Voters Weigh Taxes on the Rich, Oil Drillers, Office Space

By Michael J. Bologna

- Illinois voters asked to adopt a graduated income tax

- Californians may loosen commercial property tax caps

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Voters in Tuesday’s elections are asked whether to toss out Illinois’ flat income tax, loosen California’s commercial property tax caps, and overhaul Alaska’s oil and gas production tax.

There’s a lot at stake for taxpayers and policymakers in all three states.

Illinois, California, and Alaska are all scraping for funds to erase a period of fiscal upheaval. But some of the wealthy individuals and corporate interests question the fairness of adding to their tax burdens during a recession triggered by the Covid-19 public health crisis. They’re urging people who aren’t rich to side with those who’d have to pay more.

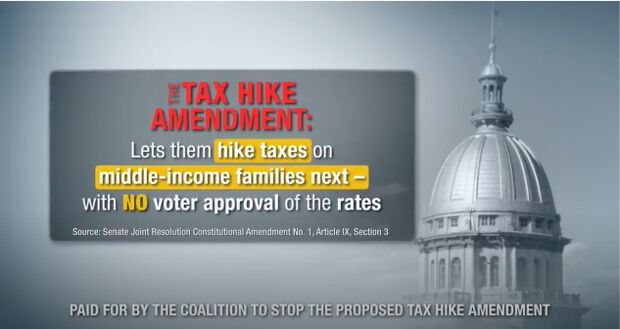

Kenneth Griffin, founder of the hedge fund Citadel LLC and ranked as Illinois’ richest resident, is a good example, opposing the ballot proposal in his state with a $53.75 million donation to the Coalition to Stop the Proposed Tax Hike Amendment. In a statement Griffin called the ballot measure, “nothing more than a graduated tax scheme engineered to extract the greatest amount of money possible from all Illinois taxpayers.”

At issue in Illinois is a proposed constitutional amendment championed by Gov. J.B. Pritzker (D). It would replace the state’s 50-year-old 4.95% flat income tax with a six graduated tax brackets that would kick in on Jan. 1, 2021. The new rates would range from 4.75% for low-income earners to 7.99% for joint filers earning over $1 million annually.

The governor has estimated the change would bring more than $3 billion into state coffers annually.

Pritzker, a billionaire whose grandfather built a conglomerate including the Hyatt hotels, has contributed $56.5 million to the “Vote Yes for Fairness” committee. One of its ads reminds small-town voters that there are a lot of rich people in the big city.

“Passing the fair tax makes it possible to charge millionaires and billionaires a different tax rate than the rest of us,” says the Vote Yes commercial. “The wealthiest residents in northern Illinois would help fund downstate local schools and universities, driving downstate jobs and breathing life into our economy.”

Billionaires’ Bankrolls Escalate Illinois Flat Income Tax Debate

Spending on previous ballot initiatives never topped $5 million in Illinois, said Kent Redfield, a professor of political science at the University of Illinois.

The Illinois Policy Institute, a libertarian think tank, filed a lawsuit on Oct. 5 objecting to “misleading” ballot language. A state court judge denied emergency relief, but the institute is still pushing for an evidentiary hearing in the matter.

The Illinois electorate has previously been favorable toward leaning on high-income taxpayers. In 2014 nearly 60% of those voting approved an advisory referendum supporting a 3% tax on individuals with incomes above $1 million for school funding. Afterward, the General Assembly didn’t take action on a millionaire’s tax.

Property Tax

California voters could upend a 42-year-old cap on property tax rates and generate up to $12.5 billion a year from higher commercial property assessments.

Proponents have raised $36 million to promote the initiative (Proposition 15), which would split California’s property tax rolls in two. Residential property owners would keep a system in place since 1978 that caps annual property tax bills at 1% of the purchase price, with a maximum increase of 2% a year for inflation. Business and commercial property would once again be assessed annually based on current market value.

Proponents say 92% of the new revenue would come from assessments on only 10% of commercial properties in the state. Owners of hotels, shopping centers, office buildings, and large properties would bear most of the burden. Owners with properties worth less than $3 million would be exempt.

Commercial property developers and business groups are financing a campaign against the proposition, arguing that it would harm small businesses. California’s county property tax assessors also oppose the measure, saying it would be costly and difficult to implement.

California voters are also weighing a measure (Proposition 19) that would let homeowners transfer their capped property tax values if they sell their homes and buy another property in the state. It would require heirs to make inherited properties their primary residences if they want to keep the low valuation.

Oil Production

Petroleum giants BP, ConocoPhillips, and ExxonMobil have a fight on their hands in Alaska, where voters are considering an initiative (Ballot Measure 1) seeking higher production taxes on the state’s North Slope oil fields.

Supporters contend the state’s been missing out on revenue because of a flat tax system and a series of generous tax credits.

Producers have invested more than $18.4 million in a campaign to defeat the proposal, complaining it threatens to destroy the most important industry in the state. ConocoPhillips Alaska president Joe Marushack has said his company would pull back on drilling on the North Slope if the ballot proposal is approved.

Oil Companies Spend Big to Try to Defeat Alaska’s Tax Proposal

Louisiana voters also are considering a question (Amendment 2) affecting oil producers. That measure would permit the presence or production of oil to be considered when assessing the fair market value of a well to calculate ad valorem property taxes.

The amendment would change a constitutional provision that currently bars the state tax commission from considering income when oil and gas assets are assessed, said Daron Fredrickson, tax chairman for the Louisiana Oil and Gas Association.

Jay Adams, a tax partner with Jones Walker in New Orleans, said the amendment would create a more predictable system for property valuation, since fields with vastly different production capacities are frequently taxed the same.

Arizona, Colorado & Oregon

Arizona voters will decide whether to raise income taxes on the state’s highest earners to fund education. The measure (Proposition 28) would add a 3.5% surcharge on taxable income over $500,000 for a married couple starting Jan. 1.

A legislative analysis estimates the measure would generate $827 million in new revenue during its first full year. Recent polling suggests supporters have an edge heading into the election.

Colorado voters could choose to reduce their income taxes under a measure (Proposition 116) that would cut the state’s flat income tax rate to 4.55% from 4.63% for tax year 2020 and beyond. The change would provide $154 million in tax relief next year.

“Colorado is experiencing a recession,” said Jon Caldara, president of the right-leaning Independence Institute during a debate on the measure. “Now is the perfect time to energize the economy.”

Colorado voters will also consider changing the state Constitution (Amendment B) to repeal a requirement that residential and nonresidential property tax revenues make up the same portion of total statewide property taxes as when the provision was adopted in 1982. Local governments say that’s outdated and resulted in some of the lowest property taxes in the nation for homeowners.

And voters in the Portland metropolitan area are considering a new business tax to fund more than $6 billion in transportation infrastructure upgrades.

Under the initiative (Measure 26-218) a payroll levy not to exceed .75% would be imposed on employers with more than 25 employees beginning in 2022. Proponents say it would raise about $4 billion over 15 years with another $2.4 billion in federal dollars slated for transportation projects in three counties.

With assistance from Laura Mahoney, Brenna Goth, Jennifer Kay, Tripp Baltz, and Paul Shukovsky

To contact the reporter on this story: Michael J. Bologna in Chicago at mbologna@bloomberglaw.com

To contact the editor responsible for this story: Katherine Rizzo at krizzo@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.