Oil Companies Spend Big to Try to Defeat Alaska’s Tax Proposal

By Michael J. Bologna

- ConocoPhillips says it may ditch Alaska if measure approved

- Initiative supporters say companies paid zero for five years

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Petroleum giants BP, ConocoPhillips, ExxonMobil, and Hilcorp Energy have invested a record $18.4 million in a campaign against an Alaska ballot measure that would boost taxes on the richest oil fields in North America.

ConocoPhillips Alaska might retreat from drilling on the North Slope if the ballot proposal is approved in the Nov. 3 election, according to company president Joe Marushack.

“This is an increase of the severance taxes by 150% to 300% depending on oil prices,” Marushack said during an Alaska Chamber presentation. “That’s in addition to the income taxes we pay, the royalties we pay, the operating costs we pay. This is a huge increase on industry.”

The North Slope Oil Production Tax Increase Initiative (Ballot Measure 1) seeks to overhaul Alaska’s formula for claiming revenue from crude oil extracted from the Alpine, Kuparuk, and Prudhoe Bay fields.

The producers, pooling their money through the OneAlaska-Vote No on One committee, argue the initiative would destroy the most important industry in the state by jacking up taxes between $265 million and $800 million annually, depending on the per-barrel price of oil.

Hilcorp vice president David Wilkins said the change would cause producers to invest in other states. “The best thing Alaska can do is make the playing field for investment stable,” he said.

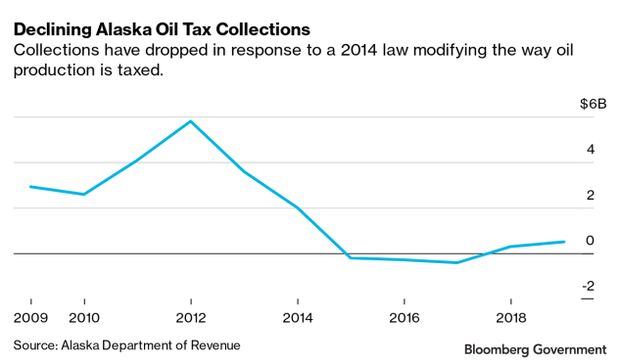

The Vote Yes for Alaska’s Fair Share committee is arguing that the current tax (S.B. 21), enacted in 2014, has essentially relieved big oil of production taxes for five years. The group points to modeling done by former state tax director Ken Alper showing Alaska netted production tax revenue of $3.8 billion annually, on average, during the five years prior to the new law. Revenues then dropped below zero because the state granted more in credits than it collected.

“Since S.B. 21, the state has paid and incurred $2.1 billion in awarded credits, and received only $2 billion in production taxes,” said Robin Brena, chairman of the Vote Yes committee. “We have paid the producers more than they’ve paid us.”

The Vote No committee argues that the state’s declining production revenues should be attributed to conditions in the global oil industry.

Lopsided Spending

More than 98% of the Vote No committee’s $18.4 million was gathered from energy companies and trade associations, according to campaign finance reports filed with the Alaska Public Offices Commission. The donations include $4.5 million from BP; $275,000 from Chevron USA; $4.5 million from ConocoPhillips; $3.7 million from ExonMobil; $4.3 million from Hilcorp Energy; and more than $800,000 from the Alaska Oil and Gas Association.

ConocoPhillips and Hilcorp have made additional campaign contributions though a $2.3 million fund directed by the Alaska Chamber, which released its own ads against the measure.

Chantel Walsh, chair of the Vote No committee and former director of Alaska’s Division of Oil and Gas, said the campaign is needed to avoid giving the petroleum industry a reason to pull back on drilling, production and investment across Alaska.

“It has to be fought, unfortunately, with lots of dollars and so the industry as a whole is rallying together,” Walsh said.

The Vote Yes committee has raised about $1.3 million from more than 500 donors. Brena, a trial attorney who made a fortune fighting oil companies on behalf of municipalities, put more than $1 million in the campaign.

Cliff Groh, a director of the voter awareness group Alaska Common Ground, called the spending by both sides unprecedented for a ballot proposal in Alaska.

In 2014, oil companies spent $14.2 million and narrowly defeated a similar ballot measure. The political dynamics are different this year, with oil prices and industry revenues slumping and Alaska’s fiscal house in disarray, said Groh.

“This will be a hard one to call,” he said. Alaska is hard to poll statewide. It’s a big state geographically, lots of rural areas, with a small population.”

The ballot measure is opposed by Gov. Mike Dunleavy (R), who believes the tax plan would harm the state’s economy. Tax reforms are best left to the state legislature, Dunleavy told a public radio station last week.

The Details

The ballot measure seeks to impose an alternative gross minimum tax or an additional production tax, whichever is greater, on oil pumped from Alaska’s North Slope. The gross minimum tax would be imposed at 10 percent of the gross value of oil at the point of production where the average per-barrel price for crude oil is less than $50. The alternative calculation would scale higher by 1 percentage point per $5 increment increase in the average per-barrel price for crude oil to a cap of 15 percent. No credits, operating losses or offsets could be used to reduce the tax due below this calculation.

Under the additional production tax method, the tax would be the difference between the average production tax value of oil per month and $50, multiplied by the volume of taxable oil produced by the producer for that month, and multiplied by 15 percent. The method would also eliminate the current credit system.

The plan also promises transparency, requiring oil company tax records submitted to the Alaska Department of Revenue to be considered matters of public record.

Edward King, a former chief economist for the state, said he agrees the production tax should be changed, just not this way.

“Oil tax law is complicated and our oil tax law in Alaska is more complicated than anywhere else,” said King, who’s running for a state House seat as an independent. “When you start adjusting something this complex through a ballot initiative that had no public process, no analysis and no transparency. That’s not a great way of rewriting a very complex area of law.”

To contact the reporter on this story: Michael J. Bologna in Chicago at mbologna@bloomberglaw.com

To contact the editors responsible for this story: Katherine Rizzo at krizzo@bgov.com; Jeff Harrington at jharrington@bloombergtax.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.