Federal Contract Spending: Five Trends in Five Charts

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to grow your opportunities. Learn more.

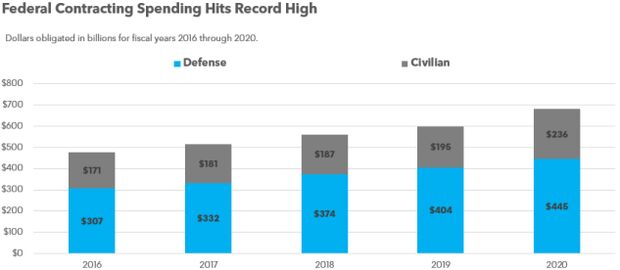

Federal contract spending in fiscal 2020 reached $681 billion, the highest amount on record. That’s a 43% increase from the $478 billion in government spending obligations in fiscal 2016.

Some areas that experienced the most growth between fiscal 2019 to 2020 include markets for: medical ($21.2 billion), research and development ($9.1 billion), professional services ($6.1 billion), and information technology ($5.5 billion).

Bloomberg Government tracks five important spending trends that developed during the past five years.

1. Covid-19, Defense Drive Record Contract Spending

Buoyed by the need to counter the Covid-19 pandemic, along with sustained budget increases for Department of Defense agencies, federal spending reached $681 billion. Since fiscal 2016, federal spending grew at an average rate of about 9% each year.

The majority of spending increases are attributable to Pentagon contracts, which alone increased by 45% since fiscal 2016, while civilian agencies increased by 38% in the same period. The share of spending added as a result of Covid-19 in fiscal 2020 is about $43 billion. The majority of that Covid-19 funding, $27.5 billion, has been funneled to civilian agencies.

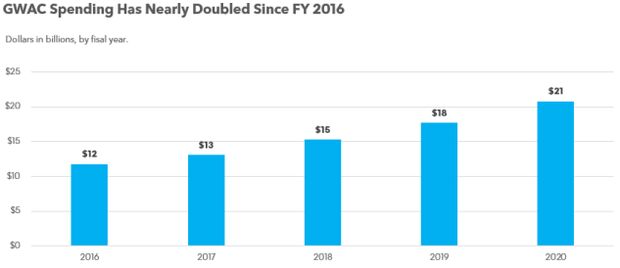

2. GWAC Spending Continues to Surge

Federal spending on government-wide acquisition contracts, which are designated exclusively for information technology purchases, has continued to accelerate, reaching $20.8 billion in fiscal 2020. The trend suggests agencies are relying more on GWACs each year to satisfy IT requirements to modernize systems.

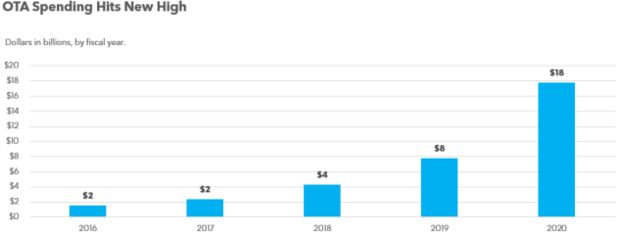

3. OTA Spending Surges as a Result of Covid

Acquisitions using the federal government’s Other Transaction Authority were intensifying even before Covid-19, but the pandemic created an unprecedented surge. Spending on OTA reached $18 billion in fiscal 2020. Since federal agencies rely on OTA to support activities for research and development and prototype growth, the acquisition method provided a favorable solution for agencies rushing to develop vaccine and medical equipment quickly.

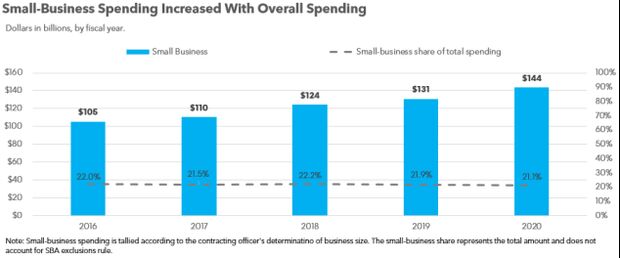

4. Small Business Spending Share Remains Steady

The amount of small business spending has risen in lockstep with overall contract spending, meaning the share of federal dollars won by small businesses has remained relatively flat, averaging about 22%. Small business won $144 billion of $681 billion in fiscal 2020.

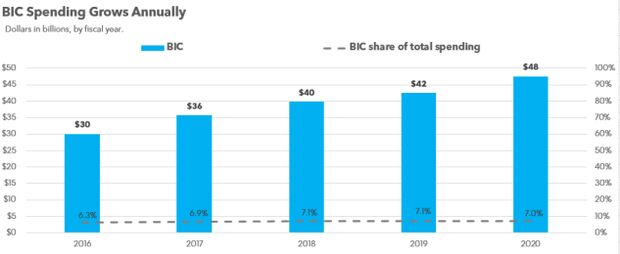

5. Best-in-Class Spending Share Remains Consistent

Best-in-Class (BIC) contracts, which are designated by the government as offering favorable pricing and solutions, have soared in conjunction with the overall spending increase. They increased to $48 billion in fiscal 2020. The share of spending has remained at a steady pace, comprising about 7% of annual spending since fiscal 2016.

To contact the reporter on this story: Daniel Snyder at dsnyder@bgov.com

To contact the editors responsible for this story: Michael Clark at mclark@ic.bloombergindustry.com

Stay informed with more news like this – the intel you need to win new federal business – subscribe to Bloomberg Government today. Learn more.