense Healthcare Management System Modernization (DHMSM) and almost a half-billion dollars in new commercial software purchased on SEWP V.

- IT Hardware — Governmentwide IT hardware spending grew by a modest 2.2% in fiscal 2019, with civilian agencies accounting for much of that growth. Hardware obligations at the Cybersecurity and Infrastructure Security Agency (CISA), an agency launched in late 2018, rose to $200 million in fiscal 2019, or by about 66%.

- IT Consulting — Spending on IT consulting related to requirements analysis and acquisition support rose by more than 20% in the defense sector, but fell slightly in civilian agencies.

- IT Outsourcing — IT outsourcing, which refers to a range of IT services, IT management, and systems integration, increased by about 7% in civilian agencies while remaining flat at the DOD. In particular, projects related to the 2020 Census boosted the Commerce Department’s IT outsourcing obligations by about 80% to $1.8 billion from fiscal 2018 through 2019.

- Telecommunications — Federal spending on telecommunications showed robust growthin fiscal 2019 — about 22% — with the bulk of that increase coming from the Army, DISA, U.S. Immigration and Customs Enforcement (ICE) and U.S. Citizenship and Immigration Services (USCIS).

BGOV Analyst-Defined Markets

The following four market definitions were created by Bloomberg Government analysts to track spending in fast-growing markets for which agencies don’t produce official estimates of contract obligations. BGOV uses a combination of PSC codes, contract numbers, and keywords to identify all transactions that meet each market definition.

- Cybersecurity — Federal contract spending on cybersecurity rose sharply to match an unprecedented fiscal 2019 cybersecurity budget request of $17.4 billion, driven bythe government’s need to evolve beyond perimeter-based defenses. Unclassified cybersecurity contract spending grew to $7.7 billion in fiscal 2019, or by about 20%.

- Cloud Services — Government obligations on infrastructure as a service (IaaS), platforms as a service (PaaS), software as a service (SaaS), and cloud support services accelerated in fiscal 2019 as multiple civilian and defense agencies embarked on enterprisewide modernization projects. DOD cloud spending reached $1.9 billion in fiscal 2019 as its cloud strategy began to take shape, while civilian agencies invested heavily to implement the goals of ‘Cloud Smart.’ Spending will only grow as the Pentagon prepares to launch its two multibillion-dollar cloud contracts, JEDI and DEOS.

- Artificial Intelligence — The White House’s executive order on artificial intelligence gave agencies a mandate to invest in technologies such as machine learning, computer vision, and robotic process automation. Civilian spending on AI technologies grew by over 22% in fiscal 2019, while Pentagon investment grew by almost 70%. Pentagon spending on AI contracts has more than tripled since fiscal 2017. Expect more growth governmentwide in fiscal 2020.

- Digital Services — Contract spending supporting the development of web-based end-user services grew to another all-time high, propelled by large-scale investments in digital health records systems by the departments of Defense and Veterans Affairs.

Spending Through OTAs and BICs

Bloomberg Government is tracking not only what federal agencies are spending their IT dollars, but also how. The two biggest trends in IT acquisition in the past year have been:

- Other Transaction Agreements — The Pentagon spent a record $7.3 billion using OTAs, which enable certain agencies to fast-track research and prototyping funding, in fiscal 2019 — up almost 80% from the $4.1 billion the department spent in fiscal 2018. OTA spending by civilian agencies, notably the Transportation Security Administration, actually fell by more than 12% to $245 million, despite growth in the prior two fiscal years. With both the Pentagon and Capitol Hill on board with OTAs, expect more Pentagon spending in fiscal 2020.

- “Best in Class” IT Contracts — Although the federal government’s push to consolidate IT spending on a handful of highly vetted governmentwide contracts dates back years, the White House’s March 2019 category management memo directed agencies to double down on using BICs. Governmentwide IT spending on BIC vehicles rose from $18.6 billion in fiscal 2018 to $21.6 billion in 2019. That trend should persist in 2020 with agencies discontinuing their standalone IT contracts in favor of BIC options.

Chris Cornillie is a federal market analyst with Bloomberg Government.

To contact the analyst on this story: Chris Cornillie in Washington at ccornillie@bgov.com

To contact the editors responsible for this story: Daniel Snyder at dsnyder@bgov.com; Jodie Morris at jmorris@bgov.com

Stay informed with more news like this – the intel you need to win new federal business – subscribe to Bloomberg Government today. Learn more.