HEALTH CARE BRIEFING: Industry Groups Fault Drug Pricing Measure

Bloomberg Government subscribers get the stories like this first. Act now and gain unlimited access to everything you need to know. Learn more.

Democrats are facing pressure from a host of health care industry groups to make key changes to their drug pricing proposal before voting on it in coming weeks, Alex Ruoff reports.

Generic drug companies are telling Democrats their legislation to empower the government to negotiate lower drug prices would cut into their profits and make it harder to bring low-cost versions of pricey medicines to market. “It would greatly effect the rate of return for a generic,” Jeff Francer, senior vice president for the Association of Accessible Medicines, said.

Their ask: exempt medicines from negotiations if a generic version is on the way.

On the same page with AAM is the Community Oncology Alliance, which represents cancer treatment practices. That coalition is warning lawmakers the drug pricing bill would mean cancer doctors would be reimbursed at lower rates than they currently are and would be paid for some drugs at a lower price than they bought them.

“You’ll have practices that are simply not financially viable anymore,” Ted Okon, executive director of the Community Oncology Alliance, said. They want doctors to be taken out of the equation by having drugmakers pay the government for excess costs for some drugs and continue to pay doctors for administering drugs under the current system.

These requests come as branded drugmakers are pushing to kill the drug pricing proposal entirely.

Democrats’ Agenda Hangs on Budget Office’s Work: House Democrats working to advance this week their $1.75 trillion tax and spending bill, which carries the drug pricing language, have balanced their legislative ambitions on an often overworked group of experts with a smaller budget than even some D.C. think tanks. Key Democrats have said they want a Congressional Budget Office score of the party’s major reconciliation bill before they vote on the bill in the House, but promised a vote no later than this week.

That puts the heat on a small band of policy experts who are required to work around the clock when the congressional schedule heats up. The CBO released estimates for six of the 13 portions of the bill last week, though Director Phillip Swagel has yet to say how long the most difficult parts of the bill will take to analyze. Read more from Jack Fitzpatrick.

House Eyes Vote on Biden Agenda, But Slowdown Looms in Senate: House Democrats aim to vote this week on President Joe Biden’s roughly $2 trillion tax and spending bill, despite lingering uncertainty over the bill’s cost, GOP attacks over its potential inflationary impact and a wide-spread expectation that the Senate won’t act until December at the earliest. Read more from Erik Wasson, Laura Litvan and Laura Davison.

Also on Lawmakers’ Radars

Biden Taps Alphabet’s Califf to Return as FDA Chief: Robert Califf was nominated on Friday by Biden to run the Food and Drug Administration, a move that is likely to put a one-time commissioner back at the health agency’s helm in the midst of a still-raging pandemic. Califf, a doctor and widely published scientist, is currently a senior adviser at Alphabet’s Verily and Google Health units. He previously served as FDA commissioner during the final year of the Obama administration.

If confirmed by the Senate, he would take the place of acting FDA Commissioner Janet Woodcock. Califf’s first appointment to lead the FDA was approved in an 89-4 vote in 2016. Fiona Rutherford, Jeannie Baumann, and Anna Edney have more.

- Improving drug competition and boosting patient access to innovative treatments will likely be among the priorities of Califf at the helm of the FDA, policy analysts say. If confirmed by the Senate, Califf is poised to bring steady leadership and clear direction on improving the FDA’s efficiency as the federal government continues to respond to the always-changing Covid-19 situation. Read more from Celine Castronuovo.

- A key Senate Democrat said on Friday he opposes Califf’s nomination. “Califf’s nomination and his significant ties to the pharmaceutical industry take us backwards not forward,” Sen. Joe Manchin (D-W.Va.) said in a statement Friday, highlighting the ongoing U.S. opioid epidemic, Daniela Sirtori-Cortina reports.

The Coronavirus Pandemic

Biden’s Shot-or-Test Rule Dealt Another Blow: A U.S. appeals court has extended its Nov. 6 order pausing Biden’s shot-or-test mandate for businesses with 100 or more employees. The verdict, issued Friday by the New Orleans-based U.S. Court of Appeals for the Fifth Circuit, solidifies its earlier ruling halting implementation of OSHA’s emergency regulation. It also comes ahead of a lottery tomorrow to decide which federal appeals court will adjudicate the rule’s many legal challenges. Andrew Harris has more.

Biden Team Eases Nursing Home Visitation Limits: Nursing home residents can once again receive visitors inside the facilities whenever they want after the Biden administration lifted Covid-19 visitation restrictions Friday. Noting the falling rates of nursing home infections—and increasing staff vaccination rates—the Centers for Medicare & Medicaid Services said the time was right to let residents safely resume unrestricted visits. Read more from Tony Pugh.

