2018 Mergers and Acquisitions Redefine IT Market: This Is IT

Major mergers and acquisitions in 2018 continued the reshaping of the federal information technology contracting market, which has been evolving over the past few years.

Deals in 2018 provided some contractors with larger shares of IT submarkets or created new federal IT market leaders. Others brought companies new capabilities, allowing them to expand into new IT markets or meet emerging technology demands such as cloud computing or cybersecurity.

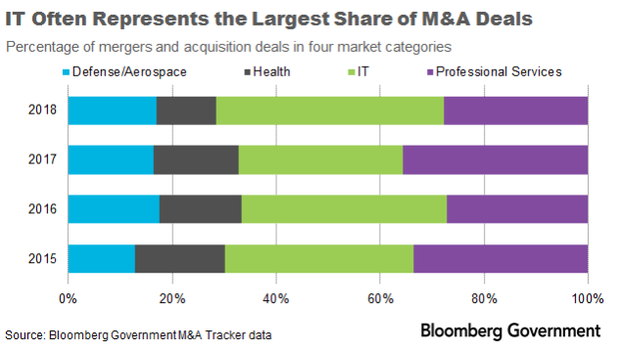

Bloomberg Government has updated its M&A Tracker dashboard with a new methodology for capturing deals and providing a more succinct, focused view of federal contracting M&A deals. Based on the deals tracked in 2018 across four markets — defense and aerospace, IT, professional services, and health — BGOV found that the IT market had the most M&A activity, with 44 percent of all M&A deals.

This week’s This Is IT focuses on the M&A dashboard update and discusses the trends and takeaways from 2018 M&A activity, with a focus on the IT deals in 2018.

M&A Activity

Of the 260 deals BGOV tracked in 2018, 44 percent were mergers or acquisitions to expand a contractor’s IT market share or add new IT expertise to the company.

This is roughly aligned with trends in previous years. In 2017, the top market for M&A deals was professional services, with 36 percent of the deals. Information technology came in second, with 32 percent. In 2016, IT deals led with 39 percent followed by professional services with 27 percent.

IT and professional services generally account for the bulk of the deals, in part because mergers and acquisitions in the health market are much more costly, and therefore less frequent, than in other markets. In 2018, the median health deal was valued at $1.1 billion, compared with median values of $447 million and $234 million for IT and professional services deals, respectively. The median defense and aerospace deal was valued at $440 million.

IT M&A Trends

The transformation of the federal IT contracting market continued in 2018.

In 2016, HPE and Computer Sciences Corp. announced their merger to become DXC Technology Co. In 2017, DXC split off its public sector business and acquired Vencore Holding Corp. and Keypoint Government Solutions Inc. to become Perspecta. And in 2018, General Dynamics Corp. bought CSRA Inc. The series of deals propelled General Dynamics and Perspecta into first and third place among federal IT contractorsin fiscal 2018 contract obligations.

In the defense market, the top five contractors — Lockheed Martin Corp., Boeing Co., General Dynamics Corp., Raytheon Co., and Northrop Grumman Corp. — are well established and would be difficult to overtake. Most of them became market leaders through M&A consolidations that took place after the end of the Cold War.

IT contractors seems to be going through a similar restructuring to establish competitive positions in the market. That may involve selling off lower-margin parts of the company, merging with another company, acquiring a company to incorporate a capability that makes the contractor more efficient, or buying niche firms to add expertise, among other things.

One of the largest defense deals of the year also had an effect on the IT market. The merger of Harris Corp. and L3 Technologies Inc. was aimed at putting the new company on equal footing with the “Big Five” defense contractors, and it does make the combined company the No. 6 contractor for the Defense Department.

Yet since fiscal 2015, the combined federal obligations of L3 and Harris Technologies were about $24 billion, less than half of No. 5 defense contractor Northrop Grumman’s.

The market where the L3-Harris deal may have an even greater effect is defense IT. The combined company would become the second-largest Defense Department IT contractor by obligations since fiscal 2015. L3 Harris would also become the top telecommunications contractor, overtaking General Dynamics.

A Different Approach

While many deals aimed at expanding market share and forming leading IT contractors, other important deals took a different approach. International Business Machines Corp. announced in October that it would acquire Red Hat Inc. for its open-source software tools and to expand its presence in the cloud computing market. Science Applications International Corp.’s goal in acquiring Engility Holdings Inc. was to expand its competitive advantage in IT services and become a top technology integrator for federal civilian and defense agencies.

A variety of smaller acquisitions also sought niche skills. Amazon Web Services boughtSqrrl Data Inc. to expand its intelligence community footprint, and Vectrus Inc. acquiredSentel Corp. for its IT share in the intelligence community and civilian agencies.

What we didn’t see much of in 2018 was the acquisition of small businesses to obtain a spot on a multiple-award contract held by the target. That’s probably because languagenow being added to many requests for proposals requires contractors to re-represent their size status within 30 days of a merger or acquisition.

These trends are likely to continue in 2019, as agencies invest in cybersecurity, cloud computing, modern IT systems, and emerging technologies and as contractors refine their businesses to find their most profitable market positions.

With assistance from Kyle Ross

To contact the analyst: Laura Criste in Washington, D.C. at lcriste@bgov.com

To contact the editors responsible for this story: Daniel Snyder at dsnyder@bgov.com; Jodie Morris at jmorris@bgov.com