Critical Facilities Infrastructure Sector Hits Contracts Record

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to grow your opportunities. Learn more.

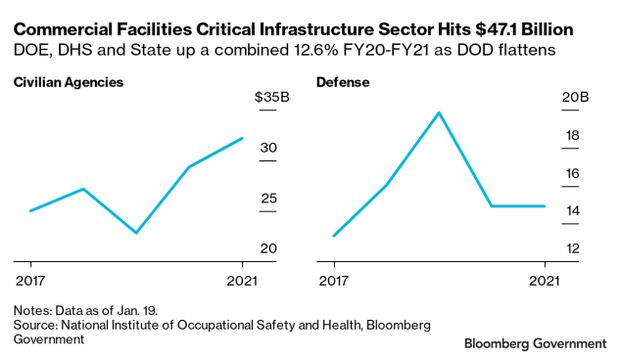

Mapping the Department of Homeland Security’s critical facilities infrastructure sector to corresponding federal markets identifies a record $47.1 billion in fiscal 2021. The government’s contract spending in this arena was driven by growth at the departments of Energy, Homeland Security, and State. Civilian agency spending grew 9.6% to $32 billion from fiscal 2020 to fiscal 2021 while Pentagon spending remained flat.

The alignment of the facilities critical infrastructure sector definition to corresponding federal NAICS markets flagged by the Cybersecurity and Infrastructure Security Agency and the National Institute for Occupational Safety and Health identifies a broad range of government facilities-related contracts and opportunities.

The market definition frames comprehensive contract portfolios, along with solicitations and recompete opportunities, tied to billions of dollars in ongoing facilities support, construction, and related infrastructure spending.

Critical government facilities include national laboratories, military installations, embassies, office buildings, and courthouses that are both open and restricted to public access. These facilities may house critical equipment and materials, systems, IT and communications networks, and cyber technology deemed essential for day-to-day government operations and employ essential support personnel.

The prominence of Energy Department procurement in this sector bumps New Mexico and Tennessee to the top locations for contract place of performance since fiscal 2017. Sandia National Laboratories and Los Alamos National Laboratory account for almost all of the $8.9 billion in obligations for critical facilities in New Mexico.

Honeywell International Inc. provides the critical facilities-related work at Sandia, and Triad National Security is the incumbent at Los Alamos. Those large Energy Department contracts put those two companies ahead of others in the market.

Among all critical facilities contracts, more than 93% of obligations went to definitive contracts and indefinite delivery vehicles, with very little use of GSA schedules, blanket purchase agreements, government-wide acquisition contracts or other types of contracts. The top 10 contract vehicles totaled $21 billion: Seven contracts worth a combined $17.3 billion funded DOE facilities, while two focused on logistics support and one on security services.

To contact the reporter on this story: Paul Murphy in Washington at pmurphy@bloombergindustry.com

To contact the editor responsible for this story: Amanda H. Allen at aallen@bloombergindustry.com

Stay informed with more news like this – the intel you need to win new federal business – subscribe to Bloomberg Government today. Learn more.