Student Loan Program Beset by Complexities Producing Debt Relief

By Andrew Kreighbaum

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Erin Gordon, a community college instructor in Arkansas, didn’t see how she would repay $88,000 in student loans she took out for college and graduate school. That debt prevented her from making major purchases like a car or home, Gordon said.

So when she learned about the Public Service Loan Forgiveness program shortly after leaving school, Gordon began meticulously checking requirements to make sure she would qualify.

“I was never really confident of anything with that program,” she said. “I was always kind of questioning whether or not I would get it.”

Late last year, the balance of Gordon’s federal student loans were forgiven. But many borrowers share her anxiety about the program.

Only 1% of applicants have been approved so far. And as Democrats in Congress have observed, the Trump administration has made multiple proposals to kill off the program—including in the White House budget released this week.

While those circumstances have fueled mistrust in the administration’s handling of the program, some student loan experts say Public Service Loan Forgiveness is working as designed. And statistics produced by the Education Department indicate the high number of denials may be driven by borrower confusion, not politics or bureaucratic hurdles.

That’s because most applicants haven’t been making payments on their loans long enough to qualify for relief, according to department officials. Findings shared with lawmakers and financial aid officials showed 8 of 10 denied borrowers haven’t been in repayment for the minimum 10 years.

‘Program Is Working’

The program, authorized in 2007, was designed to encourage student borrowers to enter public sector and nonprofit careers by offering full debt relief to those who spent at least a decade working for a qualifying employer. That timeline means the first borrowers became eligible only recently. Another catch: applicants must hold federal direct loans, and the Education Department began issuing direct loans exclusively only in 2010.

Gordon said when she learned about the requirements of the program, she immediately started the process of consolidating her Federal Family Education Loan debt into direct loans. Many borrowers became aware of that requirement only when they sought debt forgiveness.

After seeing persistently low approval rates for Public Service Loan Forgiveness and a supplementary debt forgiveness program approved by Congress, department officials studied the more than 100,000 borrowers who have submitted applications so far, which revealed most denied applicants hadn’t begun paying off their loans a decade earlier.

As of September 2019, about 76,400 of 91,900 ineligible applicants did not have direct loans that had been in repayment for 10 years, according to the Education Department’s data.

Other factors tripped up applicants. About 15% didn’t have the right kind of loan, according to the department’s data, and another 12% weren’t enrolled in a qualifying repayment plan. And the high rate of denials has made many borrowers skeptical they would ever receive debt relief.

“There’s a lot of mistrust in the program,” said Betsy Mayotte, president of the Institute of Loan Advisors. “I have borrowers who have told me they’re strongly considering leaving their jobs and are going into the private sector because of it.”

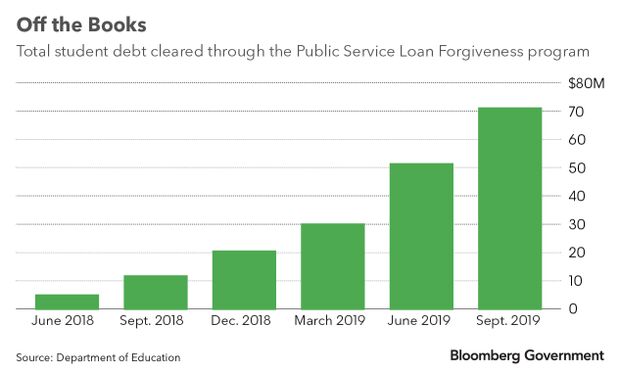

Still, Mayotte said borrowers are seeing loan forgiveness. More than $72 million in student loan debt had been canceled through Public Service Loan Forgiveness by September, according to the latest federal data. By contrast, about $534 million has been forgiven through the so-called borrower defense program created to provide relief to defrauded students. The number for public service loan forgiveness likely will climb as more borrowers cross the 10-year repayment threshold, officials say.

