Pot Sector Cut Off From Federal Pandemic Loans, Turns to States

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

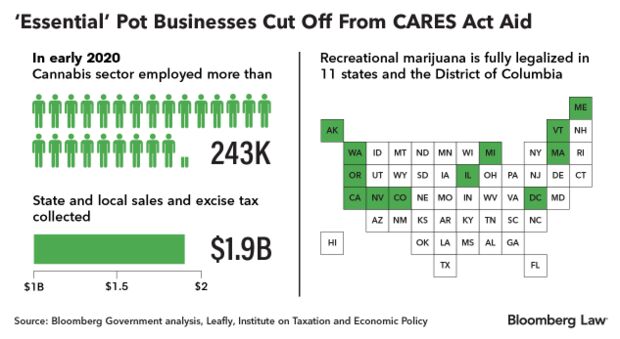

Cannabis companies struggling with slowing business don’t qualify for relief under the $349 billion federal small business lending program and instead are looking to states for help.

Cannabis products flew off the shelves when social distancing measures were first announced a few weeks ago in an effort to curb the spread of the coronavirus. But now, business has slowed for many dispensaries.

The industry has always struggled to obtain loans and banking services from traditional financial institutions. It now faces new hardships during the pandemic, said Amber Littlejohn, senior policy adviser for the Minority Cannabis Business Association.

“We’re getting the same answers, which is, ‘We can’t do anything for you,’” Littlejohn said.

The Small Business Administration, which is administering the Paycheck Protection Program (Public Law 116-136), is making it explicit that cannabis companies need not apply.

Marijuana dispensaries and testing labs, along with sellers of cannabis grow lights and smoking equipment, are all barred from federal aid, SBA spokeswoman Carol Chastang said in an emailed statement.

Getting excluded from the new disaster recovery program has made coping with the coronavirus pandemic all the harder, especially since companies still have to comply with new requirements for employee time off and sick leave.

The challenges are compounded for mom-and-pop companies that can’t lean on multi-generational wealth or private equity.

Oil, Gas Royalties Considered

For relief, cannabis businesses and their allies are asking state policy makers to consider creative solutions.

One might be using existing entitlement programs such as mineral or natural gas royalties to create a state-guaranteed, short-term fund for financial institutions to draw on to provide unsecured lines of credit to the cannabis industry.

Another might be to use federal funds allocated to the states for Covid-19 disaster relief to be offered as loans or loan guarantees to the cannabis industry. The CARES Act established a $150 billion fund to support state, local, and tribal governments. Advocates of the idea of looking to states for help don’t believe the legislation puts any restrictions on how the funds may be used, opening the door for state support for the cannabis industry.

“In the absence of an overall federal approach, we’re trying to move this forward where there are acceptable interim solutions that can help this industry at this snapshot in time,” said Fred Niehaus, co-founder and chairman of the Denver-based Public Policy Center for Public Health and Safety.

The nonprofit advocacy group, whose members include cannabis growers, suppliers, and financial compliance companies, and whose board includes former attorneys general for Alaska and Arkansas, is reaching out to policymakers and state attorneys general, as well as financial institutions in other states and national cannabis industry trade groups as part of its push.

Board members include Sundie Seefried, chief executive officer of the Denver-based Partner Colorado Credit Union, which has 500 business clients in the cannabis industry without access to federal aid through the Small Business Administration.

State-regulated financial institutions can already provide commercial loans to the industry, typically secured against a cannabis business’ real estate, but those funds risk federal forfeiture and seizure. It’s another reason the pot banking industry is looking for alternatives from state regulators.

Essential Operations

Lilach Mazor Power, founder and chief executive officer of Arizona-based Giving Tree Dispensary, said she’s found the bright side of the Covid-19 crisis: States are allowing dispensaries to remain open as essential businesses.

“It’s a good time to be in marijuana,” Power said. “We have a job. We’re open. We’re helping people through this hard time.”

Nevertheless, many cannabis businesses are feeling the pinch. Recreational retailers in Massachusetts have had to cut staff, and some have seen sales slow after the state’s governor declared only medical marijuana essential. Some have even banded together to sue Massachusetts Gov. Charlie Baker (R) over the decision, which they claim is creating undue hardship. Companies in tourism-dependent Las Vegas have also been hit as foot traffic dwindles.

“This is the biggest time of year generally for cannabis companies,” Minority Cannabis Business Association’s Littlejohn said.

“As that passes, and as the general strain on the economy starts to set in, we will be like every other industry in the country in that we are facing significant, if not unprecedented, financial challenges,” she said.

Other companies in the cannabis industry, such as GreenBits, a payments and compliance service provider to dispensaries, are already seeing cannabis sales leveling off.

Some dispensaries are asking the company for fee waivers, and the industry as a whole is in belt-tightening mode while it’s unsure of what the next several weeks will bring, said Charlie Wilson, GreenBits’ chief revenue officer.

“There could still be some pain for the industry if there are cash flow interruptions, given the high—and fixed—operating costs,” Wilson said, although he also noted that purchasing was robust in the months preceding the pandemic, confirming trends that signal bright long-term prospects for the industry.

State Tax Base

Pot has boosted state tax revenues in recent years, funding core state initiatives from education to infrastructure to health care.

California collected about $629 million in taxes on cannabis in 2019. Washington raised more tax revenue than any other state in 2019, about $67 per person, according to a study by the Institute on Taxation and Economic Policy.

Taxes on the “essential” industry could help offset shortfalls from sales tax and other revenues during the pandemic, said Aaron Klein, an economist and policy director of the Brookings Institution’s Center on Regulation and Markets.

“It’s going to make cannabis look more appealing in the future to states who are looking for new revenue streams coming out of this recession,” Klein said.

But the cannabis industry’s high effective tax rate, since losses and other business costs aren’t deductible from federal taxes, in addition to federal obligations under the pandemic response bills to pay for employee sick leave and time off, means companies are feeling the financial grind.

“The last thing we can do is close down all of our restaurants and then not support those industries that are actually able to stay open and pay those tax dollars and help pull us out of recession,” Seefried said.

To contact the reporters on this story: Lydia Beyoud in Washington at lbeyoud@bloomberglaw.com; Megan U. Boyanton in Washington at mboyanton@bgov.com

To contact the editors responsible for this story: Seth Stern at sstern@bloomberglaw.com; Cheryl Saenz at csaenz@bloombergtax.com; Paul Hendrie at phendrie@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.