This Is IT: Small Business IT Obligations Reach All Time High

By Laura Criste

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Small businesses obligations were bigger than ever in the information technology market last fiscal year.

This week’s This Is IT offers five takeaways in five charts to provide insights into how agencies are distributing IT obligations to small businesses. That includes agencies awarding the most obligations to small businesses, IT submarkets with the largest small business representation, and what to expect in fiscal 2021.

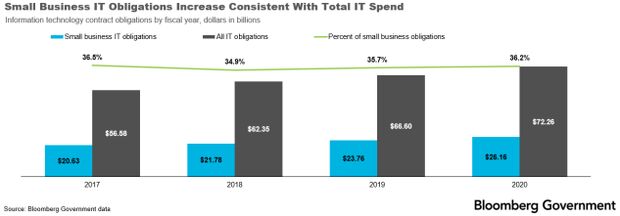

1. Small Business Obligations Increase, Share Remains Consistent

Agencies obligated $26.2 billion in IT work to small businesses in fiscal 2020, up from $23.8 billion in fiscal 2019. Those increases follow suit with the rise in obligations for the entire IT market, so small business obligations have hovered around 36% of the IT market.

Small business increases in line with the overall IT market is common in individual agencies as well. As most agencies saw overall IT spending increases in fiscal 2020, small business spending also increased. For example, the small business share of IT obligations at the Department of Defense (DOD) and the Department of Health and Human Services (HHS) were steady from fiscal 2019 to 2020 at 31% and 45%, respectively.

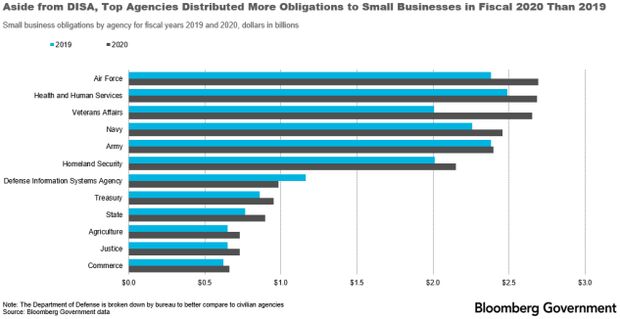

2. Select Agencies Drive Growth

The top agencies by small business contract obligations in fiscal 2020 are DOD, HHS, and the departments of Veterans Affairs, Homeland Security, and Treasury. If DOD bureaus are itemized, the Air Force, Navy, Army, and Defense Information Systems Agency (DISA) all fall in the top 12 organizations based on small business IT obligations. Of the top 12, just DISA distributed less to small businesses in fiscal 2020 than fiscal 2019.

Agencies rely on small businesses differently from large companies based on the type of IT product or service.

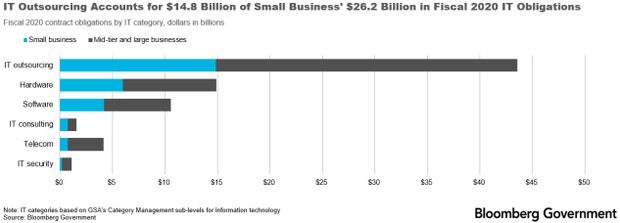

3. IT Outsourcing Outpaces All Submarkets

GSA’s category management IT submarkets show agencies buy a similar amount of IT consulting from small businesses as compared to large and that small businesses are an important part of IT outsourcing, hardware, and software market categories. Most significantly, agencies spent $43.6 billion on IT outsourcing in fiscal 2020, with $14.8 billion going to small businesses. That also means more than half of small business IT spending was for outsourcing.

But small businesses have a small footprint in the telecommunications and IT security markets. Small businesses account for $722 million of a $4.2 billion telecom market and $197 million of a $1.1 billion IT security market.

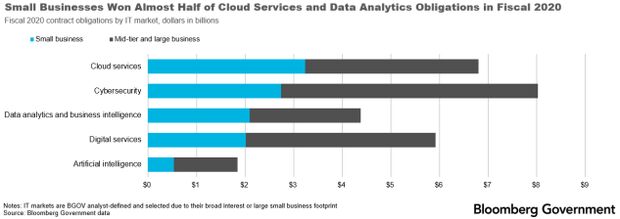

4. Cloud, Cyber Data Analytics Spend Flourishes

BGOV market definitions, those that are analyst-defined, show small businesses are a large portion of the cloud services market, with nearly half the market’s fiscal 2020 obligations. Agencies also relied heavily on small businesses for cybersecurity, digital services, and business analytics products and services in fiscal 2020. Although small businesses haven’t accounted for as large a portion of the AI market, small business obligations are still significant, at $530 million in fiscal 2020 compared with $327 million in fiscal 2019.

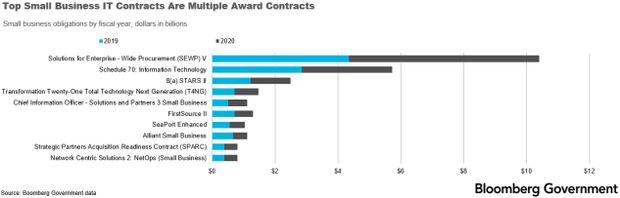

Agencies are distributing a large portion of IT obligations to small businesses through large multiple award contracts. Top vehicles include the National Aeronautics and Space Administration’s Solutions for Enterprise-Wide Procurement (SEWP) V, the General Services Administration’s Schedule IT-70, GSA’s 8(a) STARS II, VA’s Transformation Twenty-One Total Technology Generation (T4NG), and the National Institute of Health’s Chief Information Officer – Solutions and Partners 3 Small Business (CIO-SP3 SB). Small business use of these and other top vehicles has grown in recent years, but some have decreased from fiscal 2019 to 2020, likely due to agencies recompeting or ending the vehicles.

5. SEWP V is Top Contract

Small businesses in the IT space will want to track expiring task orders on DHS’s EAGLE II and solicitations for GSA’s Polaris, the recompete for GSA’s Alliant Small Business; CIO-SP4; and DHS’s FirstSource III.

What’s Ahead

Increased small business IT obligations are in line with overall IT market trends. That’s good news for small businesses. Bloomberg Government expects the IT market to grow in fiscal 2021, and small business trends indicate as the IT market grows, small businesses will continue to see more opportunities to grow as well. To date, agencies have reported $3.1 billion for small businesses in fiscal 2021. If historical trends continue, $28.3 billion in IT obligations would go to small businesses in fiscal 2021.

Agency small business goal changes aren’t likely to significantly impact small business obligations in the IT market. For most agencies, small business goals have been lower than actual small business obligations in the IT market, and changes in goals from fiscal 2019 to 2020 didn’t align with IT spending differences from fiscal 2019 to 2020.

To contact the analyst on this story: Laura Criste in Salt Lake City, Utah at lcriste@bgov.com

To contact the editors responsible for this story: Michael Clark at mclark@ic.bloombergindustry.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.