Fewer Defense Companies in Military Spending Boom Raise Alarms

By Travis J. Tritten and Paul Murphy

- Prime vendors decreased 36% since fiscal 2011

- Joint Chiefs warn Pentagon supply chain is weak

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

The number of companies winning Pentagon prime contracts has plummeted over the past decade, underlying growing concerns over the health of the defense industrial base.

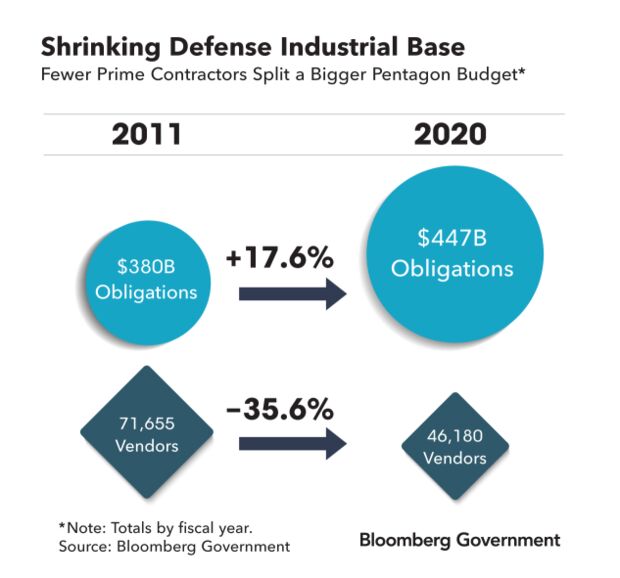

Prime vendors fell by 36% since fiscal 2011 even as defense spending climbed 18% over the same time, a new Bloomberg Government analysis shows. That means an ever-smaller pool of contractors won bigger pieces of a growing defense budget.

The figures illustrate a decline in the size of the military’s vast industrial base, which comprises more than 300,000 companies spread across every state. The shrinking number of prime contractors inking deals with the military, as well as a contraction in the vast network of subcontractors that supply them parts and services, has set off alarm bells among the highest echelons of the Pentagon and on Capitol Hill.

“The supply chain is weak and we have to take a hard look at that,” Gen. John Hyten, the Joint Chiefs vice chairman, said during a Feb. 23 appearance before the Center for Strategic and International Studies in Washington. “Without that kind of supply chain we cannot move nimbly, quickly, we cannot stay ahead of the threats that continue to morph, and we’re going to have a hard time building affordable capabilities to do that.”

A limited number of Pentagon suppliers can lead to “potentially higher prices paid due to a lack of competition,” the inspector general said in an October report on the department’s top fiscal 2021 management challenges.

The House Armed Services Committee announced Thursday a new task force to examine defense supply chain vulnerabilities. Reps. Elissa Slotkin (D-Mich.) and Mike Gallagher (R-Wis.) will co-chair the eight-member task force, which will spend three months looking at the industrial base.

Sharp Drop

The military had 71,655 prime vendors in fiscal 2011 but the number fell to 46,180 in fiscal 2020, with the sharpest drop in 2013 followed by a more gradual, steady decline.

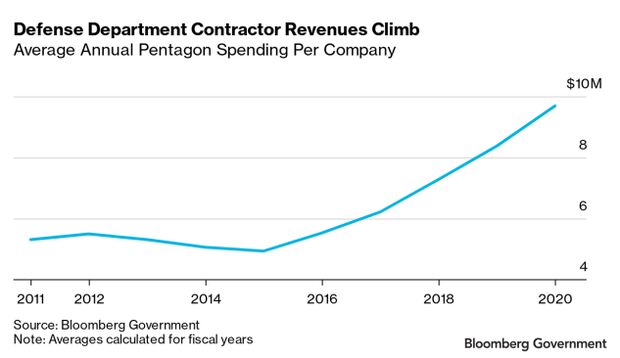

Average annual revenue per company grew by 83% over the same period. The biggest increases happened between fiscal 2017 and 2020 as the Trump administration pushed through historic highs in defense spending.

The industrial base has been shrinking since the end of the Cold War, following a wider trend of offshoring U.S. manufacturing.

The newest phase of consolidation comes as the Pentagon is locked in competition with China, an industrial powerhouse. The department is increasingly focused on attracting new companies to modernize weapons and communications systems, and adopt new technologies such as 5G networks and artificial intelligence.

“The diversity of thinking that you’d hope to get from a wider industrial base, it’s not going to be there,” said Bryan Clark, a senior fellow at the Hudson Institute think tank.

M&A Deals

A string of mergers and acquisitions in recent years has consolidated big companies that compete for the most valuable prime contracts.

The world’s largest defense contractor, Lockheed Martin Corp., announced in December a planned $4.4 billion purchase of Aerojet Rocketdyne Holdings, Inc., a California defense, aerospace, and real estate company with 5,000 employees. The sale is expected to close in the second half of this year, according to the defense giant.

The move could make Lockheed a key supplier of rocket engines as it competes with other defense companies like Raytheon for Pentagon missile and hypersonic weapons contracts.

Last year, Raytheon merged with United Technologies Corp., which owned military aircraft engine maker Pratt and Whitney. That combined the fifth and sixth biggest recipients of defense contract dollars in fiscal 2019—$26 billion total—into Raytheon Technologies, according to a Pentagon report on state-by-state military contracting.

Life has been good for the top defense firms as average annual revenue increased. They are “financially healthy, continue to expand in market share, and have seen a general increase in revenue” since 2014, the Pentagon found in an annual industrial base report released in January.

In 2019, Northrop Grumman Corp. became the sole bidder to replace the country’s nuclear Minuteman III intercontinental ballistic missiles after Boeing Co. declined to compete. Northrop won a $13.3 billion Air Force contract for the work in 2020.

Hard to Compete

Meanwhile, midsize and smaller companies, especially in valuable cutting-edge technology such as microelectronics, are finding it increasingly difficult to compete against larger competitors for prime contracts, despite the growth in defense spending, Clark said.

“The smaller companies that make some of these systems may really have been trying to work in the defensive sphere but the bureaucracy is very difficult to deal with,” Clark said. “They get bought by somebody, or they leave the business entirely because maybe defense was not that big of a component of their overall business.”

Deputy Defense Secretary Kathleen Hicks told a Senate panel last month that she is concerned about the shrinking defense industrial base. “Extreme consolidation does create challenges for innovation,” she said during her confirmation hearing.

Progressives Face Tough Road in Bid to Cut Biden Defense Budget

Ellen Lord, the Pentagon acquisition chief during the Trump administration, warned in her parting industrial base report in January that the industrial base can’t be restored without difficult decisions on bringing back domestic manufacturing from overseas.

She created programs such as the Trusted Capital Marketplace to match investors with companies that make microelectronics and drones. So far, the Biden administration hasn’t named a nominee to replace her and formulate the next strategy for the industrial base.

Pentagon spokesman John Kirby said March 2 he had no announcements on the under secretary of defense for acquisition or on other top department posts.

To contact the reporters on this story: Travis J. Tritten at ttritten@bgov.com; Paul Murphy in Washington at pmurphy@bgov.com

To contact the editors responsible for this story: Anna Yukhananov at ayukhananov@bloombergindustry.com; Robin Meszoly at rmeszoly@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.