Winning Vendors on Next Major IT Contract Ripe for M&A Attention

By Caleb Harshberger

- After delays, CIO-SP4 winners have ‘preliminary’ notice

- Predecessor CIO-SP3 fueled M&A deals over the last decade

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Contractors that win spots on a $50 billion governmentwide IT services contract may soon find themselves targeted by deal makers and prospective buyers looking to lock down long-term revenue streams.

The National Institutes of Health Information Technology Acquisition and Assessment Center March 31 announced that it was “posting a ‘preliminary’ notice of apparent successful offerors until such time that we can post the actual apparent successful offeror notice” for the Chief Information Officer–Solutions and Partners 4, or CIO-SP4, contract.

Read more: ‘Preliminary’ List for $50 Billion IT Contract Is 425 Companies

NITAAC has planned for CIO-SP4 to result in record participation by small businesses over the next decade.

Deal-makers are expected to notice.

“Anytime you see any of those lists get announced, read down that list and below a certain critical mass, they become very good M&A fodder for folks that did not win spots on those contracts,” Kevin Robbins, Senior Advisor, Deep Water Point & Associates and general partner at Blue Delta Capital Partners, said in an interview.

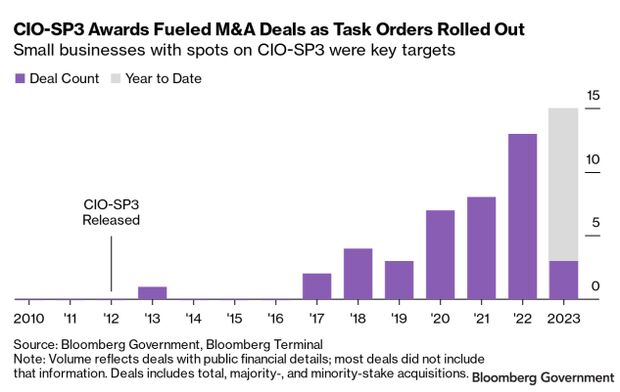

Predecessor contracts have fueled a flood of mergers and acquisition deals targeting small businesses, with CIO-SP3 winners landing around 40 deals in the years after its release.

That contract came out in 2012, and deals took off a few years later as task order awards ramped up and deal negotiations wrapped up.

Buyers included competitors looking to get a piece of the action to private equity firms intent on leveraging the visibility into long-term revenue once the task orders—and actual dollars—started to be dished out.

CIO-SP3 expires at the end of the month, and its successor could fuel an even frothier flood of deal activity with a record amount of dollars planned to be spent and the pool of buyers eyeing contractors for acquisitions continuing to grow year over year.

Private equity, long a smaller player in the space, has steadily grown its share of the contractor mergers and acquisitions pie to around half of activity now.

To contact the reporter on this story: Caleb Harshberger at charshberger@bloombergindustry.com

To contact the editors responsible for this story: Amanda H. Allen at aallen@bloombergindustry.com; Fawn Johnson at fjohnson@bloombergindustry.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.