Pandemic Meat Shortage Spurs Calls to Shift Slaughterhouse Rules

- 27 states inspect their own meat; retailers prefer USDA seal

- Tyson, JBS, Cargill, National Beef dominate meat processing

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Empty fridges at grocery stores in the early months of the coronavirus pandemic exposed weaknesses in the meat supply chain that lawmakers are seeking to address in their last-ditch efforts to pass another stimulus bill.

Outbreaks at meat-processing facilities caused temporary shutdowns that reduced the amount of meat available for sale. The disruption also exacerbated preexisting tensions over restrictions on meat sales across state lines.

To get their meat to shelves, livestock farmers pay either state- or federally regulated slaughterhouses to butcher their animals. Meat from state-inspected facilities can’t be sold across state lines, making it more advantageous for farmers to work with the four federally regulated companies that dominate the market: Tyson Foods Inc., JBS SA, Cargill Inc., and National Beef Packing Co.

Lawmakers have offered bipartisan proposals to help small-scale processors and livestock producers access larger markets at fair prices, with House Agriculture Committee Chairman Collin Peterson (D-Minn.) leading the charge. His legislation to make it easier for processing facilities to become federally regulated was added to House Democrats’ stimulus measure (H.R. 925), but it faces an uncertain future if last-minute stimulus negotiations fail.

“The pandemic confirmed something farmers have known for some time: there is a severe shortage of local and regional meat processing facilities across the country,” Rob Larew, the National Farmers Union’s president, said in a statement.

Facility Upgrades

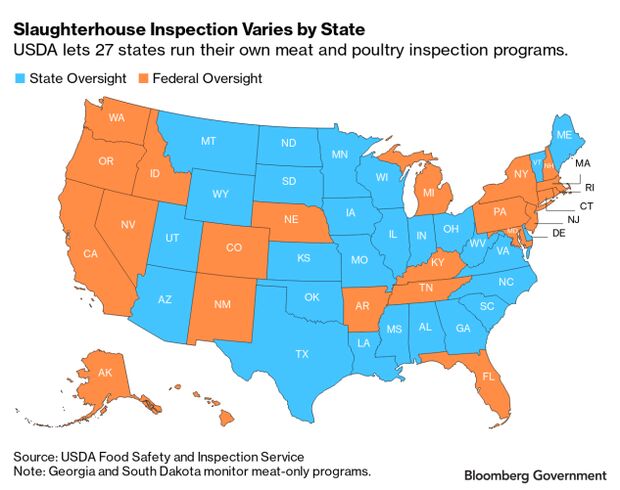

The Agriculture Department regulates about 6,500 slaughter and processing facilities nationwide, while 27 states monitor about 1,900 small-scale processing facilities. Federally inspected plants have an expanded market throughout the U.S. and abroad. Large retailers will often only sell meat that carries the Agriculture Department inspection seal.

Eight of the 27 states participate in a program that allows state-inspected plants to qualify as federally inspected establishments.

Although state inspection programs are required to impose requirements “at least equal to” those of USDA, plants applying to become federally inspected often have to spend money to upgrade their facilities.

Facility upgrades are the greatest barrier to businesses being able to qualify for USDA oversight, a department spokesperson said.

Meatpacking giants running federally inspected facilities have come under fire for allegations of price gouging during the pandemic, sparking outrage among lawmakers such as Sen. Chuck Grassley (R-Iowa) and prompting an investigation by the Justice Department.

Congressional Response

Peterson’s bill (H.R. 7490), incorporated in the stimulus package, would establish facility upgrade and planning grants for meat and poultry processors to qualify for federal inspection. The stimulus measure would set aside $100 million for the grants.

Some lawmakers have taken an alternate approach to address processing industry issues.

Reps. Chellie Pingree (D-Maine) and Jeff Fortenberry (R-Neb.) introduced the Strengthening Local Processing Act (H.R. 8431) to aid small meat processors and boost state operations.

The bill would expand the Agriculture Department’s portion of state inspection program costs. It would also offer grants to small and state-inspected plants, and set up two $10 million grant programs for meat-processing training.

Fortenberry said the legislation would reinvigorate local meat processing as there’s “broadening concern over corporate concentration in the meatpacking industry.”

The Cattle Market Transparency Act (S. 4647), introduced by Sen. Deb Fischer (R-Neb.), would address cattle industry issues by setting regional negotiated cash minimums and giving producers more market information, among other policy changes.

Beef-Packing Giants

The nation’s top four meat processing companies control about 80% of the slaughter market, according to Grassley. The North American Meat Institute estimates their share of beef production is actually closer to two-thirds.

The companies last month persuaded a judge to temporarily toss a 2019 lawsuit over alleged antitrust violations.

JBS, Tyson, Cargill, National Beef Avoid Cartel Claims for Now

Cargill, with 12 federally inspected processing facilities primarily for beef and turkey, is “confident in our efforts to maintain market integrity and conduct ethical business,” Daniel Sullivan, the company’s media relations director, said in a statement. The other companies didn’t respond to requests for comment.

Grassley urged government officials to look into possible cattle market manipulation by large beef-packing corporations in late March. A federal investigation is ongoing, he said in an Oct. 13 telephone interview, adding, “I really haven’t had this positive of a response from the Justice Department, Republican or Democrat, for years.”

The Justice Department didn’t respond to a request for comment.

Mike Stranz, vice president of advocacy at the National Farmers Union, pointed out that “98% of all meat processed in the U.S. goes through 50 plants,” making supply chain interruptions consequential, he said.

However, National Chicken Council spokesman Tom Super said in an email that “there is no shortage of chicken plants in the U.S. and we did not experience any major disruptions in production this spring or summer.”

To contact the reporter on this story: Megan U. Boyanton in Washington at mboyanton@bgov.com

To contact the editors responsible for this story: Sarah Babbage at sbabbage@bgov.com; Loren Duggan at lduggan@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.