‘Preliminary’ List for $50 Billion IT Contract Is 425 Companies

By Paul Murphy

- First awardee roster is 40 more than current incumbents

- ‘Other than small’ awardees doubles, small/mid-sized drops

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

A total of 425 companies have been named preliminary awardees on the long-awaited Chief Information Officer Solutions and Partners-4 contract vehicle following an announcement March 31 by the National Institutes of Health, which manages the governmentwide IT services vehicle.

NIH’s Information Technology Acquisition and Assessment Center told industry that it had “completed its evaluation of proposals in all three phases in accordance with the subject solicitation, including its source selection procedures.”

The CIO-SP4 announcement said NITAAC also is “posting a ‘preliminary’ notice of apparent successful offerors until such time that we can post the actual apparent successful offeror notice. This ‘preliminary’ listing may not yet be comprehensive and complete.”

Once the Small Business Administration confirms to NITAAC the named winners’ size and socioeconomic classifications, awardees can begin to receive task orders in an IT systems design market worth a total of $140 billion since fiscal 2018. SBA’s final review is expected to take one to three weeks. The new 10-year vehicle has a $50 billion lifetime value per contract.

Agencies can begin placing orders on the new CIO-SP4 contracts the day they are signed, according to information provided earlier by NITAAC. Task orders executed on CIO-SP3 vehicles will remain in effect for up to five years from the date of execution.

As of Feb. 2, the last of dozens of protests that plagued the CIO-SP4 solicitation during 2022 were dismissed.

Competition, Targets

The announcement significantly expands NITAAC’s pool of businesses deemed “other than small” or large. CIO-SP4’s preliminary list of awardees is an increase of 162% in “other than small” firms compared to the 47 CIO-SP3 incumbents.

Other awardees are spread across nine socioeconomic groups representing a mix of small and mid-sized companies. This combined group accounts for 71% of CIO-SP4 awards.

Vendors can hold positions in more than one socioeconomic group, with some awardees linked to as many as six. According to the solicitation, companies within one socioeconomic group will compete for task orders only with other companies in that group. The socioeconomic groups are represented by:

- 123 8(a) contractors;

- 84 women-owned small businesses;

- 60 veteran-owned small businesses;

- 59 businesses with a HUBZone designation;

- 46 service-disabled veteran-owned businesses; and

- 18 companies in two American Indian-owned categories.

The list includes 257 small businesses, more than double the number originally sought. The combined count of unique entities across these nine categories, however, is 36 fewer than the currently reported 338 contract holders on CIO-SP3 Small Business.

Preliminary slots were also won by 75 companies NITAAC designated as “emerging large businesses,” defined by annual revenues averaging between $30 million and $500 million over the last five years. For task orders, an ELB is considered other than small.

If a significant event occurs causing a company to re-certify its status—like a merger or acquisition or outgrowing a small business size standard—it could be re-classified to continue competing for task orders among a group of industry peers.

Since fiscal 2012, 31.7% of spending on the incumbent CIO-SP3 and CIO-SP3 Small Business vehicles has gone to small firms.

There will be no on-ramps on the new contract for three years, according to NITAAC officials.

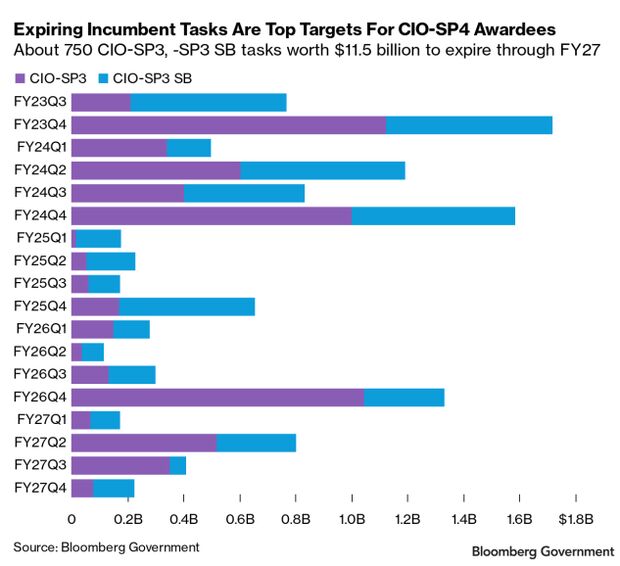

Among the new awardees’ high-priority business targets will be an estimated $10.8 billion in expiring task orders on the two predecessor contracts. Both vehicles expire April 29.

Other near-term opportunities include the approximately $56 billion in non-NITAAC IT systems design tasks overall, in NAICS 541512, set to expire starting May 1.

Growing Reach

NITAAC’s initial goal for its CIO-SP3 vehicles was to address requirements in the health IT market, but demand from other agencies expanded. By fiscal 2022, more than three dozen agencies used NITAAC contracts.

In October 2022, NITAAC announced the Department of Defense renewed its “801 certification” for fiscal 2023. This certifies that NITAAC complies with DOD procurement requirements and authorizes the agency to place large CIO-SP4 orders on behalf of the Pentagon without special waivers.

NITAAC has seen a spike for DOD-assisted acquisitions spending, according to NITAAC deputy director Ricky Clark.

Agencies have spent a total of $26.7 billion on the two incumbent contracts since fiscal 2012: $14.2 bllion on CIO-SP3, and $12.5 billion on CIO-SP3 Small Business.

In fiscal 2022, the top three agency users were the departments of Health and Human Services ($1.7 billion), Homeland Security ($685 million), and Defense ($649 million). DHS grew its CIO-SP3 spending more than 31 times since fiscal 2018 as it phased out its own agency-managed IT services contracts. Since fiscal 2012, HHS has accounted for $11.8 billion, or 44.3%, of CIO-SP3 spending.

CIO-SP4 will join a handful of other top contracts in the computer systems design market. These include the General Services Administration’s Alliant and Alliant 2 vehicles, 8(a) STARS II/III, VETS 2, and the Multiple Award Schedule for IT. Also in this market are the Department of Veterans Affairs’ T4NG and its pending follow-on, T4NG2.

Together, these contracts have accounted for a reported $96 billion in contract obligations since fiscal 2018. GSA’s portfolio of pending Polaris small business contracts—follow-ons to its Alliant Small Business vehicle—will join this group upon award.

NITAAC’s contracts have performed well against other vehicles in the last five years, growing their share of the computer systems design market governmentwide to 14.6% in fiscal 2022, up from 13.4% in fiscal 2018.

Leading CIO-SP3 awardees since fiscal 2012 include General Dynamics Corp. ($2.2 billion), Guidehouse LLP ($1.6 billion), and both Deloitte, Touche, Tohmatsu, and Booz Allen Hamilton Holding Corp. ($1.5 billion). All of these incumbents are on the initial list of CIO-SP4 winners.

Top small business incumbents include Tista Science & Technology ($431 million), Sekon Enterprise Inc. ($347 million), and Tantus Technologies Inc. ($319 million). Sekon and Tantus have graduated to the “other than small” grouping in NITAAC’s preliminary list.

To contact the reporter on this story: Paul Murphy in Washington at pmurphy@bloombergindustry.com

To contact the editors responsible for this story: Amanda H. Allen at aallen@bloombergindustry.com; Fawn Johnson at fjohnson@bloombergindustry.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.