ARTICLE

Five Trends in Government Contracting for FY 2023

February 17, 2023

IN THIS ARTICLE

1. Cutting-edge technology needed as threats increase

2. Federal climate and sustainability spending provides opportunities

3. Best-in-class contracts speed up procurement and establish consistent pricing

4. Agencies need more funding and collaboration to overhaul outdated IT

5. Government contractors need to prioritize compliance

Grow your business strategy with market intelligence from Bloomberg Government.

[For the complete picture on government contracting trends, plus details on top markets of growth and BGOV’s top 20 opportunities, download our FY 2023 Government Contracting Playbook.]

From FY 2021 to FY 2022, government contract spending rose by about $50 billion, with a few key areas of growth driving the increase. FY 2022 surpassed $700 billion, with boosts from the R&D market, IT, federal infrastructure spending, and support for the war in Ukraine. Bloomberg Government analysts predict these five federal contracting trends for 2023:

1. Cutting-edge technology needed as threats increase

Vendors will need to help the U.S. defense and national security sectors achieve improved hacking-resistant encryption. Quantum technology could decrypt files in a matter of minutes, leaving essential information vulnerable to hackers. A new law requires federal agencies to strengthen protection of IT that would be vulnerable to attacks powered by faster computers than currently used. Companies working on efforts to improve quantum cybersecurity in the U.S. worry about restrictions on overseas collaborations—the restrictions are meant to keep U.S. tech from helping the Chinese government crack the quantum code, but may hamper encryption and decryption advances here.”

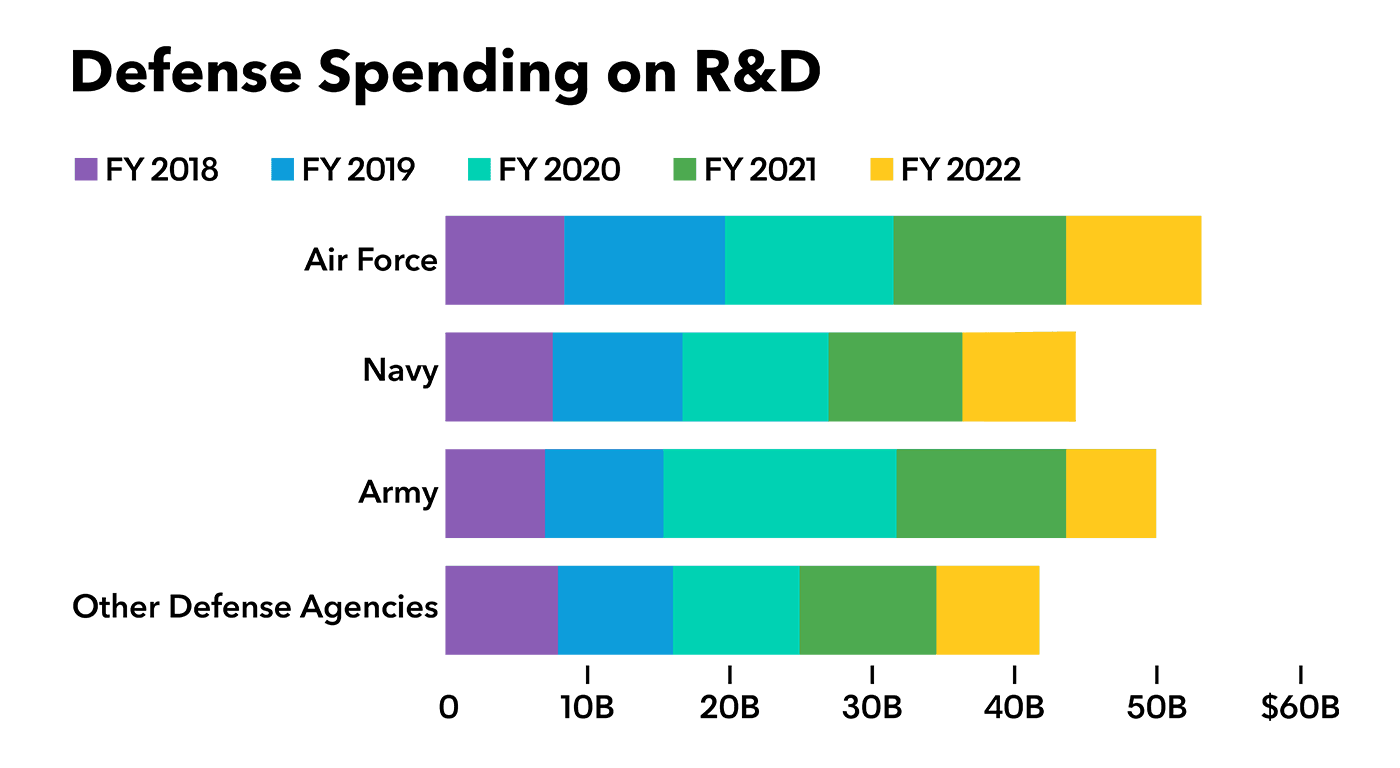

The Pentagon spends tens of billions annually to keep up with near-peer rivals on the world stage, so companies with new technology should expect ongoing interest. From FY 2017 to FY 2022, the DOD outspent all civilian agencies on R&D contracts, having obligated $202 billion on unclassified contracts. R&D spending was unusually high starting in FY 2020 because of the federal response to Covid-19, especially within Army programs. The Army’s $7.6 billion in Covid-19 procurement spending was almost entirely due to a contract with Analytic Services Inc. that has since surpassed $8 billion.

