Key provisions from the Tax Cuts and Jobs Act (TCJA) of 2017 are set to expire Dec. 31, 2025. With a Republican-led White House and Congress, policymakers are projected to preserve a majority of the TCJA provisions, but they will need to find a source of funding for the extensions.

The debate over tax policy, the federal budget, and the federal deficit is ongoing. Government affairs professionals with interests on either side of the debate need to track tax policy developments as they happen.

Staying ahead of policy developments is one of the most critical tasks when planning a successful lobbying and public affairs strategy, especially when it comes to a policy area poised for change, like tax.

[Download our report, Tracking and Influencing Tax Policy in 2025, for tips and best practices to better monitor, respond to, and influence critical tax policy changes with confidence and precision.]

What is the Tax Cuts and Jobs Act?

The TCJA, passed by a majority-Republican Congress in 2017, was the largest tax code overhaul in nearly three decades. The law cut the corporate tax rate to 21%, capped deductions for state and local taxes (SALT) at $10,000, doubled standard deductions, and expanded the child tax credit.

The goal of the one and a half trillion-dollar tax reform bill was to spur economic growth, reduce regulations, and create a more business-friendly environment in the U.S.

The TCJA was passed as reconciliation legislation, meaning the bill overrode typical filibuster rules and was passed by a Republican-led Senate with a simple majority of 51 votes. However, many provisions were made temporary to keep costs down and comply with the Byrd Rule, which prohibits reconciliation bills from raising the federal deficit beyond a 10-year budget window or making changes to Social Security.

Does the 21% corporate tax rate expire?

The TCJA cut the corporate tax rate to 21%, from 35%, which does not expire. Even though the corporate rate was made permanent, lawmakers are reopening the tax code to address all of the TCJA’s expiring provisions, so everything is on the table.

While on the campaign trail, Trump has stated that he intends to reduce the corporate rate to 15% for companies that make their products in America. Republicans may have to swallow raising the rate back up a bit during the 2025 negotiations, as Congress will need to find ways to offset a loss of revenue from extending other pieces of the TCJA, especially those benefits for individual taxpayers.

Which TCJA corporate tax provisions are set to expire?

The potential expiration of the TCJA’s corporate tax provisions poses significant implications for U.S. businesses, including changes to the corporate tax rate, capital expensing, the pass-through income deduction, and international taxation. The following sections describe which provisions are set to expire in more depth.

Pass-through income deduction

Pass-through businesses – sole proprietorships, partnerships, and S-corporations – will no longer be able to deduct up to 20% of qualified business income (QBI) when calculating annual taxes.

Republicans are more staunch supporters of the 199A deduction and claim that it levels the playing field for small and mid-sized business by reducing their tax burden in a similar way to how the TCJA’s corporate tax rate cut did for C-corporations.

Industries that primarily benefit from the deduction, such as real estate and manufacturing, have revved up lobbying efforts on Capitol Hill to extend the tax break. Many groups are targeting moderate Democrats to create bipartisan support for the deduction’s extension.

Business expense deductions

Bonus depreciation

The 100% bonus depreciation provision – allowing the deduction of certain capital investments – will be phased out by 2027. The 2025 bonus depreciation rate will be reduced to 40%.

Research and development (R&D)

The TCJA’s amortization requirement will remain in effect beyond 2025 unless Congress acts to repeal or modify it. The Wyden-Smith bill aims to restore immediate expensing for R&D costs and expand the R&D tax credit.

Business interest deduction

The business interest deduction will revert to pre-TCJA rules, which generally allowed business interest expenses to be deducted in the year the interest was paid or accrued, with some limitations.

International tax provisions

International tax policy has significantly changed since TCJA’s passage. Brokered by the Organisation of Economic Co-operation and Development (OECD), a global agreement called Pillar 2, went into effect in 2024 in many countries and will continue to impact businesses worldwide.

Pillar 2 aims to curb base erosion and profit shifting (BEPS) by applying a 15% minimum tax rate for multinational enterprises (MNEs) with a global annual revenue of 750 million euros. The TCJA also attempts to address tax avoidance through measures such as the global intangible low-taxed income (GILTI) tax, the foreign-derived intangible income (FDII) tax, and the base erosion and anti-abuse tax (BEAT). However, the TCJA’s provisions and Pillar 2 clash on several key details.

There is a safe harbor provision that shields U.S. companies from some of the harshest effects of Pillar 2. But given that the safe harbor provisions expires at the end of 2026, Congress will need to decide how to rectify the TCJA and Pillar 2 clash.

[Are you a tax professional? See how Bloomberg Tax provides the tools and intelligence to guide your tax department through changes with ease.]

Which TCJA individual tax provisions are set to expire?

If Congress doesn’t renew or amend TCJA tax provisions, then individual filers will see a rise in their income tax rates, a lower standard deduction, changes to itemized deductions, and a rollback of the child tax credit. These changes could reshape the financial outlook for many Americans. See more details below.

Individual tax rates

When the TCJA expires at the end of 2025, marginal tax rates for individuals will revert to pre-TCJA levels, including a maximum rate of 39.6% from 37%. Generally, Democrats are hoping to raise the top rate back up, whereas Republicans support lowering marginal rates.

