This Is IT: After a Slow Year, IT M&A Deals Accelerate in FY21

By Laura Criste

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Contractors may have pinched their pennies in 2020, but this year, they are spending at rates that more than make up for their conservative finances of last year. We’re talking mergers and acquisitions of information technology companies in this week’s This Is IT.

The analysis includes M&A deals among the top 200 contractors by prime contract obligations in fiscal 2020 and identifies IT deals based on whether the company being purchased is primarily an IT or telecommunications company.

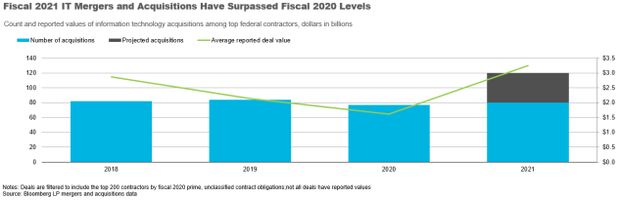

In fiscal 2020, contractors announced 77 deals, down slightly from previous years. Since October, fiscal 2021 deals total 78. Average deal size is up, too. Reported deal value isn’t shared often, typically only if required because the company is publicly traded, making total deal value not comparable from year to year. Average deal value is a better indication on market activity. In fiscal 2018 and 2019, average deal values were $2.9 billion and $2.1 billion, respectively. That dropped significantly in fiscal 2020 to $1.6 billion, but in fiscal 2021, the average deal size has been $3.4 billion.

The pandemic likely impacted deals and purchase prices, as companies reacted to financial uncertainty. As a result, data shows contractors didn’t make planned purchases, especially large ones. Fiscal 2018 and 2019 had 10 and seven reported purchases valued at more than $1 billion each, respectively, but there were just five in fiscal 2020.

Some companies may have postponed executing a purchase in fiscal 2020. As contractors start to feel financially stable, with the pandemic’s end in sight, they are back to buying firms at a much quicker rate and with higher price tags than recent years. Companies have already reported values for eight IT acquisitions with price tags of $1 billion or more.

Top Fiscal 2021 Deals in the Federal Market

Just past the halfway point in fiscal 2021, there have been a few important deals in the federal IT market. Most are large IT contractors aiming to improve cybersecurity, cloud computing, artificial intelligence, digital services, and health IT offerings. A couple appear to be strategic purchases to strengthen the chances of winning a spot on an important contract.

Most recently, Booz Allen Hamilton Holding Corp. announced May 4 an agreement to acquire Liberty IT Solutions LLC for $725 million, a deal that would provide access to relationships at the Department of Veterans Affairs (VA). VA has obligated $729 million to Liberty through its service-disabled veteran-owned small business IT contract Transformation Twenty-One Total Technology Next Generation (T4NG). Much of the work has been for health and clinical software development, and $158 million is Covid-19-related.

Microsoft Corp. announced plans in April to acquire Nuance Communications Inc., valued at $17.2 billion, in an effort to expand its cloud and artificial intelligence offerings, specifically in the health-care sector. Nuance has been obligated $262 million since fiscal 2017, almost entirely through VA’s Health Information Coding, Building, and Auditing Software contract, which ends in June.

Maximus Inc. bought Attain LLC’s federal business in March for $430 million for its artificial intelligence and machine learning services. Attain has received $639 million in obligations since fiscal 2017, $388 million of which came through Chief Information Officer – Solutions and Partners 3 Small Business (CIO-SP3 SB). CIO-SP3 SB and CIO-SP3 will be recompeted this year as a combined contract, CIO-SP4. Although Maximus holds a spot on CIO-SP3, Attain has more government customers on the contract vehicle, including a large footprint at the Securities and Exchange Commission.

ManTech International Corp. acquired Tapestry Technologies Inc. in December for an undisclosed amount for the company’s defensive cybersecurity capabilities. Tapestry has received $122 million in contract obligations since fiscal 2017, all with the Defense Information Systems Agency (DISA) and through Schedule IT-70. Tapestry holds one of four incumbent contracts for DISA’s $269 million Virtual Desktop Infrastructure and Cloud Storage contract, perhaps a factor in ManTech’s decision to purchase the company.

The big one: In December and January, Veritas Capital Fund Management LLC announced plans to buy Northrop Grumman Corp.’s IT services business for $3.4 billion and Perspecta Inc. for $7.1 billion with plans to merge them under Peraton Inc. and set up the company to be the leading IT contractor for the federal government.

The number of deals is expected to reach 115 this fiscal year, which would more than make up for the number of delayed or abandoned deals from last year. That would be another 38 deals between now and the end of September, or one every three to four days.

Note: This Is IT is a weekly column by Bloomberg Government focused on information technology matters affecting government contractors.

To contact the analyst on this story: Laura Criste in Salt Lake City, Utah at lcriste@bgov.com

To contact the editor responsible for this story: Michael Clark at mclark@ic.bloombergindustry.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.