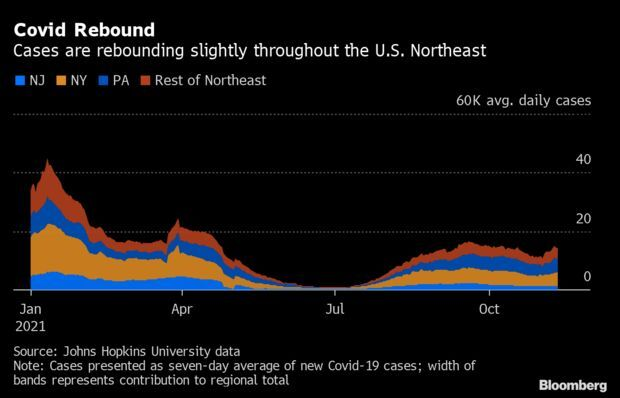

Virus Rebound Hits U.S. Northeast: Early signs of a Covid-19 resurgence are emerging in the Northeast, with cases increasing in seven of the region’s nine states. The seven-day average of reported Covid-19 cases in the region has climbed 11% in the past week to 14,318 last Thursday, according to Johns Hopkins University data. Until last week, the region’s numbers had trended steadily downward for about six weeks. Read more from Jonathan Levin.

More Headlines:

- U.S. Vaccine Mandate for Troops Survives a Legal Challenge

- Covid-19 Pills May Save Lives, But They Won’t End the Pandemic

- Covid-19 Aid Rules Not Likely to Affect State Suits, Attorneys Say

- China’s Wildlife Harbor Plethora of Germs that Endanger People

- Unvaccinated? Prepare to Pay as Countries Prepare Crackdowns

Industry, Regulation & Courts

J&J to Split Into Drug, Consumer Product Companies: Health-care giant Johnson & Johnson is splitting off its consumer division, following in the footsteps of other big drugmakers that have moved to focus on the more-profitable pharmaceutical markets. The consumer division will be separated in 18 to 24 months, it said in a statement Friday. The unit has been beset by lawsuits involving products such as baby-powder, which has been linked to ovarian cancers in some users.

But J&J said the legal challenges it’s facing had nothing to do with the decision to split. The pharmaceutical arm has long been the strongest performer at the more than 130-year-old company, featuring top sellers such as immune drug Stelara and Imbruvica for cancer. Prescription drugs generated 55% of the company’s sales in 2020, with another 28% coming from the medical device unit, and 17% from the consumer arm. In 2020, J&J made $83 billion in revenue, and analysts estimate $94 billion in 2021 sales. Read more from Riley Griffin.

Read more:

- A 135-Year History of Empire-Building Culminates in J&J’s Breakup

- For Banks, GE, J&J Breakups Add More Fuel to the Dealmaking Fire

Kaiser Strikes Deal With Unions, Averting Strike: Kaiser Permanente reached a tentative agreement with unions, averting what may have been the largest strike yet this year. The averted strike would have involved more than 30,000 workers from nurses and pharmacists to janitors and locksmiths. The health-care company reached the agreement on a four-year contract covering 50,000 employees in 22 local unions, the Alliance of Health Care Unions said in a joint statement Saturday.

Workers were planning to walk out of hospitals across mostly the U.S. West Coast this morning, a move that could have disrupted a health-care system recovering from the damage of the pandemic and as U.S. hospitals confront a new wave of infections ahead of the winter. Sarah Holder has more.

- Eight Senate Democrats had weighed in on the Kaiser Permanente labor dispute, urging the company to negotiate a “fair contract.” The senators, led by Bernie Sanders (I-Vt.), wrote to Kaiser Chair and CEO Greg Adams on Friday, saying the workers “deserve a fair wage increase” and pointing out that many “risked their lives to save patients” during the Covid-19 pandemic. Read more from Paige Smith.

Alzheimer’s Drug Spurs Record Medicare Premium Hike: The standard monthly premium for Medicare outpatients, or “Part B,” coverage, will be $170.10 in 2022, up from $148.50 in 2021, senior Biden administration officials said Friday. The $21.60 increase is the largest annual dollar-amount rate hike ever for Part B coverage, while the 14.5% increase is the third-largest percentage jump since 2007. The yearly deductible for Medicare Part B beneficiaries will be $233 in 2022, up from $203 in 2021.

Half of the unusually high rate increase is due to two factors: rising prices and use across the health-care system, and pandemic-related congressional action, which lowered Part B premiums in 2021. Congress directed CMS to pay it back the rate reductions over time, a senior administration official said during a briefing with reporters.The other half of the increase is due to the need to build contingency reserves if Medicare decides to cover the costly Alzheimer’s drug, Aduhelm, manufactured by Biogen. Tony Pugh has more.

Biden Kills Trump-Era Rule for Life-Saving Devices: The Biden administration on Friday rescinded a Trump-era rule that would have given medical device companies faster Medicare payments for life-saving products. CMS said in a statement it was taking the action “because of concerns that the provisions in the final rule may not have been sufficient to protect Medicare patients.” Read more from Alexis Kramer.

More Headlines:

- Data Breach Rule for Health Apps Leaves Developers in the Dark

- Justices Drop Argument in CVS Pharmacy Mail-Order Drug Lawsuit

- Washington State Long-Term Care Fund Tax Faces Legal Challenge

- FTC Clears Modifications to Bristol Meyers’s Acquisition of Celgene

- Holmes Says Theranos Customers Liked Blood Tests’ Cheaper Cost

To contact the reporters on this story: Brandon Lee in Washington at blee@bgov.com; Alex Ruoff in Washington at aruoff@bgov.com

To contact the editors responsible for this story: Zachary Sherwood at zsherwood@bgov.com; Giuseppe Macri at gmacri@bgov.com; Michaela Ross at mross@bgov.com

Stay informed with more news like this – from the largest team of reporters on Capitol Hill – subscribe to Bloomberg Government today. Learn more.