Standard deductions

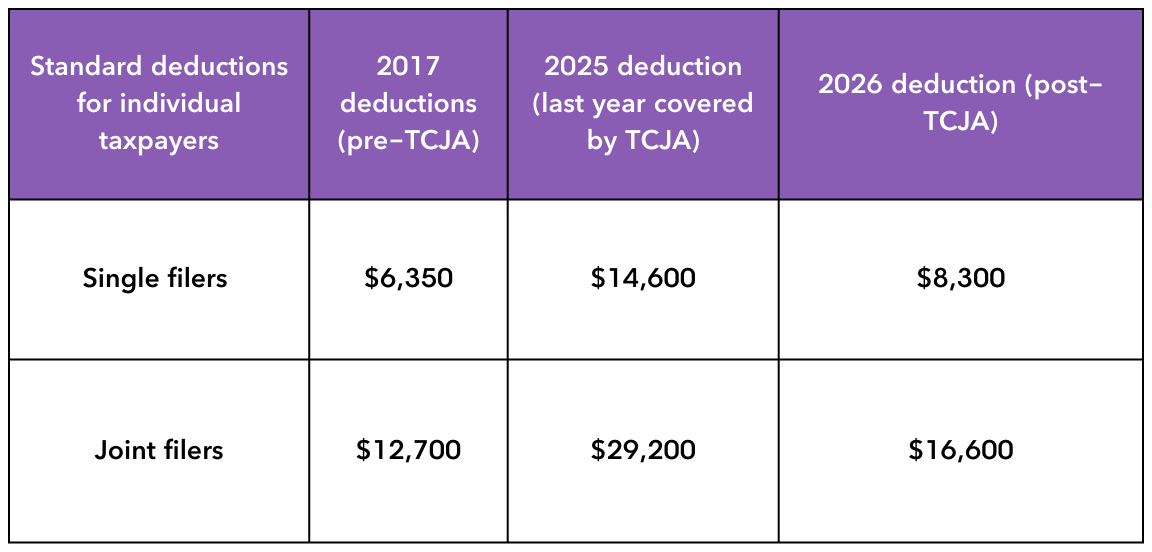

The TCJA nearly doubled the standard deduction for both single and joint filers when it went into effect in 2018. Once the TCJA expires in 2025, the standard deduction will return to pre-TCJA levels, with an adjustment for inflation.

Standard deductions before and after TCJA

Mortgage interest and charitable donation deductions

Once the TCJA expires, single and joint filers will be able to claim a mortgage interest deduction (MID) on properties up to $1 million in value. Between 2018 and 2025, the TCJA limited the MID to $750,000 in property value. Charitable contributions will revert to 50% from 60% of adjusted gross income (AGI).

In general, itemized deductions will be more relevant with lower standard deductions. If the standard deduction goes back to a lower level, those making at least $400,000 would see diminishing value of the MID and charity deductions.

SALT deductions

The $10,000 SALT deduction cap will no longer apply. Since 2018, lawmakers from high-tax states, such as California, New Jersey, and New York, have tried and failed to get rid of or raise the cap, reporting that their constituents were disproportionately affected.

Prior to the TCJA, there was no cap on SALT deductions. However, there were levers in place – such as the alternative minimum tax (AMT) – to ensure wealthy taxpayers couldn’t use deductions and loopholes to reduce their federal tax liability to zero.

Estate and gift taxes

Exemptions from estate and gift taxes will revert to pre-TCJA levels of around $5 million, adjusted for inflation. The 2024 exemption is $13.6 million.

Republicans see the estate tax as a “death tax” that punishes wealth accumulation, as in the case of farmers who want to pass on their land through inheritance, but their estate ends up needing to sell assets to cover the estate taxes.

Democrats, on the other hand, view the estate and gift taxes as a means to address inequities, where high income earners cannot pass on substantial fortunes or trusts without paying their fair share in taxes.

Child tax credit

The maximum child tax credit (CTC) will return to $1,000 per child, from the TCJA level of $2,000. Income thresholds will decrease to $75,000 for individuals and $110,000 for married couples.

During the pandemic, the CTC was raised even further to $3,600. Census data showed that it cut childhood poverty in half, as a lot more families were eligible for the program.

Although Democrats did not vote for the TCJA, party members back the expansion of the CTC. The bipartisan Wyden-Smith bill – which aims to raise the cap on CTC back to $2,000 – has languished in the Senate, though, due to opposition from Senate Republicans.

On-demand webinar: Preparing for tax changes post-2025

Chris Cioffi and Danielle Parnass of Bloomberg Government and Kim Dixon of Bloomberg Tax discuss individual and corporate tax provisions that are on the table following TCJA’s expiration and how key decision-makers aim to extend or amend those areas of tax law. See the full replay on tax policy.

[Are you a tax professional? See how Bloomberg Tax provides the tools and intelligence to guide your tax department through changes with ease.]

Will the TCJA be extended?

Partisan control of Congress will have a big impact on whether TCJA provisions will be renewed, reformed, or allowed to expire. Republicans are looking to extend the TCJA and further expand some tax cuts, while Democrats are focused on reforming tax breaks for lower- and middle-income households and raising taxes on wealthier individuals and corporations.

There are several possible scenarios for tax policy proposals in 2025:

Long-term extension

If they control Congress following the 2024 election, Republican lawmakers are aiming to once again use the reconciliation process to extend the TCJA. Because reconciliation bills bypass the filibuster in the Senate and therefore don’t require 60 votes, it would be easier for GOP legislators to pass an extension of the TCJA – so long as there are no intra-party divisions that would affect the simple majority requirement.

If Congress is divided, lawmakers could pass a bipartisan agreement that addresses expiring provisions in a long-term or permanent way. This happened in 2012 when a series of tax cuts enacted by George W. Bush were extended.

Short-term extension

Absent a full agreement, lawmakers could decide to extend the TCJA tax breaks by one or two years to give themselves more time for negotiations. This happened in 2010 when the government was divided after Democrats got “shellacked” in the midterms.

Expiration

If Congress fails to act, the TCJA’s provisions will expire and revert to pre-2017 levels. Although it is unlikely that all the provisions would expire, if this did happen, both corporate and individual taxpayers would experience a lot of uncertainty.