What Bidders Can Expect on the $50 Billion STARS III: Top 20

By Paul Murphy

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

The U.S. General Services Administration issued a final request for proposal on July 6 for the 8(a) Streamlined Technology Acquisition Resource for Services (STARS) III governmentwide acquisition contract (GWAC).

STARS III, the follow-on to STARS II, is the subject of this week’s Top 20 Opportunities.

Contract Overview

STARS III boasts a $50 billion spend ceiling, more than double the current STARS II contract ceiling, which was recently raised to $22 billion after it reached its spending cap earlier than expected.

GSA appears to be striving for broadened use of STARS III through the combined application of the increased funding, along with efficiency, flexible solicitation terms, and low barriers to entry. Task order awards on the new vehicle will be competed over a shorter time frame than the 10-year STARS II. STARS III carries a five-year base period and just three one-year option periods, but the total period of performance on certain tasks could be as long as 13.5 years.

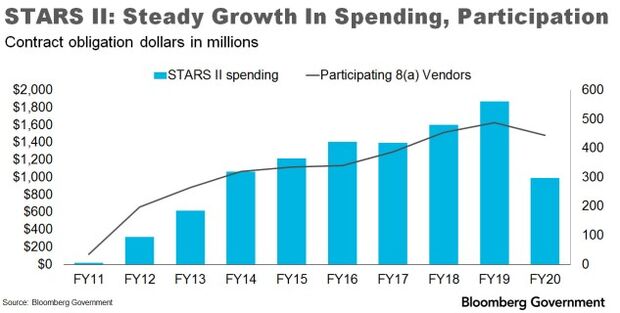

GSA is looking to build on the success of STARS II. Since fiscal year 2011, STARS II spending has totaled $10.5 billion, with annual spending growth averaging 12.2% from fiscal years 2015 through 2019. Year-over-year growth in the number of active vendors averaged 9% over the same period.

STARS II’s 787 awardees are led by Buchanan & Edwards ($338 million), Dovel Technologies ($304 million) and ActioNet ($227 million). DOD has spent the most from the 63 agencies that have obligated funds through STARS II with $3.9 billion, followed by the departments of State ($1.4 billion) and Agriculture ($961 million).

Some familiar, some new conditions

As with STARS and STARS II, the primary requirements addressed by the new vehicle will fall under computer systems design services (NAICS 541512), which has a $30 million small-business size standard. Certified 8(a) vendors qualified to perform work in this market are invited to bid.

The STARS III RFP eliminates the previous STARS II market groupings, referred to as “constellations” and “functional areas.” GSA specifies that several “aligned” IT services and “ancillary” supporting services, will be within the scope of the contract.

The new RFP authorizes task order requests in two sub-areas: emerging technologies (ET); and work performed outside the continental U.S., including foreign and non-foreign places of performance.

By authorizing requests for state-of-the-art ET, GSA is positioning itself to attract non-traditional bidders offering solutions that “are not yet mature in the marketplace and have potential for wide-spread adoption,” according to the statement of work.

Examples of emerging technologies cited in the SOW include: artificial intelligence; autonomic computing; blockchain/distributed ledger; quantum computing; robotic process automation; technological convergence; and virtual reality.

While past performance will be a key evaluation element, GSA has set the threshold value of relevant experience projects to just $100,000, according to a FAQ document. GSA does not require that a bidder hold any other GSA contract.

Cybersecurity and Supply Chain Risk Management

STARS III bidders will be considered in light of the terms and conditions of as many as 38 cybersecurity and supply chain risk management (SCRM) laws, regulations, standards and policies listed in an attachment document to the RFP.

The RFP addresses the possibility that some STARS III task orders will be subject to the Pentagon’s contentious Cybersecurity Maturity Model Certification (CMMC) that requires all defense suppliers to undergo regular cybersecurity audits. It’s likely the initiative will soon extend to all agencies. The RFP instructs companies to “begin preparing for CMMC and SCRM accreditation by staying aware of developing requirements.” Although non-compliant CMMC companies will not be disqualified for a STARS III bid, but Bloomberg Government expects it may put companies at a competitive disadvantage for task orders in future years.

What’s Ahead

Recompetes of existing STARS II task orders will not be automatically converted to the follow-on contract, but Bloomberg Government finds it likely the majority of orders will continue to be fulfilled via STARS III.

To maintain efficient contract management, GSA will not exercise contract option periods for awardees that have not performed at least $100,000 of work on STARS III by the end of the initial five years. GSA also reserves the right to terminate STARS III contracts for convenience if the agency finds an awardee is not actively engaged in the task order bidding process, or suffers from other performance issues. Almost 25% of STARS II awardees received no STARS II awards, according to Bloomberg data.

Companies vying for a slot on STARS III should be monitoring follow-on work from expiring STARS II task orders. According to BGOV data, 865 STARS II task orders worth a total of $2.5 billion will be expiring by the end of the 2021 fiscal year. With limited, direct access to program offices through traditional industry days and conferences, vendors will need to monitor all official communications closely and reach out pro-actively to contract officers and program offices with targeted questions about the status of specific requirements.

GSA expects to award STARS III in the spring of 2021. GSA does not have a target number of contracts but all 8(a) companies who qualify are likely to win awards. Responses to the final RFP are due August 5.

To contact the analyst: Paul Murphy in Washington at pmurphy@bgov.com

To contact the editor responsible: Daniel Snyder at dsnyder@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.