Intelligence Contractors Vying for Slimmer Spy Budget in FY 2021

By Robert Levinson and Cameron Leuthy

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

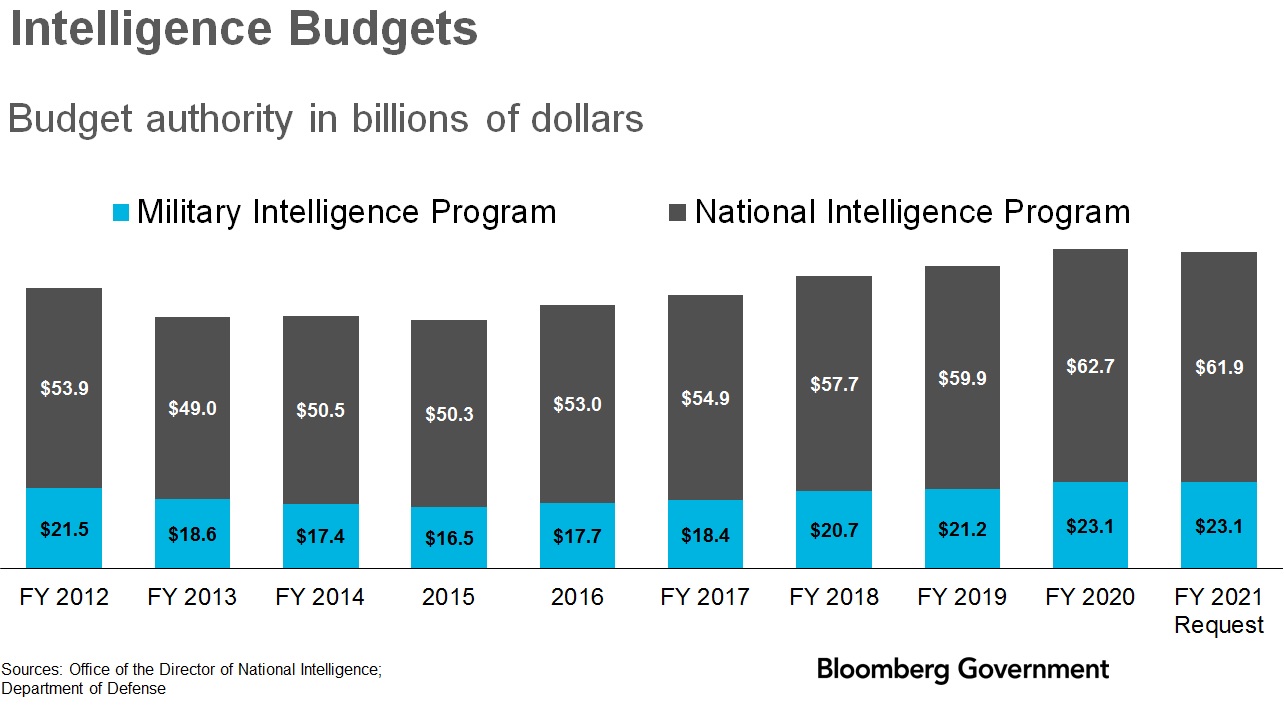

The Department of Defense and the Office of the Director of National Intelligence (ODNI) released their intelligence budget requests for fiscal 2021 totaling $85 billion earlier this year. DOD and ODNI released enacted 2020 figures Oct. 21, allowing for comparisons and revealing a slight decrease from $85.8 billion total in the fiscal 2021 request. A large portion of the intelligence community’s budget goes to contracting which indicates companies are likely to be competing for fewer dollars in the future.

Most contracting by the intelligence agencies is not transparent. Historically, the share of budgets devoted to contracting has been reported at about 70%.

Classifying Intel Budget

The U.S. intelligence community’s budget is comprised of two primary categories, the Military Intelligence Program (MIP) and the National Intelligence Program (NIP). The MIP is overseen by the Pentagon and includes spending for the intelligence components of the military services as well as some of the funding for intelligence agencies that fall under DOD such as the Defense Intelligence Agency (DIA) or the National Geospatial-Intelligence Agency (NGA). The NIP pays for other intelligence agencies such as the Central Intelligence Agency, portions of the FBI, and the State Department’s Bureau of Intelligence and Research (INR), as well as some portion of the DOD-controlled agencies. For fiscal 2021, DOD announced its MIP request would be $23.1 billion, the same as was appropriated for fiscal 2020, and ODNI requested $61.9 billion, a decrease from $62.7 billion in fiscal 2020. DOD and ODNI do not release detailed budget figures for the various agencies for security reasons.

In fiscal 2012, the combined MIP and NIP budget was $75.4 billion making the compound annual growth rate (CAGR) through the 2021 request about 1% and thus not keeping pace with inflation. About 70% of the intelligence budget is spent on contracts based on the latest figures available, meaning that the approximately $59.5 billion to be spent on contracts for the intelligence community in fiscal 2021 is smaller in real terms than it was a decade ago.

Intel Spending Mostly Exempt

Determining what exactly the intelligence community spends its contracting dollars on is difficult because the intelligence community is exempt from reporting contract spending to the Federal Procurement Data System (FPDS). A search in Bloomberg Government’s Contracts Intelligence tool shows a total of only $3 billion for the National Security Agency, DIA and NGA since fiscal 2017 and no data for the CIA.

The billions that the community spends that are not disclosed are spent on a broad range of goods and services. Some of these contracts are directly related to personnel that perform intelligence collection and analysis, or the building of intelligence satellites, while others may pay for more mundane things, such as janitorial services in intelligence community facilities, office supplies, or construction and repair of buildings. However, even in the cases where the work is not directly intelligence-related, contractors often require security clearances because of the sensitivity of the work being performed around them, the individual identities of those performing the intelligence work, or even the location where the work is being done.

Competition for intelligence community work is challenging because of the limited number of contractors that have cleared personnel authorizations. It’s also difficult to identify available opportunities because solicitations are often released with a prerequisite for organizations to have certain security clearances. The intelligence community’s primary platform for releasing opportunities, Acquisition Research Center, has both unclassified and classified components and does release a portion of the acquisition documents at the unclassified level that are accessible with registration and login-in credentials. For contractors seeking to participate in the intelligence market, partnering with companies already in the market, or hiring personnel with experience are often the best ways to break in. If the budgets continue declining slowly, as they have for fiscal 2021, the market is only likely to become more competitive in the immediate future.

To contact the analysts on this story: Cameron Leuthy at cleuthy@bgov.com and Robert Levinson at rlevinson@bgov.com in Washington, D.C.

To contact the editors responsible for this story: Daniel Snyder at dsnyder@bgov.com; olesonJill Oleson at joleson@bloombergindustry.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.