Colleges Brace for Student Aid Appeals as Virus Slashes Incomes

By Andrew Kreighbaum

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

College financial aid offices are bracing for a spike in appeals from students finding that the aid packages they were offered for next year are no longer enough after the coronavirus pandemic cost their parents jobs or income.

Appealing financial awards has always been an option, yet the volume this time could be unlike anything colleges have seen, said MorraLee Keller, director of technical assistance at the National College Attainment Network. Some financial assistance advocates are concerned about aid officers’ ability to handle high appeal volumes and get reworked packages to students in time for them to decide whether to enroll or return to campus.

“Financial aid delayed is the same as no financial aid,” said Justin Draeger, president and CEO of the National Association of Student Financial Aid Administrators.

Many colleges have already pushed back to June 1 the traditional May 1 deadline for admitted students’ decisions, and some may extend it further. Some colleges and a foundation are hurrying out tools to let students file appeals online, and the Education Department, in guidance in early April, encouraged administrators to use their authority to adjust students’ federal aid applications case by case.

The Obama administration encouraged colleges to use that option for students affected by the 2008 financial crisis, Draeger said.

The Education Department didn’t respond to a request for comment on anticipated appeals.

“Every year colleges deal with families who have experienced a loss of income due to businesses closing or layoffs,” Keller said. “The process, they’re used to. The volume is to be determined.”

Many colleges are staring down market losses that hurt their endowments, which help fund financial aid. College groups are asking Congress for postpone a Trump administration tax on their endowments and enact other relief in response to the pandemic.

Colleges Seek Suspension of Endowment Tax in Virus Aid Bill

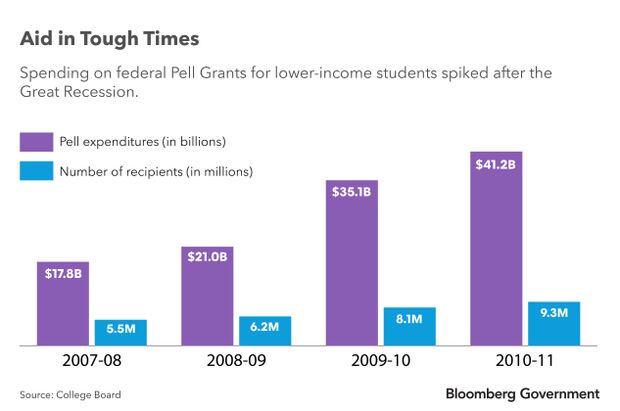

Great Recession Echo?

Awarding federal student aid looks backward, relying on tax records families submit. Students filing the Free Application for Federal Student Aid, or FAFSA, get a calculation of how much their family is expected to pay for college based on income from two years before the academic year.

Students submit the FAFSA as soon as the fall of their senior year in high school and receive aid offers the following spring, in time to meet the May 1 commitment deadline. But job losses or other financial difficulties in the meantime could undercut the assumptions used to calculate the aid offer. By mid-April, jobless claims for the four weeks since coronavirus forced much of the economy to shut down had surpassed 22 million.

Inaccurate financial aid is a huge concern for high school juniors and seniors the organization works with across the country, Nicole Hurd, CEO of the College Advising Corps, said.

“We’ve heard countless stories of mom and dad having both lost jobs,” she said. “Or mom and dad were Uber drivers and now they don’t want to drive anymore because they don’t feel safe. There are a lot of employment security issues.”

For some students, a change in income of even a few thousand dollars could qualify them for the Pell Grant, the federal government’s primary form of need-based financial aid. For the academic year starting next fall, students could get a maximum of $6,345 from the grant.

Returning students as well as high school seniors face a crunch.

Katelyn Perryman, a sophomore at Howard University in Washington, supplemented student grants and loans with money from nanny and tutoring jobs.

“That income has been disrupted because I’m physically not able to go and be there anymore,” she said.

Perryman is considering a financial aid appeal among other options if she lacks funds next fall to pay for food, textbooks, or gasoline to get to campus.

‘Personal’ Discussions

The appeals volume could depend on the campus, Draeger said. Colleges with many middle-income students could potentially see the biggest changes to aid eligibility.

“We’re going to see an uptick in these requests,” said Jennifer Harpham, director of the office of student financial aid at the University of Akron, a four-year public institution in Ohio.

Akron is using an online form for students to submit an estimate of the family’s 2020 income to appeal for financial aid without having call or visit campus. All 20 staff in the financial aid office will likely pitch in to review those applications, Harpham said.

The university is using emails to students and social media tools like Facebook Live to let them know about the option. Although the process is straightforward, financial aid officials worry some students may skip enrolling for next fall if they don’t know they can ask for more aid.

“That’s why we’re doing so much outreach and trying to get the word out to help students navigate those difficulties,” Harpham said.

At Pima Community College in Tucson, Ariz., campus aid officials typically meet with students in person to address disruptions that could merit a financial aid appeal — an option out of the question because of the pandemic.

Students seeking aid appeals often deal with financial emergencies involving a loss of housing or employment or an illness that can be difficult to address over the phone or online, said Aurie Clifford, assistant director of Title IV compliance at the college.

“Those conversations tend to be personal ones,” Clifford said. “There’s a trust level that I feel isn’t super well-suited to virtual meetings.”

Pima is allowing students to take an incomplete grade on courses they would finish when the campus reopens, a process that has absorbed much of campus officials’ time in recent weeks. But the college expects financial aid appeals to increase, driven by job losses or health problems from the pandemic.

Pandemic Pressure

A new online tool, SwiftStudent, offers financial aid offices’ advice for students appealing for financial aid, said Abigail Seldin, CEO of the Seldin/Haring-Smith Foundation, which created the tool.

“Our goal is to give students the information they need to advocate for themselves,” she said.

College financial aid offices will shoulder most of the burden of handling appeals. But the wide economic impact of coronavirus suggests college students overall will need more support, said Clare McCann, a former Department of Education official and deputy director of higher education policy at New America.

“The actual solution here is more funding for higher education and more money for low-income students,” she said. “Because we know we’re going to have more low-income students.”

To contact the reporter on this story: Andrew Kreighbaum in Washington at akreighbaum@bgov.com

To contact the editors responsible for this story: Paul Hendrie at phendrie@bgov.com; Bernie Kohn at bkohn@bloomberglaw.com; Robin Meszoly at rmeszoly@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.