Virus Tax Cuts, ‘Recovery Rebates’ Have $591 Billion Price Tag

By Sarah Babbage

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

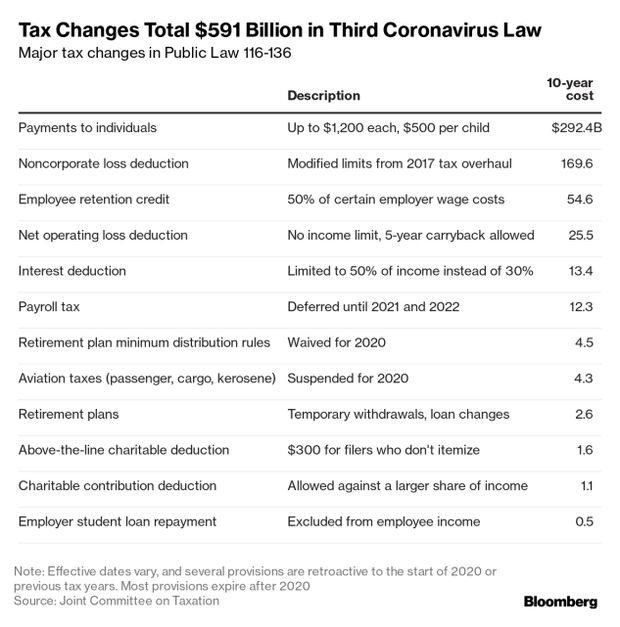

Sending $1,200 checks to millions of Americans, providing tax breaks to employers that retain their staff, and securing other tax help for businesses will come with an almost $600 billion price tag.

The nonpartisan Joint Committee on Taxation estimated a $591.1 billion reduction in revenue over a decade from tax and health provisions in the third coronavirus response law (Public Law 116-136; see BGOV Bill Summary).

The payments of as much as $1,200 per individual and $500 per child account for almost half that cost.

The law includes several changes to the 2017 tax overhaul (Public Law 115-97), including a fix to the “retail glitch” long sought by Republicans to allow restaurants and retailers to immediately write off the cost of improvements. It also temporarily rolls back some of the revenue-raising provisions of that law, such as limits on businesses’ ability to carry back losses and deduct interest.

Additionally the measure allows money in medical savings accounts to be used for over-the-counter medicine and menstrual products. That change will cost $8.7 billion over a decade.

The following table summarizes the most costly tax provisions in the $2 trillion package. The law includes several additional tax and health provisions that would affect revenue.

To contact the analyst: Sarah Babbage in Washington at sbabbage@bgov.com

To contact the editors responsible for this story: Adam Schank at aschank@bgov.com; Loren Duggan at lduggan@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.