Second Coronavirus Package Creates New Emergency Leave Programs

By Naoreen Chowdhury and Sarah Babbage

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

New emergency sick and family leave programs were established by coronavirus response legislation signed into law by President Donald Trump on March 18.

The legislation (H.R. 6201) also included provisions to make coronavirus tests free, ensure students continue to receive free lunches, and expand unemployment insurance benefits.

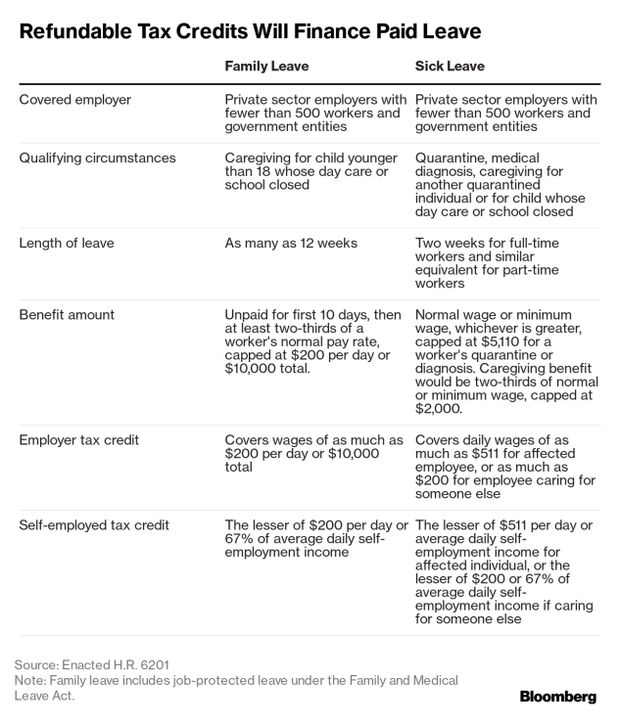

The centerpiece of the second package, however, was the emergency paid leave programs that will support time off for workers affected by coronavirus. Employers will receive refundable tax credits that also cover their share of workers’ health insurance coverage. Those credits will cost $104.5 billion over a decade according to the nonpartisan Joint Committee on Taxation.

The measure followed an initial $8 billion package (Public Law 116-123) signed into law on March 6. Lawmakers and the administration are working on a “phase three” proposal to aid individuals and businesses, which could include changes to the paid leave programs in the second package.

The attached graphic provides an outline of the key elements of the emergency leave programs and how employers and self-employed workers can use tax credits to offset the cost.

Click here to download the chart.

To contact the authors: Naoreen Chowdhury in Washington at nchowdhury@bgov.com; Sarah Babbage in Washington at sbabbage@bgov.com

To contact the editors responsible: Adam Schank at aschank@bgov.com; Loren Duggan at lduggan@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.