Entities in the Asia Pacific and Near East regions collectively accounted for 61% of threats reported from companies that work on sensitive technology, a designation that requires various levels of security clearance. DOD spending on contracts in Australia is rising as continued concerns about China spark heavy U.S. military investments in the Pacific arena overall. The chart below details the five vendors with the most revenue in contracts performed in Australia in FY 2022.

The trilateral defense alliance of Australia, the U.S., and the U.K. includes among its focus areas development of artificial intelligence and autonomous systems. Contractors in the business of large weapons systems are also finding ways to get involved and have announced expansions and new business with DOD in Australia and with the Australian government.

[With ample contracting opportunities this year, the FY23 Government Contracting Playbook has the market intelligence you need to start strategizing your bids.]

2. Federal climate and sustainability spending provides opportunities

Congress and federal agencies are positioning themselves to tap into cutting-edge technology for climate preparedness and sustainability efforts. Over the last few years, the government’s satellite data has monitored and responded to wildfires, droughts, and floods. Using sophisticated sensors, these satellites also have detected greenhouse gas emissions, which have been applied commercially to forecast weather impacts on crops.

The General Services Administration (GSA) – the nation’s largest property owner – is working on transitioning 253,000 buildings to 100% renewable electricity by 2025, in addition to requiring low-carbon construction materials in new structures. Like the GSA, the Army is also committed to sustainability measures, including a strategic FY 2023 to 2027 plan to implement electric chargers on battlefields, build out microgrids on bases, and complete three on-site carbon-free power generation projects.

3. Best-in-class contracts speed up procurement and establish consistent pricing

Best-in-class (BIC) contracts chip away at agencies’ procurement silos and establish consistent pricing strategies, making them attractive for agencies and vendors. Awardees of next-generation multiple-award contracts, like Alliant 3 and CIO-SP4, will enter a federal procurement arena focused on governmentwide vehicles categorized as “best in class.”

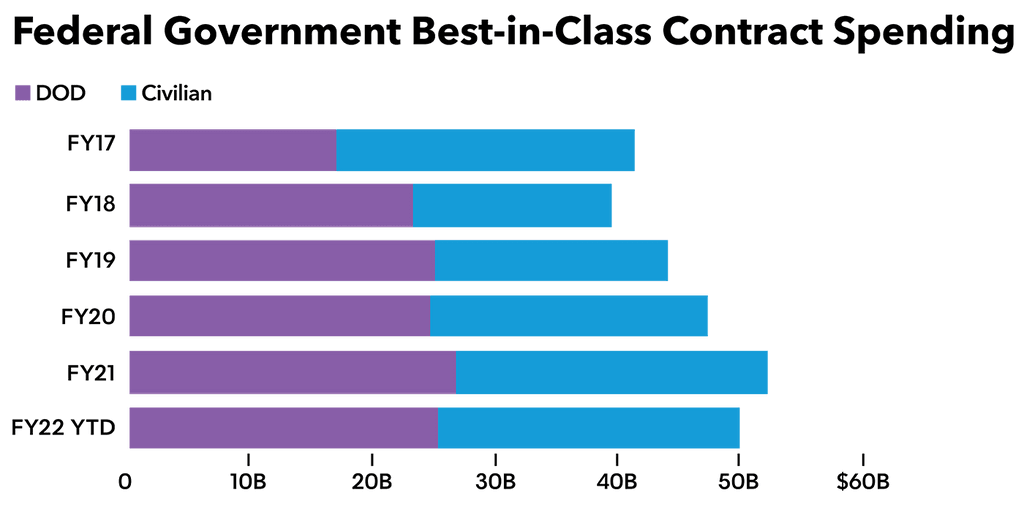

Within the past five years, there has been an increase in BIC spending. Combined defense and civilian BIC spending is rising faster than overall contract spending. That said, from FY 2017 to 2021, Pentagon BIC spending growth was 2.5 times higher than DOD spending. Federal contractors can expect a trend of spending growth to continue in FY 2023.

4. Agencies need more funding and collaboration to overhaul outdated IT

In 2021, President Biden’s pandemic relief stimulus law injected a billion dollars into the Technology Modernization Fund (TMF), which aims to replace old tech with modern tech. However, the annual appropriations process can’t match the speed needed to modernize IT across the 24 major government agencies – all of which have their own unique needs.

Agencies spend $100 billion on IT each year, with 80% of that money going toward existing operating systems. Relic IT systems present an exorbitant maintenance cost, vulnerable cybersecurity postures, and the need for customer assistance from federal agencies. TMF is one channel designed to ensure solvency, lending money to agencies with a five-year reimbursement timeline.

[Get additional details on the top spending agencies and a complete breakdown of the top 20 contract opportunities in our FY 2023 Government Contracting Playbook.]

5. Government contractors need to prioritize compliance

Contractors will need to evaluate their climate-related risks, such as vulnerability to litigation and potential supply chain disruptions caused by extreme weather events as part of their annual financial filing and reporting. Following an announcement by President Biden at the COP 27 in Egypt, large and mid-sized federal contractors will also be required to report their greenhouse gas emissions.

Foreign actors, such as China, have profited from the U.S.’s open innovation system. In efforts to put safeguards in place, federal agencies have new requirements that assess risks of foreign influence in a small business contracting program. This will have a chilling effect on some startups and university researchers. However, the new policy is a trade-off to ensure China will not benefit from U.S. technology advances.

Following a string of hacks, President Biden issued an executive order in May 2021 to strengthen the nation’s cybersecurity. Since then, a spate of new rules, frameworks, and strategies have been introduced. One rule coming later in 2023 on federal software purchases has elicited objections from agency contracting offices and vendors—it will require agencies to obtain “self-attestation letters” from software vendors declaring a product adheres to NIST guidance.