Staffing, Spending Trends Feed Appetite for High-Value Contracts

By Paul Murphy

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Lagging agency contract officer employment growth combined with a $205 billion surge in contract spending since fiscal 2016 generated procurement portfolios with fewer, more lucrative contracts, according to analysis by Bloomberg Government.

A shrinking pool of prime contractors competes on large contract vehicles amid a trend of contract consolidation fueled by procurement efficiency initiatives. Bloomberg Government data show the count of active federal prime contractors fell 17.5% to 102,047 in fiscal 2020, from 123,790 in fiscal 2016. Simultaneously, federal subcontract spending has nearly doubled since fiscal 2016, exceeding $100 billion in fiscal 2020.

These factors describe a federal marketplace that favors companies able to win bids on large indefinite-delivery, multiple-award, and government-wide contracts and increasingly pushes companies that will lose out on or choose not to compete for those complex, highest-dollar opportunities into secondary subcontract or teaming roles—or to drop out of the market altogether.

How Many Contract Officers Does It Take to Spend $680 Billion?

The 24 Chief Financial Officer Act agencies’ cohort of contract official personnel, as classified in Office of Personnel Management employment groups 1101-1102, grew 9.2% to 69,541 by fiscal 2020. Civilian agency employment was up 6.1% overall, but down 1% in cabinet-level agencies. DOD employment was up 11.5%.

But contract spending at the CFO Act agencies grew 43% from fiscal year 2016 to 2020. The agencies, which account for more than 99% of overall contract spending, laid out $680 billion in fiscal year 2020. That money went out the door on fewer contracts: The count of unclassified prime contracts fell 14.7% government-wide, dropping to 904,000. The value of an average prime contract reached $753,000 in fiscal 2020, a 68% increase over five years.

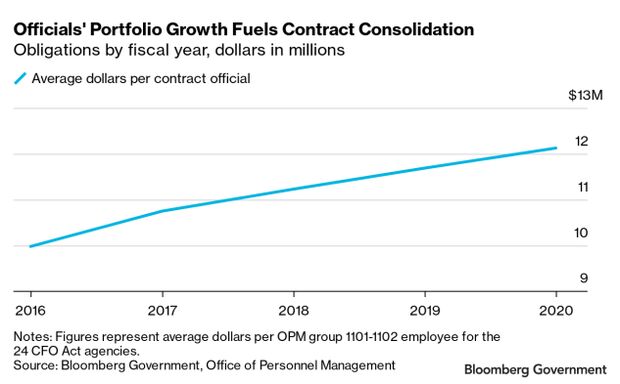

The average contract administrator in fiscal 2020 managed a portfolio consisting of 13 contracts (down from a fiscal 2016 average of 16.6) obligating $12 million (a 21% jump compared to fiscal 2016).

MACs, BICs Take On Bigger Roles

Indefinite Delivery Vehicles represent many of the largest contracts across the government. IDV spending increased 41% from fiscal 2016 to fiscal 2020 and now accounts for nearly half of all obligated spending. Pitfalls of single-award IDVs include uncompetitive prices and duplicative contracts with widely different prices and labor rates. Over the past five years, procurement offices have addressed those pressures on budgets by adding competition into the flexible and expedited bidding process of IDVs—issuing an IDV to multiple vendors and then competing specific deliverables at the task order level.

These realities facing agency contract shops with limited staff relative to the increase in appropriated funds have led to a proliferation of large, multiple-award contracts, or MACs. MAC spending grew 42% over five years to a record $159 billion in fiscal 2020. There are now more than 2,000 MAC vehicles, accounting for nearly one of every four federal contract dollars.

The government’s ongoing category management initiative has aggressively shifted dollars to multiple-award, best-in-class (BIC) contracts like the General Services Administration’s Multiple Award Schedule, Alliant, and OASIS vehicles. BIC spending totaled a record $51 billion in fiscal 2020, up 74% since fiscal 2016.

The inability of Congress to pass budgets on time increases reliance on MACs and BICs. Congress has enacted continuing resolutions in all but three years since 1977. When agencies don’t receive full appropriations until several months into the fiscal year, contract staff face more uncertainty and less time to conduct solicitations. These complications increase the possibility contract officers will choose existing contracts or MACs to fulfill urgent requirements.

To contact the analyst on this story: Paul Murphy in Washington at pmurphy@bgov.com

To contact the editors responsible for this story: Michael Clark at mclark@ic.bloombergindustry.com and Amanda H. Allen at aallen@bloombergindustry.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.