2019 Outlook: Four Things About Trump’s Push to Deregulate

- President promised to slash rules, but it’ll be harder in 2019

- Agency focused on regulation policy awaits a new leader

President Donald Trump came into office promising to slash regulations, but his drive to roll back federal rules will see brake lights in 2019, regulatory analysts said.

Earlier this year, the president touted his administration’s regulatory reform efforts as the most sweeping in history.

“No president has ever cut so many regulations in their entire term,” Trump bragged to the Conservative Political Action Conference.

The Office of Information and Regulatory Affairs, a small agency within the White House Office of Management and Budget that reviews all significant federal regulations, hasn’t been able to verify those claims.

Yet, the Trump administration has made significant inroads by preventing new regulations from being added to the existing stockpile.

“The first two years of the administration have produced unparalleled reform, and we project even more significant results in the coming year,” said OIRA Administrator Neomi Rao in an introduction to the fall 2018 unified agenda, which is a listing of all active agency regulations.

But the administration could have a difficult time keeping up its promised pace of deregulation.

Agencies made the easy cuts first to comply with Trump’s executive order that requires them to eliminate two rules for every new one issued. What’s left to cut are major regulations that will take more time, analysis, and legal justification to get rid of.

Several forces are likely to slow the deregulatory pace the Trump administration had hoped for. Here are four.

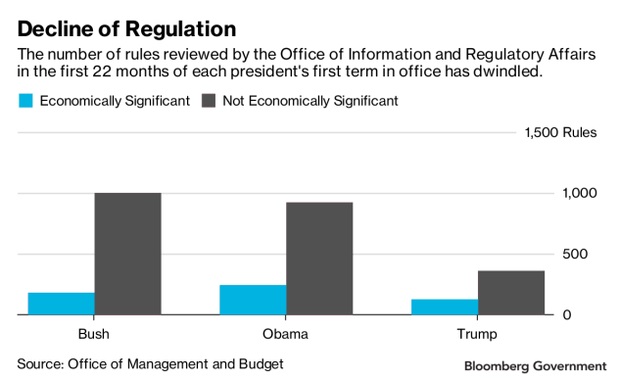

1. PACE WAS SLOWING DOWN ALREADY

The ratio of rules cut to rules issued is not nearly as dramatic this year as last, and it’s likely to shrink even more.

OIRA made it easy to exceed the president’s standard of two rules out for every new one in by broadly defining deregulatory actions while exempting most new rules from counting toward the total.

In 2017, agencies across government took 67 deregulatory actions and issued just three new significant rules, for a ratio of 22 cuts for every new regulation issued.

In fiscal 2018, agencies took 176 deregulatory actions to offset 14 new rules, a ratio of 12 cuts for each new regulation issued.

For fiscal 2019, agencies across government have been directed to cut $18 billion in regulatory costs, with half coming from the Department of Health and Human Services.

The savings are supposed to come from 671 planned deregulatory actions and just 174 economically significant new rules, according to one count. But as cuts become harder to make, the ratio is likely to get smaller.

2. DEMOCRATS WILL USE OVERSIGHT POWER TO PUSH BACK

Incoming Democratic chairmen are already planning checks on agencies’ actions.

“Pretty much anything that they are doing or not doing is going to get scrutinized,” said Michael Livermore, law professor at the University of Virginia School of Law. “I think it is going to be a really substantial challenge that I don’t think this administration has, in any way, prepared for,” he said.

This administration, which has never faced serious congressional oversight, is now going to have to start answering for workplace injuries, climate change, and health care market failures, Livermore said.

Congress has substantial power over agencies through subpoenas, hearings, and requests for information, which will put a lot of pressure on regulators and make it difficult for them to accomplish much, Livermore said.

Democrats also can block attempts by the administration to advance its regulatory policies by legislation.

It will be difficult to pass regulatory overhaul legislation with a divided House and Senate, because traditionally, Democrats have been uninterested in trying to fix the rulemaking process, said Sen. James Lankford (R-Okla.), chairman of a key regulatory affairs subcommittee in the Senate.

3. COURTS AREN’T SYMPATHETIC ENOUGH

The courts will continue to overturn sloppy attempts by agencies to deregulate.

Trump-era deregulation has prompted a number of legal challenges that the administration has overwhelmingly lost, said Connor Raso, counsel at the Securities and Exchange Commission.

According to a tally of lawsuits by the Institute for Policy Integrity at the New York University School of Law, as of Dec. 10 agencies had won just two out of 24 cases challenging their deregulation, a win rate of 8 percent.

Regulatory rollbacks so far—mostly delays of effective dates and late Obama-era rules—have been based on thin records and little evidence, so they’ve been struck down by the courts far more often than they’ve been upheld, said Amit Narang, regulatory policy advocate at Public Citizen.

Eliminating significant rules requires agencies to work hard to collect data, prepare analysis, and write a strong legal justification, Narang said. “I don’t have a lot of confidence that they’ll be able to do that,” he said.

4. WHO WILL DO THE WORK?

The linchpin of any administration’s regulatory policy is having people in place to implement it, yet vacancies remain high in many agencies.

Of more than 700 key positions at executive-branch agencies, 123 positions have no nominee and just 381 have confirmed nominees in place as of Dec. 17, according to a tracker maintained by the Washington Post and Partnership for Public Service.

Another disruption to the administration’s regulatory agenda was Rao’s nomination Nov. 14 to serve on the U.S. Court of Appeals for the District of Columbia Circuit.

Rao is unlikely to advance any new regulatory initiatives next year, such as restricting agency guidance, while her nomination is pending in the Senate, regulatory analysts said.

It is also unclear how long it will take the president to nominate a new OIRA administrator. Paul Noe, vice president at the American Forest & Paper Association, was a candidate in 2017.

In the meantime, an acting administrator can oversee the routine, day-to-day activities of OIRA until the president’s nominee is confirmed, but is unlikely to push bold, aggressive deregulation.

To contact the reporter on this story: Cheryl Bolen in Washington at cbolen@bgov.com

To contact the editor responsible for this story: Cheryl Saenz at csaenz@bloombergtax.com