DeVos-Backed School-Choice Groups Hurt by SALT Rules Crackdown

By Andrew Kreighbaum and Sam McQuillan

- Tax-law changes, Covid deal fundraisers `a real double whammy’

- Trump officials push private scholarship aid during pandemic

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

School choice groups at the center of the Trump administration’s signature K-12 education policy say recent federal tax rules are hurting their fundraising, leading some to freeze or cut down on scholarships offered this year.

The dip in donations comes as the coronavirus pandemic and resulting job losses already hurt scholarship programs, the groups said. The Internal Revenue Service rules were part of the agency’s crackdown on workarounds of the $10,000 limit on state and local tax deductions, a provision in the 2017 tax law.

“It’s been a real double whammy,” said Bruce Ely, a partner at Bradley Arant Boult Cummings LLP, who advises clients on tax regulatory policy.

The kinds of tax credit programs that operate in Alabama and 17 other states have been at the core of proposals from Education Secretary Betsy DeVos and GOP lawmakers to expand school choice by steering new assistance to families who send children to private schools. The programs allow groups to award scholarship funded by donors who in return can write off their state tax liabilities.

DeVos wants to enact a new federal version of the scholarship tax credit programs, but Democrats and educator groups have said the plan would undermine public schools while diverting federal funds to private education.

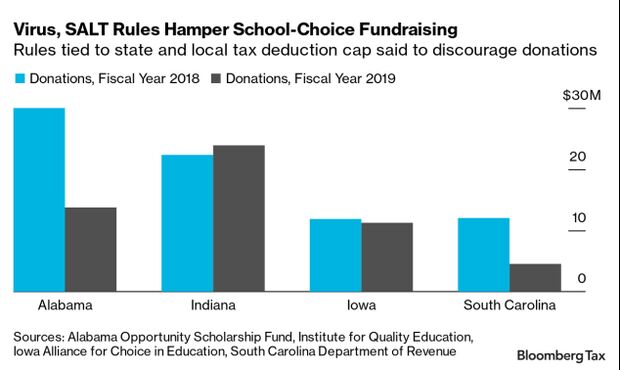

Scholarship groups say despite DeVos’s support, federal rule changes under President Donald Trump have hampered their fundraising. The Alabama Opportunity Scholarship Fund saw donations tumble by 53% from 2018 to 2019. This fall, the organization wasn’t able to offer scholarships to any new students and it cut the value of existing scholarships in half, said Andy Ryan, director of program initiatives at the fund.

In Indiana, scholarship organizations had hit the cap for tax credits each year until 2018, said Betsy Wiley, president and CEO of the Institute for Quality Education, the largest organization providing tax credit scholarships in Indiana.

SALT Impact

Exacerbating the fundraising crunch are SALT-related rules (T.D. 9907) the IRS issued in August that offer a safe harbor for businesses donating to a charitable fund in exchange for a state tax credit.

The rules followed a 2019 prohibition on (T.D. 9864) state workarounds that would allow residents to create charitable funds in which donors could get a state tax credit in exchange.

Scholarship funds warned that the IRS actions would lead to a decrease in donations. The agency’s August rules didn’t heed their requests for relief.

“You see contradiction between Treasury rules and efforts by DeVos and Congress to pass school-choice programs because Treasury was not motivated by school choice,” said Leslie Hiner, vice president of legal affairs at EdChoice Inc., which advocates for such policies.

Treasury didn’t return a request for comment. In the August rules, the department referenced the criticism, saying, “The Treasury Department and the IRS recognize the importance of the federal charitable contribution deduction, as well as State and local tax credit programs, in encouraging charitable giving. However, the concerns expressed by these commenters relate more directly to the 2019 final regulations.”

Digging Deeper

Dalphine Wilson, a parent in Montgomery, Ala. has sent both of her children to private Catholic schools for the past five years thanks to tax credit-funded scholarships.

This fall though, smaller scholarship awards meant she had to cut expenses and dig deeper into her own pockets to cover tuition as her out of pocket costs jumped to $414 from $286 each month. Wilson, a part-time social services coordinator at a low-income housing community, said she’s gone as far as putting her house into forbearance to cover the additional costs of private school.

“I feel that it’s worth it,” she said. “It may mean a little less of this, a little less of that—one or two more trips to the thrift store versus retail.”

While national educator groups have called for tens of billions in federal aid for public schools, DeVos says the pandemic should give Congress more reason to support parents who use tax credit scholarships. She has championed a proposal to launch a $5 billion annual program to offer federal school-choice tax credits administered by state scholarship organizations.

Legislation (S. 4284), proposed by Sens. Lamar Alexander (R-Tenn.), chairman of the Health, Education, Labor & Pensions Committee, and Tim Scott (R-S.C.), would steer emergency aid to scholarship granting organizations while enacting the DeVos proposal.

A GOP pandemic relief proposal released this week includes $5 billion annually over the next two years to fund dollar-for-dollar tax credits for donors to the organizations. The measure’s inclusion was sought by Sen. Ted Cruz (R-Tex.), who introduced legislation in 2019 (S. 634) to enact the DeVos-backed tax credits.

‘Stacking Up’ Tax Cuts

Critics of state tax credits say the IRS workaround rules were a common-sense effort to address donors double-dipping on tax credits — essentially collecting state and federal tax benefits on the same contributions.

“They were stacking up state and federal tax cuts larger than what they ever donated,” said Carl Davis, research director, at the Institute on Taxation and Economic Policy. “It really was a tax shelter.”

The 2019 rule change weeded out opportunists using the programs as tax shelters, he said. Committed donors can still get as much as 100% of their contributions back through state tax deductions, but those deductions put tax credit scholarships in “direct competition” with funding for public schools, Davis said.

“With states in the tough revenue spot that they’re in, you’d have to think the first priority would be public education system,” he said.

Fundraising Successes

Not all scholarship organizations have struggled to raise money after the IRS rule changes. The Georgia Goal Scholarship Program has hit the state cap for tax credits for the past two years. That’s in part because the group focused on promoting its successes to donors, said executive director Lisa Kelly. Scholarship-granting organizations in Florida, where tax credits are capped at $700 million, have continued to pull in money from corporate donors.

The Trump administration has emphasized to scholarship groups that C corporations and pass-through entities can make tax-deductible contributions to scholarship-granting organizations under the August SALT rules, Ely said.

School-choice advocates may also look to expand other funding options beyond tax credits in forthcoming state legislative sessions. The Supreme Court’s ruling in Espinoza v. Montana took away an obstacle to enacting state-funded vouchers that could benefit private religious schools, said John Schilling, president of the American Federation of Children.

Tax credit programs were originally set up as a workaround for restrictions in state constitutions to funding religious schools, he said.

“This paves the way for different kinds of choice programs in a lot of states,” Schilling said.

To contact the reporters on this story: Andrew Kreighbaum in Washington at akreighbaum@bgov.com; Sam McQuillan in Washington at smcquillan@bloomberglaw.com

To contact the editors responsible for this story: Paul Hendrie at phendrie@bgov.com; Colleen Murphy at cmurphy@bloombergtax.com; Robin Meszoly at rmeszoly@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.