Lobbying Spending in 2019 Reached Second Highest Point of Decade

By Megan R. Wilson

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

The influence industry in Washington is booming. The more than $3.4 billion spent on lobbying in 2019 was the most since 2010.

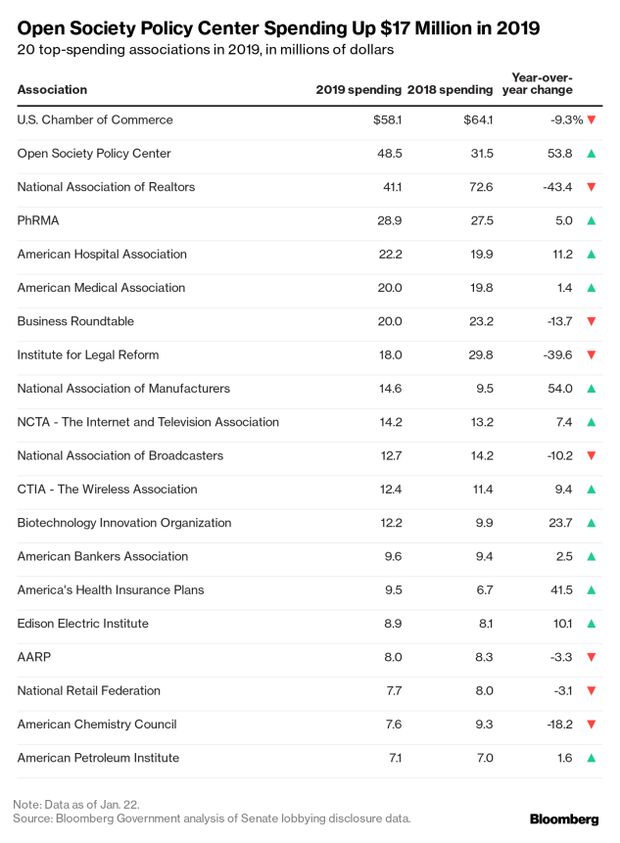

Increases in lobbying expenditures occurred primarily within the non-profit world, with 12 of the 20 highest-spending associations putting more money into lobbying than they did in 2018, according to a Bloomberg Government analysis of disclosures.

The $48.5 million spent by Open Society Policy Center was $17 million more than in 2018. In the fourth quarter alone, the center, backed by liberal billionaire George Soros, reported $24.1 million in lobbying expenditures.

The non-profit, which reported lobbying on defense authorizations, spending bills and national security powers, includes the grants it gives other advocacy organizations with its own lobbying figures.

Organizations representing drug companies, health services and health care providers made up a majority of the remaining associations that increased spending. The industry spent the last year battling different drug pricing proposals coming from Capitol Hill and the Trump administration.

Read more:Drug Lobby Spends Record Amount in Fight Over Medicine Costs (1)

Top Corporate

The tech industry continued to reign supreme on K Street last year, with Facebook Inc.’s lobbying surging 32% to $16.7 million and Amazon.com Inc. following close behind, spending $16.1 million, a 14% increase over its 2018 lobbying expenditures. Microsoft Corp., which ranked 18th among the top-spending corporations, spent $10.2 million last year, compared to $9.5 million in 2018.

Read more:Facebook Opens Wallet, Leading Peers in Newly Hostile Washington

As many individual pharmaceutical companies had lobbying numbers dip, Swiss drug company Roche Holding AG disclosed a $3 million increase in its Washington advocacy, spending nearly $10 million.

More than half of the top 20 corporate lobbying spenders reported spending less in 2019 than they did the year before, with telecommunications and defense companies hit the hardest.

Comcast Corp. spent $13.4 million on lobbying last year, an 11% drop from the year before. AT&T Inc.’s lobbying spending slumped 31% to $12.8 million and Verizon Communications Inc. spent $11.1 million on lobbying in 2019, an 8% decrease over 2018.

Some of the nation’s largest defense contractors — Boeing Co., Lockheed Martin Corp., Northrop Grumman Corp. and General Dynamics Corp. — all decreased their spending. Still, Boeing was the third-highest corporate spender on lobbying in 2019, behind Facebook and Amazon.com.

Read More:Boeing Hiked Fourth-Quarter Lobby Spend in 737 Max

Defense contracting giant United Technologies Corp. bucked the defense company slump last year, bumping up its spending by 20% to $12.7 million. In June, the company announced its aerospace business would be merging with Raytheon Co. Shareholders approved the transaction in October.

Top Associations

It was a busy year for the health care industry, driving a 42% spike in lobbying by America’s Health Insurance Plans (AHIP), which spent $9.5 million lobbying Capitol Hill and the Trump administration last year. The Biotechnology Innovation Organization spent 24% more, up to $12.2 million, and the American Hospital Association increased its lobbying by $11%.

In addition to the debate around drug pricing, the industry successfully pushed for the elimination of a trio of Obamacare-era healthcare taxes, which was tucked into a government spending bill at the end of the year.

The National Association of Manufacturers, which reported lobbying on Washington’s hottest issues — from trade and tax extenders to environmental regulations and drug pricing — spent $14.6 million on its advocacy last year, $5 million more than it did in 2018.

The Trump administration negotiated multiple trade agreements, including one with Mexico and Canada, and increased tariffs on goods from around the world, hitting a slew of Chinese imports particularly hard.

Regulators have handed the industry a number of wins by rolling back environmental regulations, with 85 in the crosshairs last year alone, according to Harvard Law School’s rollback tracker. This includes rules imposed by the Obama administration to restrict auto pollution and a clean water regulation that prohibited the dumping of toxic substances into waterways without a permit.

Many of the larger year-over-year decreases among associations stem from the tax overhaul passing in 2018, including a drop in lobbying spending by large business groups.

Many companies and associations also spend more on advocacy during election years, with some lumping political and state-level spending in with their federal lobbying dollars. Three of those groups, the U.S. Chamber of Commerce, the Business Roundtable and the National Association of Realtors all had drops in expenditures over 2018. The National Association of Realtors, for example, reported spending 43% less than it did in 2018.

What’s Next

Lobbyists say the 2020 election doesn’t mean legislative and regulatory activity is going to stop, and are prepping for an onslaught of work before lawmakers in Washington head home to campaign.

Read More: Lobbying Firms Report Lucrative 2019, Look to Busy New Year (1)

With assistance from Jorge Uquillas

To contact the reporter on this story: Megan R. Wilson in Washington at mwilson@bgov.com

To contact the editors responsible for this story: Kyle Trygstad at ktrygstad@bgov.com; Bennett Roth at broth@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.