Industry Lobbyists Push to Expand Trump Tariff Deferral Scope

By Megan R. Wilson

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

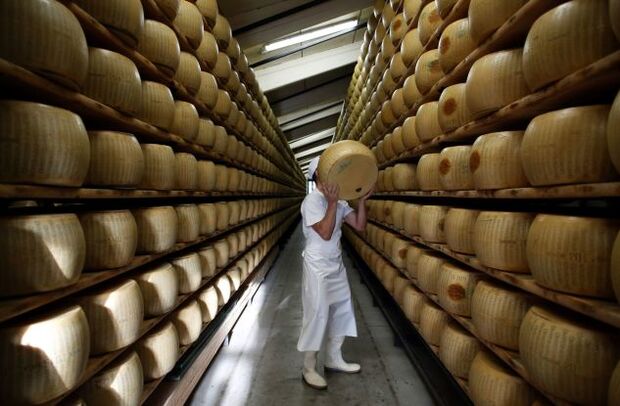

Lobbyists are scrambling to expand relief on more tariffs, as payments for U.S. companies are coming due on everything from imported Chinese fabrics to Italian cheeses and Scotch whisky.

The administration gave some importers a three-month postponement on duties for select goods imported in March and April. But not included in the recently announced deferral are billions of dollars in other tariffs, including those imposed on goods from China, imported steel and aluminum, and a number of products from Europe.

It was a blow to industries pushing for more comprehensive duty relief.

“We are going to push very, very hard on Congress to say, ‘OK, thanks for the beautifully wrapped box, but can we put something in it now?’” said Nicole Bivens Collinson, the head of the international trade and government relations practice at Sandler, Travis & Rosenberg. The former official in the office of the U.S. Trade Representative is lobbying for an informal coalition of companies seeking to defer most other tariffs.

Advocates say a deferral on all tariffs wouldn’t have a lasting impact on government revenues. They’re simply asking to make the payments at a later date.

The new tariff deferral policy, announced on April 19, also doesn’t refund any duties already paid — even in the period covered by the deferral — so it, in practice, is only applicable for select products imported in April. Tariff invoices for May will begin to arrive soon.

Collinson said the new rule’s limited scope and eligibility criteria are problematic during the economic collapse. One of her clients in the apparel industry, she said, is only seeing $56,000 of its $190,000 in duty payments deferred under the new rule.

“My thing is, why is the government taking the money out of their hands, only to turn around and then give them a stimulus package to put it back in?” Collinson said.

Not Enough

The policy shift came after weeks of denials by the administration that it would make such a move. Industry groups and lobbyists are now urging officials and lawmakers to go further.

“The deferral of these payments will provide some of the liquidity needed to keep more Americans employed and more American companies operational during this crisis,” said Steve Lamar, the leader of the American Apparel & Footwear Association. “Still, there is more that can and should be done.”

Lamar is among those arguing to include in the deferral the so-called Section 301 tariffs on items imported from China, which impact many retail and apparel companies. The wine and spirits industries have expressed concerns about the tariffs on European imports imposed last fall, which have resulted in retaliatory duties on U.S.-made products, like bourbon, leading to a precipitous decrease in exports.

Brian Dodge, the president of the Retail Industry Leaders Association (RILA), is pushing for a 180-day deferral on all tariff payments.

“The limited duty referral is a start and it is appreciated. We hope the administration will be open to doing more,” RILA spokeswoman Melissa Murdock said in an email. She added that “a suspension or full repeal of the 301 tariffs remains the ultimate goal and would do the most to help retailers.”

Prior to the change, Treasury Secretary Steven Mnuchin twice phoned into CEO calls held by RILA, during which executives advocated to defer the duties on Chinese items, according to Jo-Ann Stores, Inc., CEO Wade Miquelon. Miquelon said total tariff payments were “far more” than the company’s operating profit, and have left retailers caught up in a trade war with China and hurt by tariffs that were sparked by intellectual property theft allegations.

“I mean, what does cotton have to do with anything? What does elastic have to do with anything?” he said.

“It’s not China or anybody else paying the tariffs. It’s U.S. companies that are paying,” said Americans for Free Trade coalition spokesman Jonathan Gold, who is vice president of supply chain and customs policy at the National Retail Federation.

Homegrown Opposition

U.S. steel companies and other domestic producers are pushing back against the effort to expand the deferral.

The Coalition for a Prosperous America, which represents a group of unions and domestic manufacturing and agricultural interests, wrote a letter to President Donald Trump on Wednesday urging the administration not to do it. The letter stated it would “simply increase imports and make it harder for our members to avoid laying off employees.”

The president was adamant he wouldn’t delay any tariffs before doing so this month. While limited, that initial reversal gives Collinson hope the administration will go even further if companies can illustrate how the initial deferral was helpful and explain why it should be more inclusive. She’s hoping to leverage congressional support on the issue to have it included in future relief legislation.

“We’ve written language that will accentuate the change,” Collinson said. “It’s three sentences, it’s very easy. It’s one of those things where if you have the right support it can become part of a piece of legislation pretty easily.”

To contact the reporter on this story: Megan R. Wilson in Washington at mwilson@bgov.com

To contact the editors responsible for this story: Kyle Trygstad at ktrygstad@bgov.com; Heather Rothman at hrothman@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.