Prepare for Policy Change

The strategic government affairs platform you need to achieve policy objectives in a new political era

Trending topics

Designed to sharpen any team

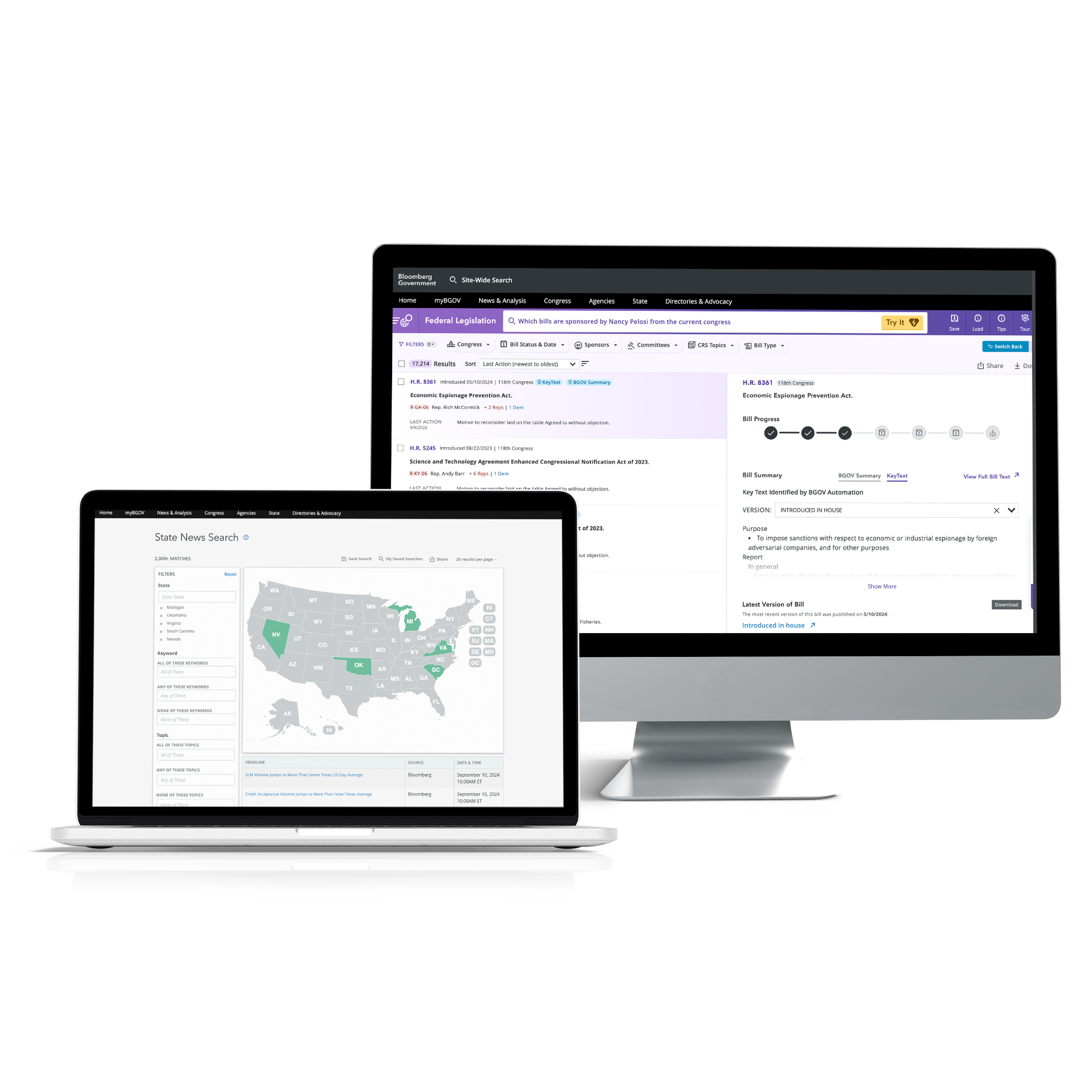

Bloomberg Government is the all-in-one public affairs platform for your organization’s needs, whether you’re part of a lobbying firm, corporation, government, association, or nonprofit.

Insights

Request a demo

Bloomberg Government gives professionals like you everything you need to understand, respond to, and shape policy and spending priorities with confidence.

Complete the form and a representative will contact you to schedule a demo. The demo will provide an overview of our latest features and an inside look into our product.

All fields with an asterisk (*) are required.

Already a customer? Get in touch with the support team.