Less Money—Again—Forecast for Full Fiscal 2022 Contract Spending

By Paul Murphy

- Tapering pandemic costs lower civilian contract estimates

- R&D, medical care, equipment maintenance could boost DOD

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

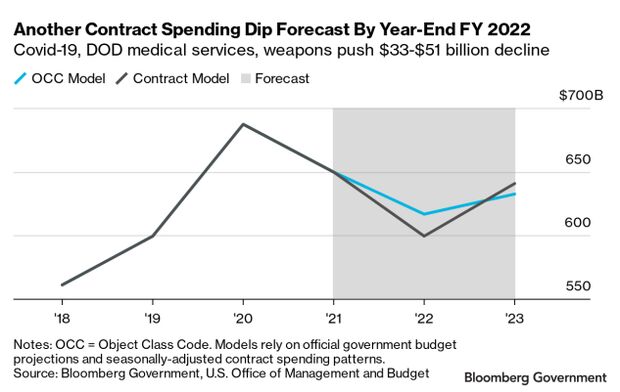

A new analysis of contract and budget data points to a second consecutive procurement spending dip this fiscal year, with an estimated cap at $617 billion.

Bloomberg Government data models using the federal government’s official projections and historical spending patterns show a potential full fiscal-year total for obligations as low as $599 billion. A projected recovery in fiscal 2023—to between $632 billion and $641 billion—would still fall well below fiscal 2021’s $650 billion contract total.

The decline in spending forecast by the models aligns with ongoing consolidation of the federal industrial base and trends in contract size—fewer and larger contracts going to fewer and larger companies. Industry response to the shrinking pool of obligations could include vendors adjusting their competitive approach regarding large contract vehicles and the number of bids they submit overall.

Forecast Breakdown

The new forecast estimates a year-over-year contract spending drop between $33 billion and $51 billion through the end of fiscal 2022.

Bloomberg Government bases its annual spending estimates on the most recently released Office of Management and Budget Object Class Code budget forecast and a seasonally adjusted contract spending model covering the previous five fiscal years. Together, the dual forecasts provide a range of expected contract spending for the remainder of fiscal 2022 and all of fiscal 2023.

Civilian contract obligations through September 30 are projected to fall from $241 billion in fiscal 2021 to between $201 billion to $224 billion. The professional services market loses as much as $9.2 billion, while IT could shed $6.4 billion.

Spending declines at the departments of Health and Human Services, Agriculture, and Homeland Security are key contributors to the downward movement. Contract data point to the tapering of pandemic crisis spending as a central factor.

Pentagon spending estimates diverge depending on the model employed, either growing from $409 billion to $416 billion or slipping to $376 billion. Proposed increases for R&D, medical services, and operations would fuel an increase according to the budget-based forecast, but the seasonally adjusted contract trend model shows significant drops in medical services, weapons, and professional services.

Budget requests, including proposed cuts as well as increases, are political documents that reflect administration priorities. The outer bounds of Bloomberg Government’s forecast modeling have considerably narrowed during the first two years of the Biden administration.

Bloomberg Government’s forecast last year pegged overall fiscal 2021 spending at between $669 billion to $680 billion, which proved accurate to within less than 5% of the final spending tally.

To contact the reporter on this story: Paul Murphy in Washington at pmurphy@bloombergindustry.com

To contact the editors responsible for this story: Amanda H. Allen at aallen@bloombergindustry.com; Bennett Roth at broth@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.