The Federal IT Market Grew by 10 Percent in Fiscal 2018

- FY 2018 government spending on cybersecurity and cloud computing rose to $6.4B and $4.1B, respectively

- Pentagon spending on AI increased by 170 percent FY 2017-2018, spending via OTAs by 90 percent

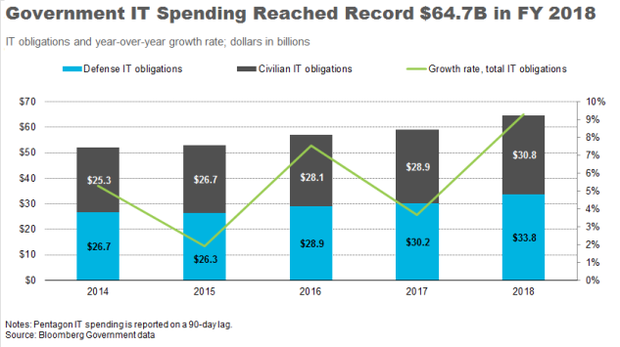

The U.S. federal government spent an all-time high of $64.7 billion on information technology contracts in fiscal 2018, a 9.5 percent increase from fiscal 2017 levels, according to Bloomberg Government’s analysis.

The Defense Department’s IT contract spending grew by more than 12 percent to $33.8 billion in fiscal 2018, while total IT contract spending by civilian agencies rose to $30.8 billion, a 6.6 percent increase. These figures underscore just how central IT and IT contractors are to modern government operations.

Although the fiscal year ends at the end of September, the full picture of governmentwide spending typically emerges only months later. That’s because for security reasons, the Pentagon reports its spending to the Federal Procurement Data System (FPDS) on a 90-day lag, meaning that September spending figures typically aren’t finalized until Dec. 31.

IT spending reached unprecedented levels in fiscal 2018. The Pentagon’s $33.8 billion in obligations on unclassified IT contracts is its highest-ever figure in nominal U.S. dollars. Adjusted for inflation, it’s the highest since fiscal 2012, when the drawdown of U.S. forces from the Middle East and sequestration exerted downward pressure on Pentagon IT spending. The military services each saw sizeable increases in IT contract spending. Air Force IT spending, for example, rose from $6.3 billion to $7.6 billion, a jump of more than 20 percent.

The $30.8 billion that civilian agencies spent on IT is the highest-ever total in both nominal and real dollars. The departments of Veterans Affairs, Treasury, State and Education each saw double-digit IT spending growth pursuant to their goals of infrastructure modernization and rolling out digital services to citizens and end-users. For example, that figure includes $487 million in new spending on electronic health records modernization by the VA.

SPENDING IN KEY MARKETS

As the Trump administration outlined in its 2018 President’s Management Agenda, the federal government is making substantial investments to modernize its IT infrastructure, to improve the quality of the digital services it offers citizens, to upgrade its information security capabilities, and to enable data-driven decision making.

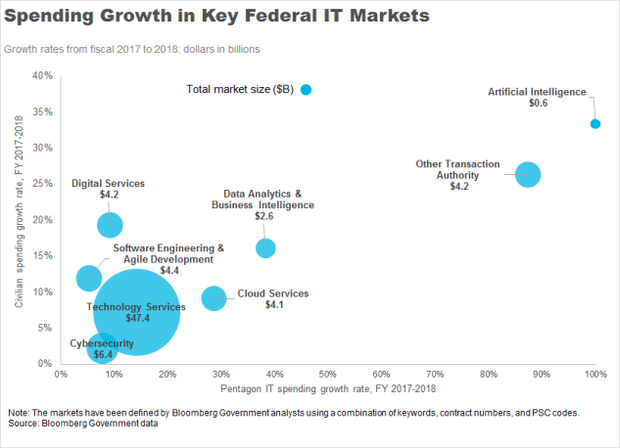

Below, Bloomberg Government mapped spending in eight key federal information technology markets against three variables: fiscal 2018 spending in each market in billions, the growth in Pentagon spending in each market from fiscal years 2017 to 2018, and the growth in spending among all civilian agencies during the same period.

(Note: These figures do not add up to the governmentwide IT contract spending total of $64.7 billion because there is considerable overlap, i.e., agencies may build and host new digital services in the cloud.)

Technology services – Governmentwide spending on ongoing technology services, including systems integration, operations and maintenance, and network management, rose by 10 percent to $47.4 billion. For comparison, the technology products and hardware market grew by 8 percent, to $20.3 billion.

Cybersecurity – Governmentwide spending on cybersecurity contracts increased by about 6.7 percent to $6.4 billion from fiscal years 2017 to 2018.

Cloud services – Even before the White House Office of Management and Budget unveiled the �?Cloud Smart’ strategy in September 2018, spending on cloud computing services surged to $4.1 billion. Cloud spending grew by 9 percent among civilian agencies and by almost 30 percent among defense agencies from fiscal years 2017 to 2018.

Digital services – In fiscal 2018, governmentwide spending on digital services for citizens and government end users rose from $3.6 billion to $4.2 billion, a 17 percent increase governmentwide.

Software engineering and agile development – The federal government spent $4.4 billion to develop and customize new software applications in fiscal 2018, a 7 percent increase above fiscal 2017 levels.

Data analytics and business intelligence – Federal agencies invested heavily in tools to manage, analyze and visualize data in fiscal 2018. Spending on data analytics rose to $2.6 billion, representing 24 percent growth governmentwide.

Artificial intelligence – Fiscal 2018 saw enormous growth in contracting opportunities for artificial intelligence and machine learning. Governmentwide spending on AI contracts rose from $340 million to $592 million. Pentagon AI spending grew by more than 170 percent, largely a result of the government’s first AI contract award to exceed $100 million.

Other transaction agreements – In fiscal 2018, governmentwide spending through OTAs, which are designed to fast-track small contracts between agencies and nontraditional technology suppliers, practically doubled, from $2.3 billion to $4.2 billion. The Pentagon accounts for about 95 percent of that spending.

WHAT’S AHEAD

Government spending in key technology markets, such as cybersecurity, cloud services, and artificial intelligence, is expected to rise in fiscal 2019 and beyond. However, the continuing partial government shutdown poses questions for government technology leaders and contractors alike.

More than a dozen civilian agencies, including the departments of Homeland Security, Treasury, Justice, and Transportation, are currently facing a lapse in funding. These departments collectively account for about 30 percent of governmentwide IT spending, meaning that millions in IT contracts are at risk every day they remain closed.

Ultimately, once a deal is reached and funding is restored, these agencies will be able to resume IT projects that are currently on hold. For mission-critical projects, such as the implementation of continuous monitoring tools or a migration to the cloud, agencies may simply have less time to complete the same amount of work and spend the same amount of money. But for some ongoing IT operations and maintenance contracts, agencies will not make up that spending or reimburse vendors for lost time.

Chris Cornillie is a federal market analyst with Bloomberg Government.

To contact the analyst on this story: Chris Cornillie in Washington at ccornillie@bgov.com. Follow Chris on Twitter @ChrisCornillie

To contact the editors responsible for this story: Daniel Snyder at dsnyder@bgov.com; Jodie Morris at jmorris@bgov.com