“The program is working,” Mayotte said. “This is going to have a huge financial impact on consumers, so they have a responsibility to make sure they’re following the rules.”

Tweaking Application

Public Service Loan Forgiveness has become a political football under the Trump administration, which has repeatedly proposed scrapping the program. Democrats in Congress have accused Education Secretary Betsy DeVos of mishandling it and failing to hold loan servicers accountable for errors on borrower accounts.

Education Budget Offers More Flexibility, Less Aid for States

The Government Accountability Office reported in 2018 that the high number of denied applicants suggested many borrowers were confused about the program and called for the Education Department provide new guidelines to loan servicers and make sure borrowers receive detailed explanations for why they haven’t qualified. Those recommendations haven’t been carried out so far but the department aims to complete an overhaul of the application this summer.

Some fixes to the application process have already been rolled out. The office of Federal Student Aid last year launched a PSLF Help Tool to help borrowers check whether they meet the program’s standards. And in January, the Education Department introduced a single application for Public Service Loan Forgiveness and a $700 million supplementary program authorized by Congress two years ago.

The department aims to make the application fully digital; currently, borrowers receive a PDF form after submitting their information online. It will also notify borrowers using the online tool whether their employer is eligible. Another department change will count borrowers’ payments toward their required monthly total even if they previously made an advance payment on their loan.

“All of these efforts aim to get borrowers personalized answers efficiently, so we can eliminate confusion and replace it with clarity,” said Angela Morabito said, an Education Department spokeswoman.

House Education and Labor Committee Chairman Bobby Scott (D-Va.) said the department’s lack of urgency helping borrowers has left applicants “confused, panicked, and rightfully frustrated.”

“I am relieved that—in response to intense public pressure—the Department is finally taking a step toward fixing the PSLF application process,” he said in a statement. “However, this change alone does not satisfy the Department’s responsibility to faithfully implement the law. Secretary DeVos and the Trump administration must clearly communicate these changes to student borrowers, and then quickly process claims so that borrowers can get relief.”

Complex Requirements

While they’ve pressured DeVos to address hurdles for borrowers, Democrats in Congress have introduced their own proposals to simplify the loan forgiveness program.

Congressional Democrats have introduced a bill (S. 1203) to overhaul Public Service Loan Forgiveness by making all federal loans eligible for the benefit and move up loan forgiveness by wiping out half of a student’s debt in five years. While that proposal isn’t likely to advance, lawmakers in 2018 approved a temporary expansion of Public Service Loan Forgiveness benefits for borrowers whose applications were mishandled by loan servicers. But the approval rate for both programs has remained low, drawing additional ire from lawmakers.

Jason Delisle, a resident fellow at the American Enterprise Institute, said both borrowers and the department are operating within requirements that make simplifying the process difficult. “What everyone is up against here is a really convoluted system that Congress created,” he said.

The high rejection rate has been disheartening for many borrowers, but the department’s data shows there are a number of factors behind servicing errors, said Rachel Fishman, deputy director for research at New America’s Education Policy program. The department should release more projections to show when borrowers are likely to qualify, she said.

“What’s it going to look like two years from now?” Fishman said of the denial rate. “It shouldn’t stay at 99% forever.”

Gordon’s experience shows how applying for Public Service Loan Forgiveness can be fraught even for borrowers who meet all the criteria. Her application was approved only in December after weeks of back and forth with her loan servicer. After applying in August, she waited nearly a month before receiving a denial from her loan servicer.

The denial cited, among other reasons, missing information about her current employment, even though her college indicated she was still employed. Eventually, Gordon contacted her congressman, who inquired about the application with the Education Department. Six weeks later, her loans were cleared.

“I had so much riding on this,” she said. “It’s not a great way to manage a program. You shouldn’t have to call your congressman.”

To contact the reporter on this story: Andrew Kreighbaum at akreighbaum@bgov.com

To contact the editor responsible for this story: Cheryl Saenz at csaenz@bloombergtax.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.